Top Notch Difference Between Profit And Loss Appropriation Account And Profit And Loss Adjustment Account

Salaries Wages Rent Depreciation Loss on Sale of Assets etc are all charges against profits.

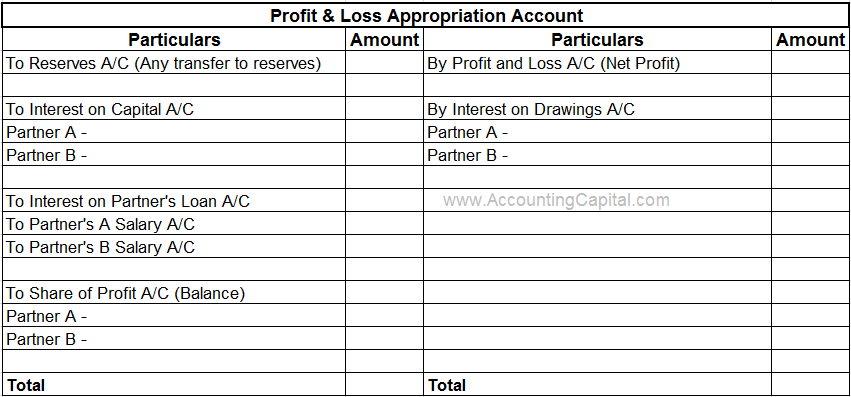

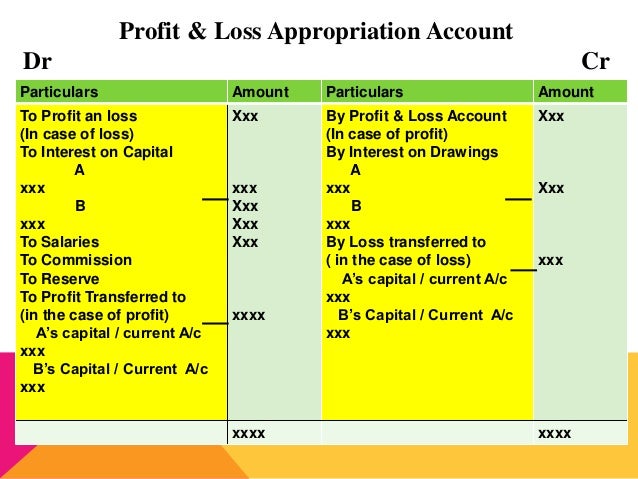

Difference between profit and loss appropriation account and profit and loss adjustment account. In this account how the profit or loss among the partners of the firm is distributed is shown. PL appropriation account is used for allocation and distribution of Net Profit among partners reserves and dividends. Hence the Profit and Loss Account is prepared.

Are you looking for the difference between profit and loss account and profit and loss appropriation account as given in accounting of partnership firm -. This account is credited with the amount of net profit and debited with the amount of net loss. The difference between PL and PL appropriation account is that while PL account records the profit for the year PL appropriation account records the uses of the profit by distinguishing the activities for which the profits will be distributed to.

A charge can be interpreted as a debit to the profit and loss account which represent an expenditure or loss. PL is predominantly important in income and expenses management to improve profit levels. Charge against profit means the deduction of any amount from the firms revenue to reach Net Profit or Loss.

Give or assign profits for a particular person or cause. It doesnt have an opening or closing balance. Appropriation of Profit.

In other words Net Profit or Net Loss from Profit and Loss Account will be transferred to opposite side Below the line method. Profit and Loss Account. Profit and Loss Appropriation Account is used for allocation of net profit among different partners.

A charge will result in reduction of profits. Profit and Loss Appropriation Account is then followed by the preparation of Profit and Loss Adjustment Account. This is the appropriation account in the appropriation section of Profit and Loss Account.