Simple Ias 12 Illustrative Examples Pdf

3 IAS 12 Income Taxes IASB APPLICATION DATE NON-JURISDICTION SPECIFIC IAS 12 was adopted by the IASB in April 2001.

Ias 12 illustrative examples pdf. Consolidated Financial Statements IFRS 11. Employee Benefits 2011 255 VII Example disclosures for entities that early adopt IFRS 10. IAS 12 proposals Recognising deferred tax on leases.

Illustrative Examples on IAS 12 Income Taxes. These Illustrative Examples accompany IFRS 17 Insurance Contracts issued May 2017. Financial Instruments 2010 233 VI Example disclosures for entities that early adopt IAS 19.

International Financial Reporting Standards linked to Deloitte accounting guidance International Accounting Standards. Or - Interest in an unconsolidated structured entity. Employee Benefits 2011 255 VII Example disclosures for entities that early adopt IFRS 10.

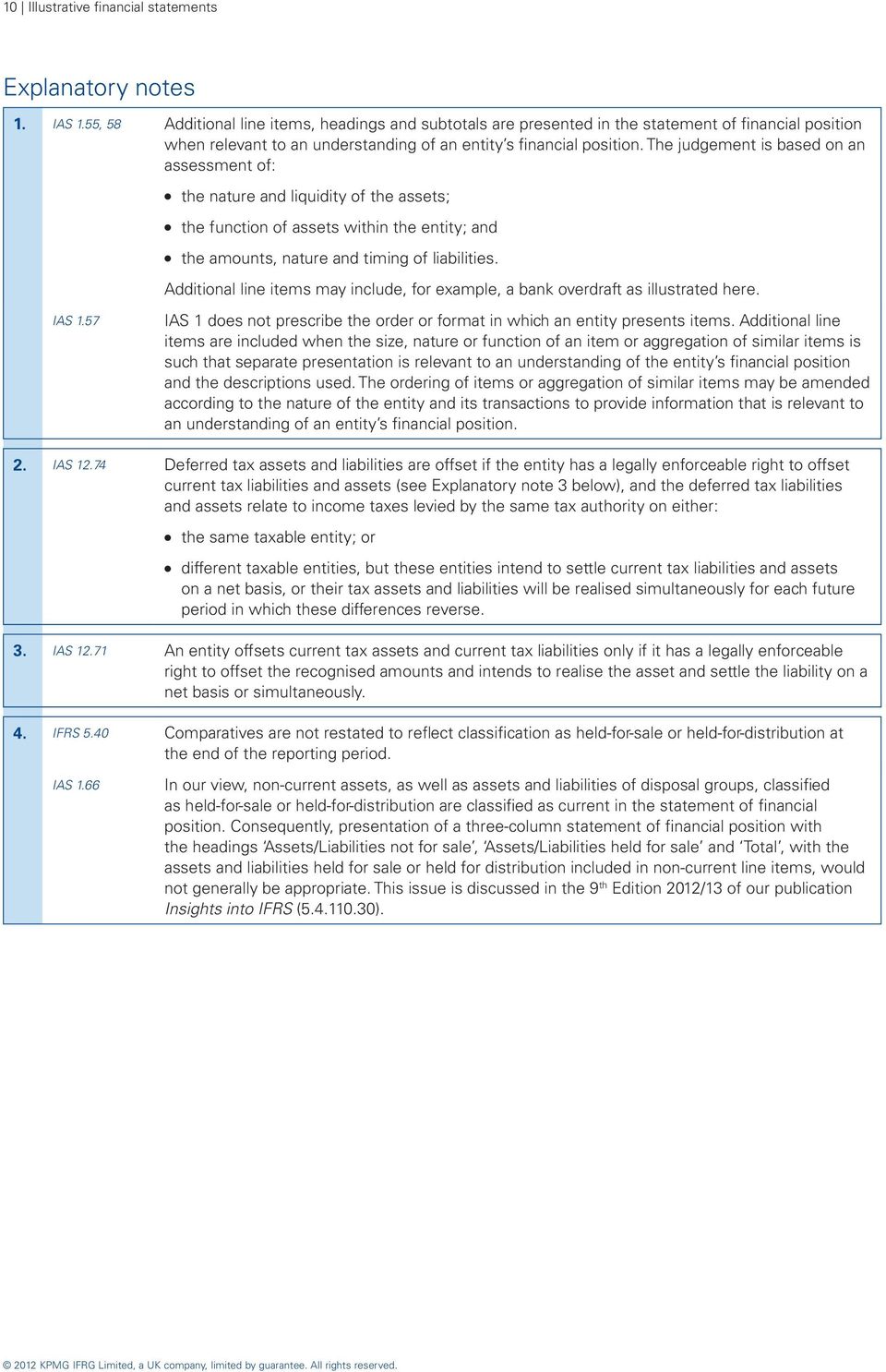

IAS 12 Income Taxes. IFRS 12 - effective date IFRS 12 shall be applied for annual periods beginning on or after 1 January 2013. The amounts recognised in the statement of financial position are as follows.

OBJECTIVE IAS 12 prescribes the accounting treatment for income. To the extent permitted by applicable law the Board and the IFRS Foundation Foundation expressly disclaim all liability howsoever arising from this publication or any translation thereof. And the lease liability under IFRS 16 are CU 435.

These examples represent how some of the disclosures required by IAS 12 in Example 2 - Illustrative disclosure for income taxes might be tagged using both block tagging and detailed tagging. Each plant is located in a different continent. Deferred tax assets are the amounts of income taxes recoverable in future periods in respect of.