Stunning Accretion Expense Example

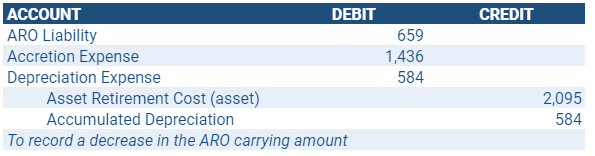

Generally accretion is recognized as an operating expense in the statement of income and often associated with an asset retirement obligation.

Accretion expense example. Accretion for an Acquisition Determine the earnings per share EPS for a company that is buying another company. Company ABC reported 200000 in net income in the past year and it owns 1000000 in outstanding shares. For example a company with 100000000 in net income and 500000000 shares outstanding has an EPS of 020.

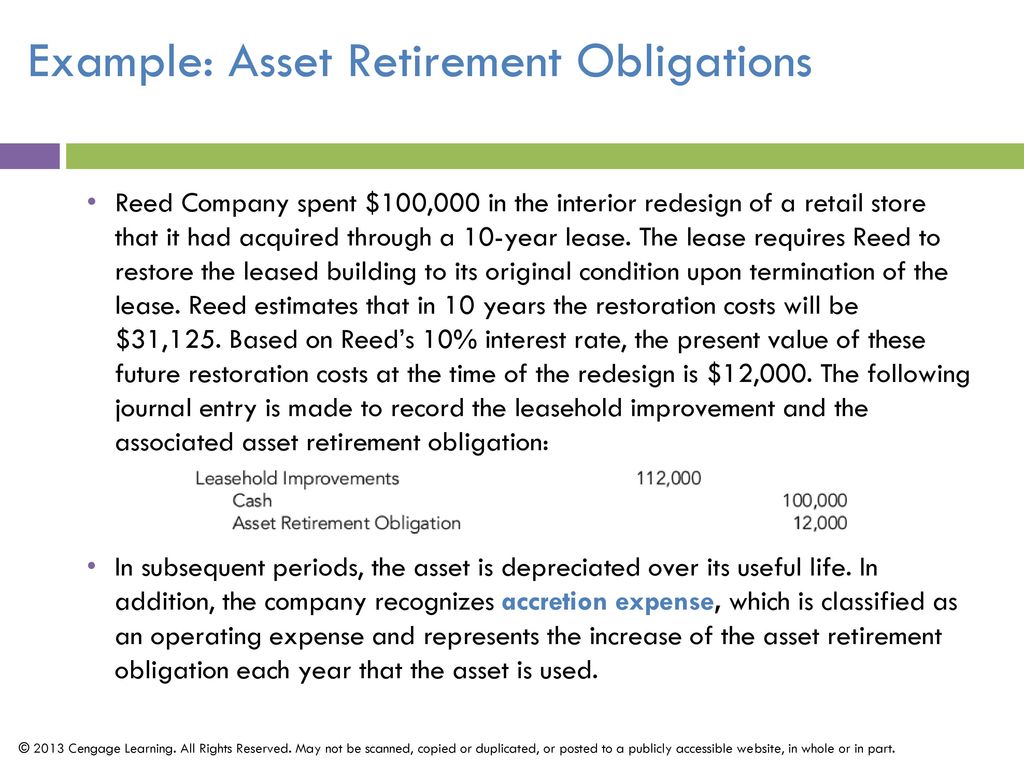

Accretion expense is the ongoing scheduled recognition of an expense related to a long-term liability. Leases a building for 5 years to host their annual awards shows and other company events. For example when new assets are acquired at a discount or for a cost that is below their.

