Wonderful Revised Schedule Vi Format In Excel

You can also see Class Schedule Template.

Revised schedule vi format in excel. Click here and download Revised Schedule III in Excel At CAKART wwwcakartin you will get everything that you need to be successful in your CA CS CMA exam Indias best faculty video classes online or in pen drive most popular books of best authors ebooks hard copies best scanners and all exam related information and notificationsVisit wwwcakartin and chat with our counsellors any time. Or press AltA to go to the respective Additional Details report. The text of the revised Schedule VI is available at httpwwwmcagovin.

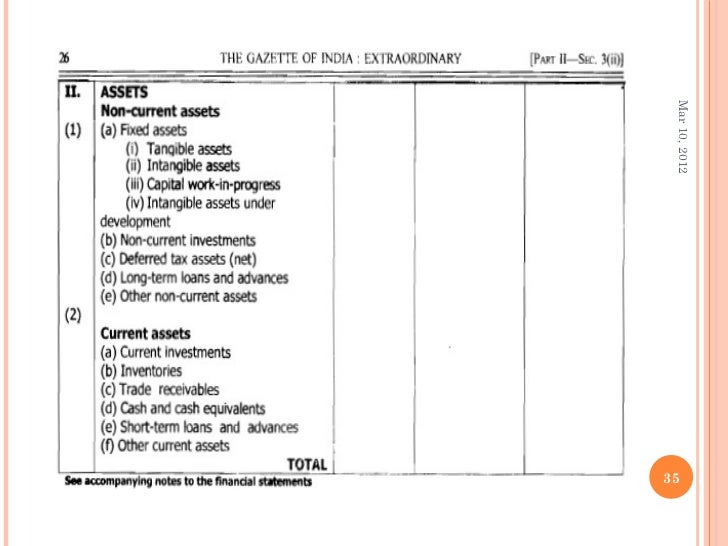

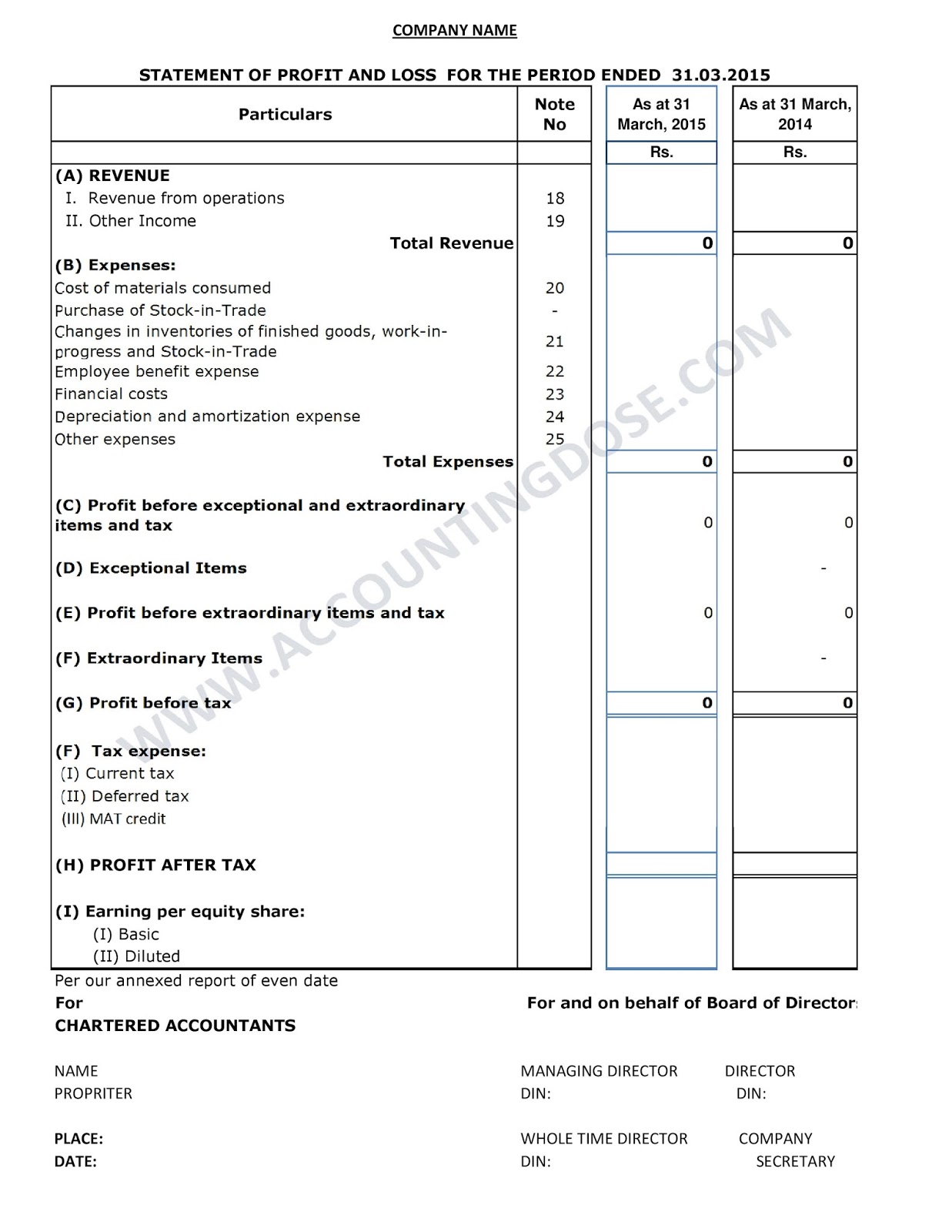

Format of Revised Schedule VI to the Companies Act 1956 in excelOnly Bs and profit Loss Account Balance Sheet profit and Loss Account Schedules as per Revised Schedule VI in Excel FormatRevised Format of Revised Schedule VI to Companies Act 1956 in PDF with Notification. Profit before tax VII - VIII 2 Deferred tax 1 Current tax X. As per the Government Notification no.

Profit before extraordinary items and tax V - VI VIII. It also requires allocation of operating expenses into selling and marketing expenses and administrative expenses. Reporting period reporting period 1 2 3 4 I.

Revised Schedule VI Format in Excel BS and PL Download Preview. Select a Schedule VI Head and click A. On 12 April 2012.

Tax expense of discounting operations XIV. Download a customized project schedule template to manage a thorough description of your project. Here you can find the EPF ECR calculation sheet with formulas for the year 2011.

This Excel template containing balance sheet profit loss account in revised schedule vi format with auditors report director report tax aduit report form 3CD and annexures Annual Return of MCA all containing. Unlike the Old Schedule VI the Revised Schedule VI lays down a format for the presentation of Statement of Profit and Loss. FNo262008-CL-V dated 30-3-2011 the Revised Schedule VI is applicable for the Balance Sheet and Profit and Loss Acco New Schedule VI In Excel with BS PL Notes Disclosures Comparison with Old.