Perfect Ind As Balance Sheet Format Mca

For example Ind AS 1731b means that the disclosure is required by paragraph 31b of Ind AS 17.

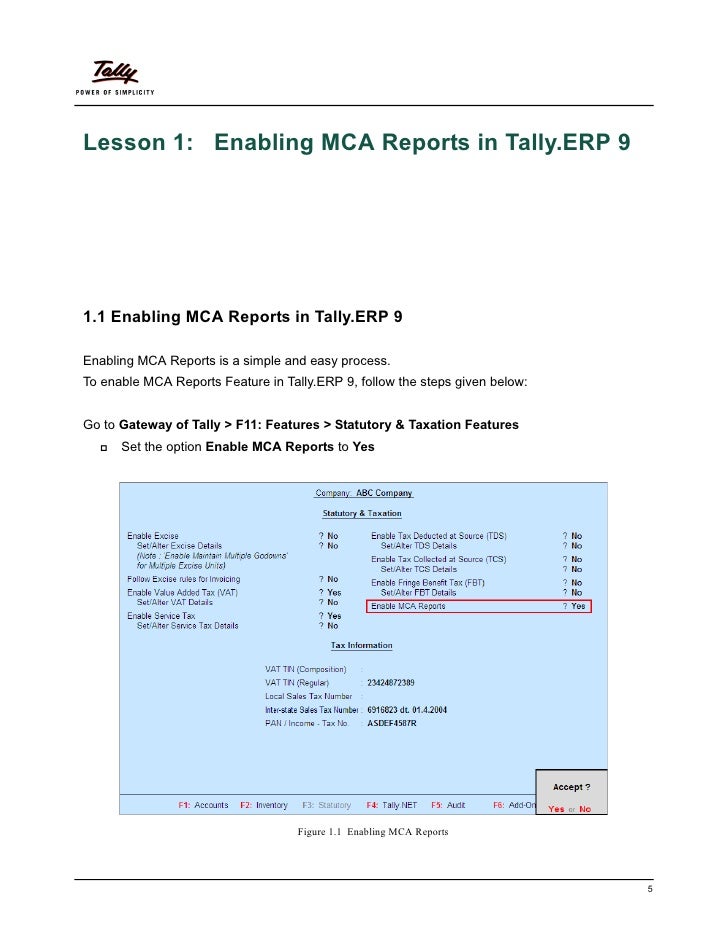

Ind as balance sheet format mca. Few illustrations have also been included with a view to provide guidance on. MCA notified amendments to Schedule III to the Act on 6 th April 2016 whereby. Statement of profit and loss.

Companies are required to adhere to the updated balance sheet format and create balance sheets in a timely manner. NBFCs have to separately disclose in note item of other income or other expenditure exceeding 1 of the total income. Cash flow statement shall be prepared where applicable in.

Items presented in the balance sheet are to be classified as current and non-current. However in the case of division II disclosure were required to be given in case of an item of income or expenditure. The MCA vide Notification dt 6th April 2016 has notified amendments in Schedule III to the Companies Act 2013.

Ministry Of Corporate Affairs - Indian Accounting Standards. These amendments indicates the revised instructions for preparation of financial statements ie. The Guidance Note provides guidance on each of the item of the Balance Sheet Statement of Profit and Loss Major differences in Division I and Division II of the Schedule III to the Companies Act 2013 besides providing Illustrative format for Standalone financial statements and Consolidated Financial Statements etc.

Although MCA and ICAI provides for proposed Ind AS but one of the key elements missing till date was the format of the financial statements as per Ind AS. This publication also covers Illustrative Format of Standalone Financials and additional notes issued by Ministry of Corporate Affairs MCA which are applicable to all listed companies in a phased manner. 6 April 2016 Amended Schedule III to Companies Act 2013.

Notwithstanding anything contained in the above para Ind. Disclosure requirements specified under Ind AS. The General Instructions for preparation of balance sheet of the Schedule III to the Companies Act 2013.