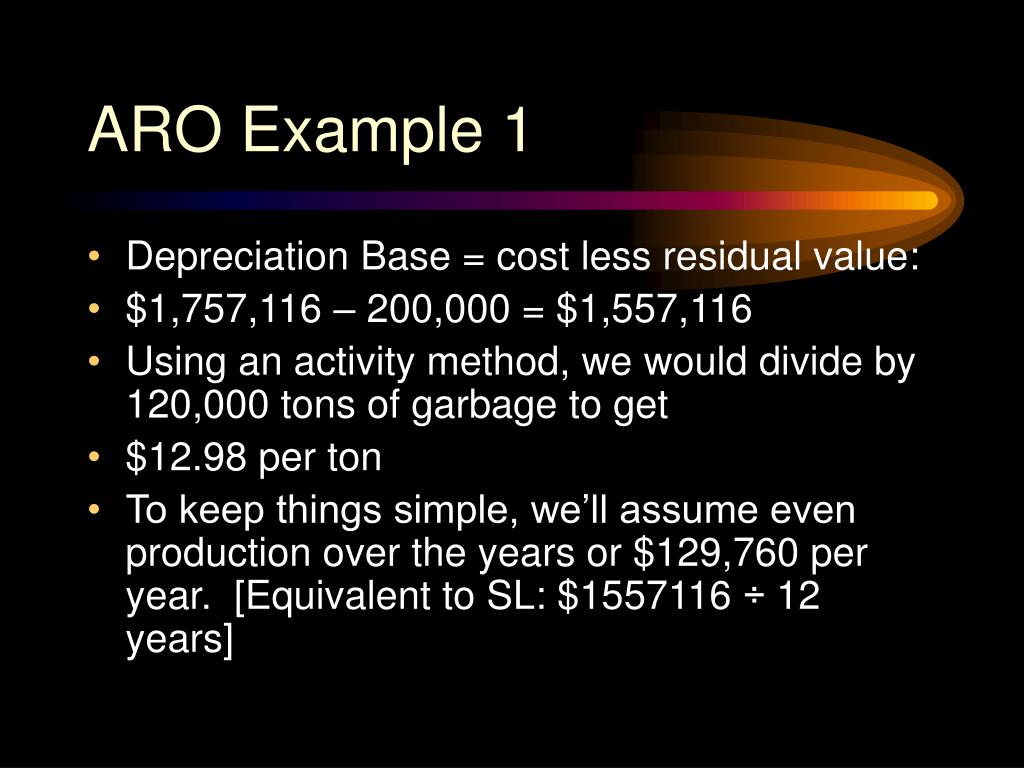

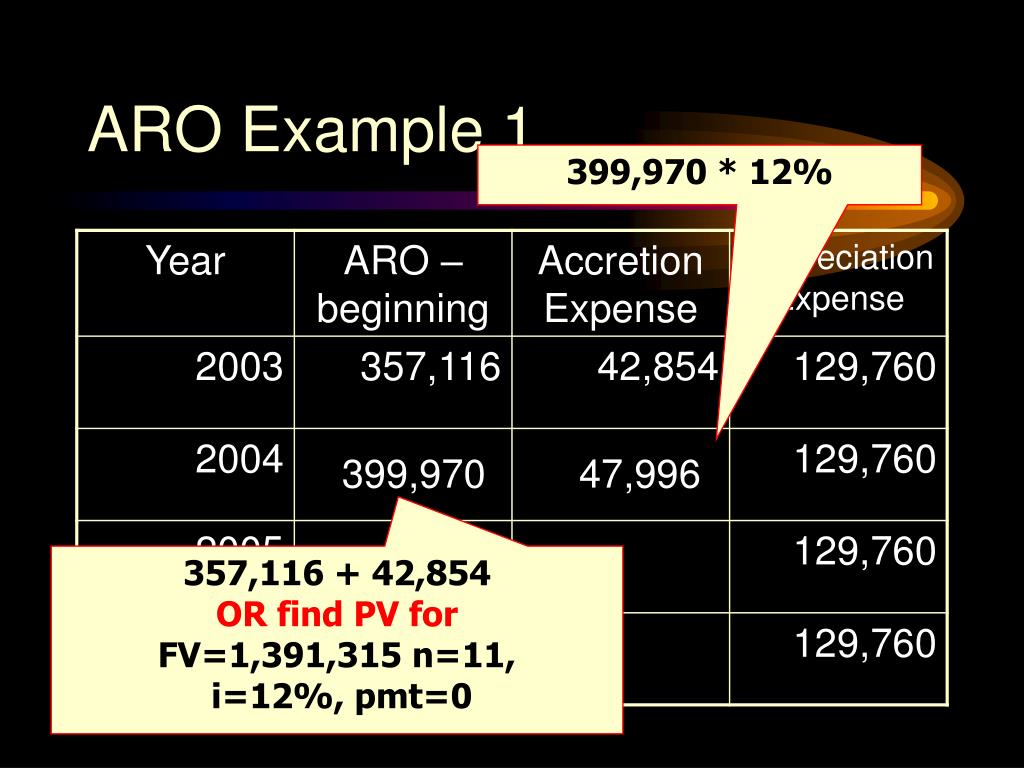

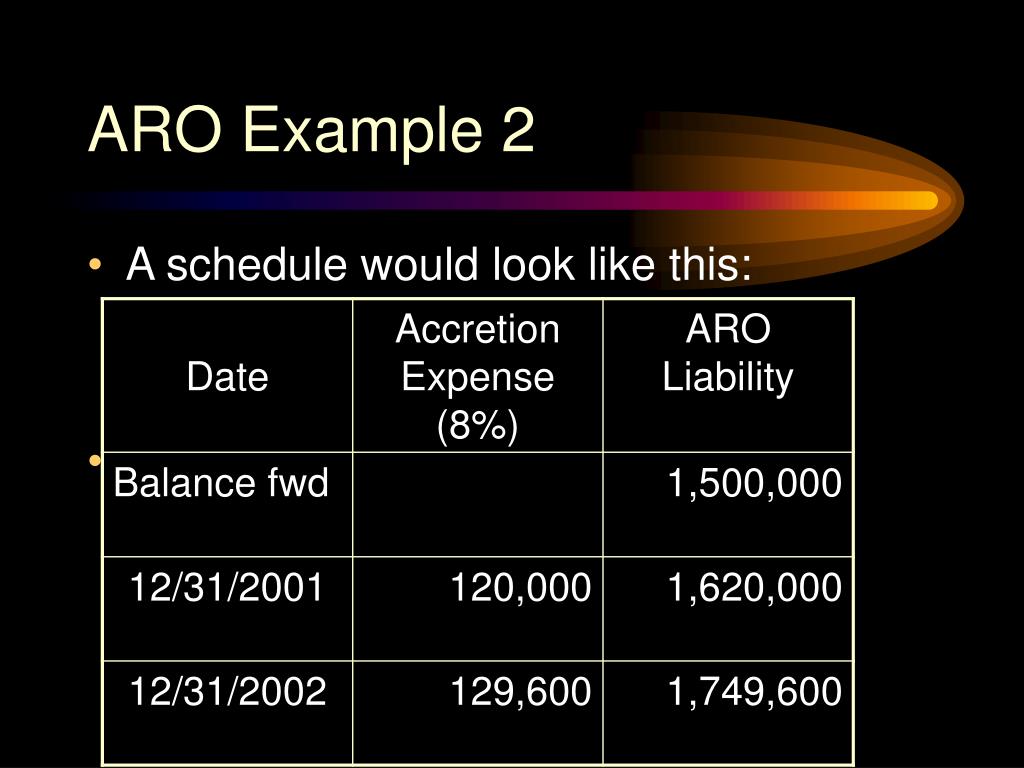

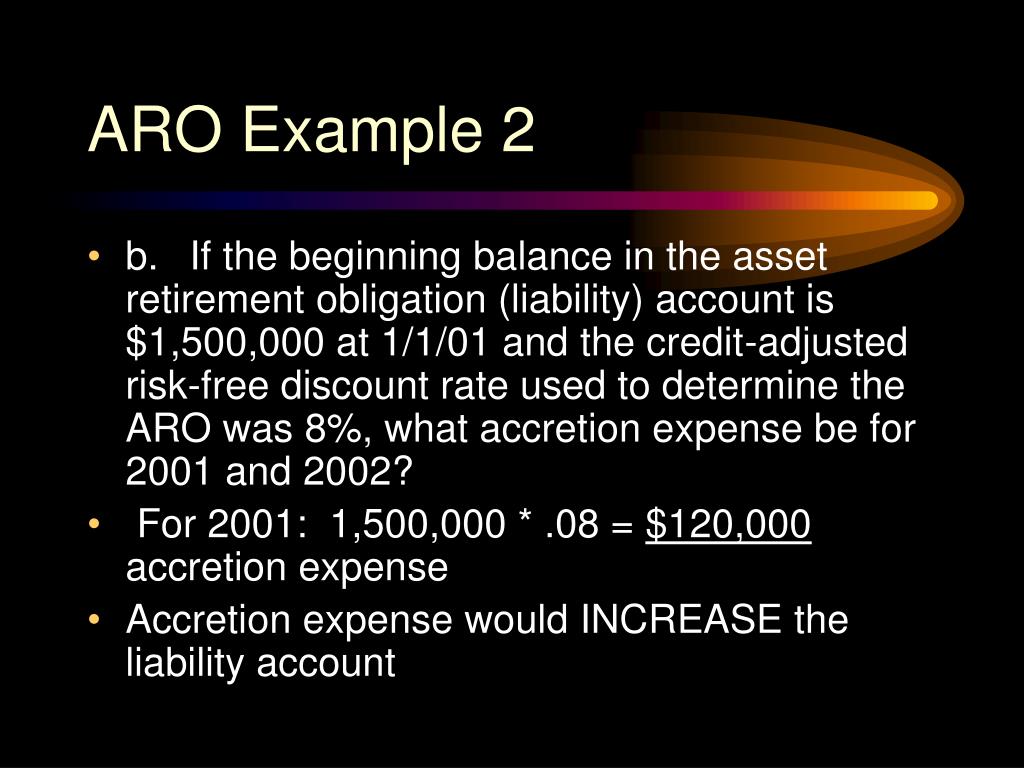

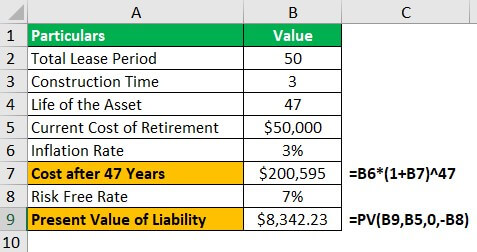

Assuming an inflation rate of 3 the cost of retirement at the end of 47 years will be 200595. In accounting terms accretion expense is expense created when the present value pv of financial instruments is updated. For example if you originally recognize the present value of a liability at 650 which has a future value of 1000 every year you must increase the PV of the liability as it comes closer to its FV.

Is accretion expense tax deductible. In accounting an accretion expense is created when updating the present value of an instrument. To take that into consideration the retirement cost will increase at the rate of inflation.

Accretion period2 020 Using this example one can see that a discount bond has a positive accrual. Example of Acquisition Accretion Assume that Company ABC wants to acquire Company XYZ as a way of increasing its EPS. Divide the total net income for the company by the number of shares outstanding.

Accretion expense example. Assuming a risk-free rate of 7 this obligations present value comes out to be 8342. In accounting an accretion expense is a periodic expense recognized when updating the present value of a balance sheet liability which has arisen from a companys obligation to perform a duty in the future and is being measured by using a discounted cash flows DCF approach.