Great Ifrs 16 Deferred Tax Example

Exemption for initial recognition of leases under IFRS 16 Entity A enters into a lease of an asset on 1 January 20X1.

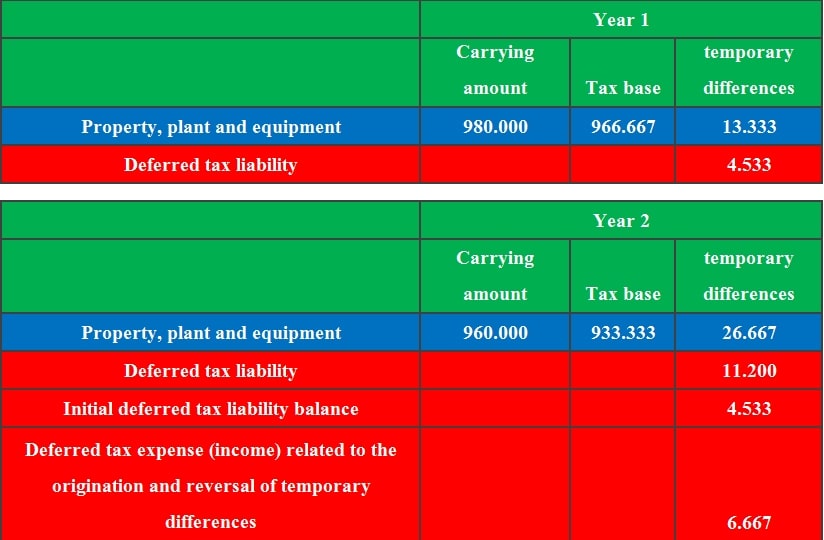

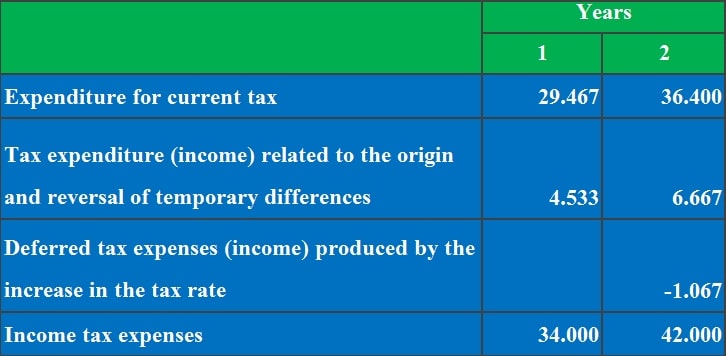

Ifrs 16 deferred tax example. IFRS16 also gives rise to lease assets and liabilities and question around what the tax base of this asset and liability should be. Deferred tax liability is a liability that will credit when it increases. Modified retrospective option 2 as if IFRS 16 is always applied for right of use asset Netting of deferred taxes in presentation compulsory if conditions are met.

In many jurisdictions there is one tax deduction for a lease involving the recognition of a right-of-use asset and corresponding lease liability under IFRS 16 Leases 1. The introduction of IFRS 16 will also impact tax accounting as depending on the local tax law deferred tax and the ETR may be impacted. IFRS 16 sets out a comprehensive model for the identification of lease arrangements.

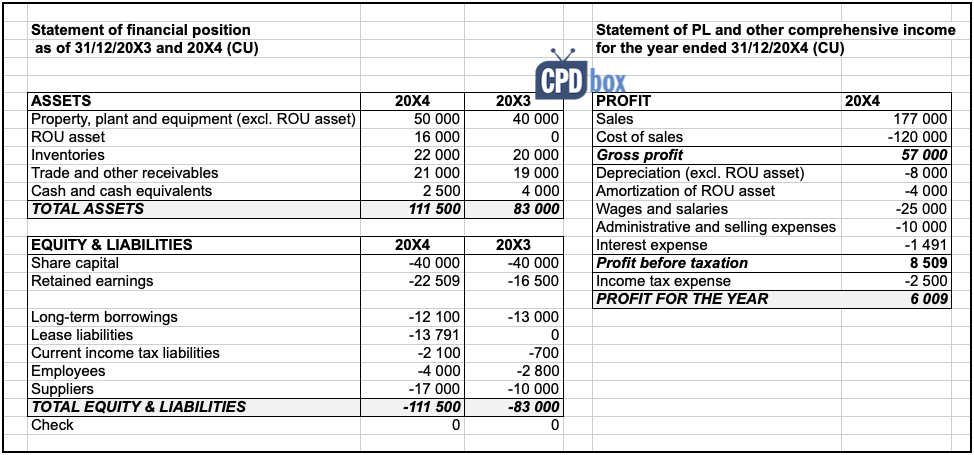

Debit Credit Right-of-use asset 450 Lease liability 450 To recognise lease liability and right-of-use asset Right-of-use asset 20 Cash 20 To recognise initial. Disclosure in the financial statements remains necessary. On 31 Dec 2017 ABC Co.

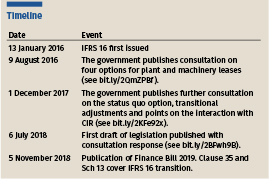

It will replace IAS 17 Leases for reporting periods beginning on or after 1 January 2019. Deferred Tax arises from the analysis of the differences between the taxable profit and the accounting profit. For example a company may be entitled to a tax deduction on a cash basis for a lease transaction that involves recognising a right-of-use ROU asset and a corresponding lease liability under IFRS 16 Leases 2.

In March and June 2018 the IFRIC published staff papers in which the view was taken that in order to determine the tax base of the lease asset and lease liability an entity should allocate the available tax. There is currently diversity in practice for the accounting of deferred tax on transactions that involve the recognition of an asset and a liability with a single tax treatment related to both. The sections of the guide are as follows.

On commencement of the lease C records the following entries under IFRS 16 Leases. And the lease liability under IFRS 16 are CU 435. Lessee T rents a building from Lessor L for five years commencing on 1 January.