Best Examples Of Contingent Liabilities In Banks

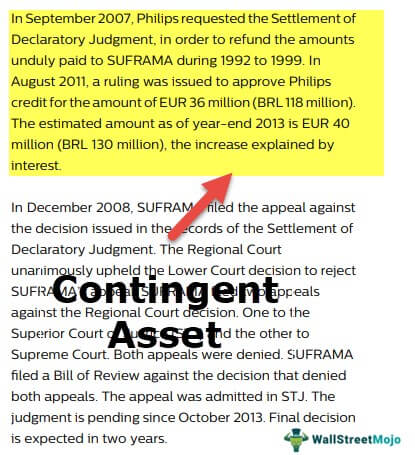

Example of contigent liabilities Guarantees and counter guarantees are given by a company.

Examples of contingent liabilities in banks. Contingent liabilities are liabilities that may come into existence depending on the outcome of a future occurrence. Other examples include guarantees on debts. California national banks are subject to double liability.

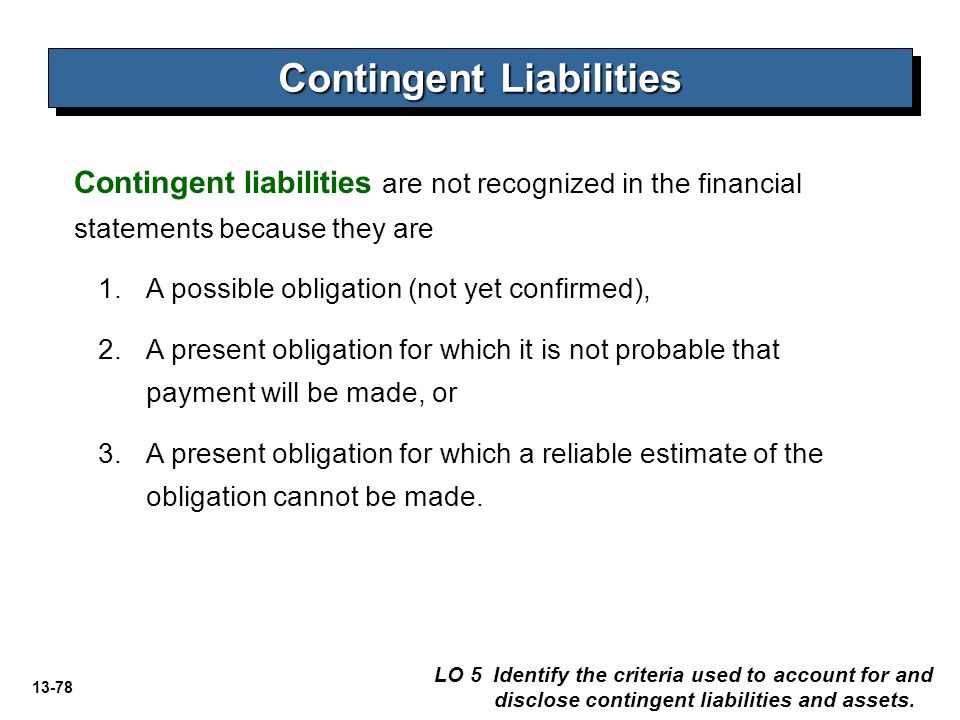

Are liabilities that may occur depending on the outcome of a future event. In case the event does not happen an organization is not liable to pay anything. Unlimited liability on bank owners was an important element in the success of Scottish banking for example and lasted until 1862 when banks were allowed to adopt a limited liability.

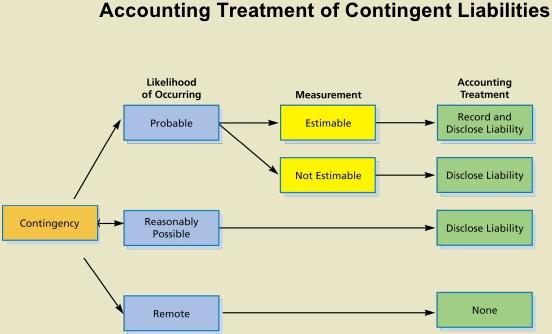

The accounting rules for reporting a contingent liability differ depending on. Therefore contingent liabilities are potential liabilities. A company gave a bank guarantee on behalf of a subsidiary.

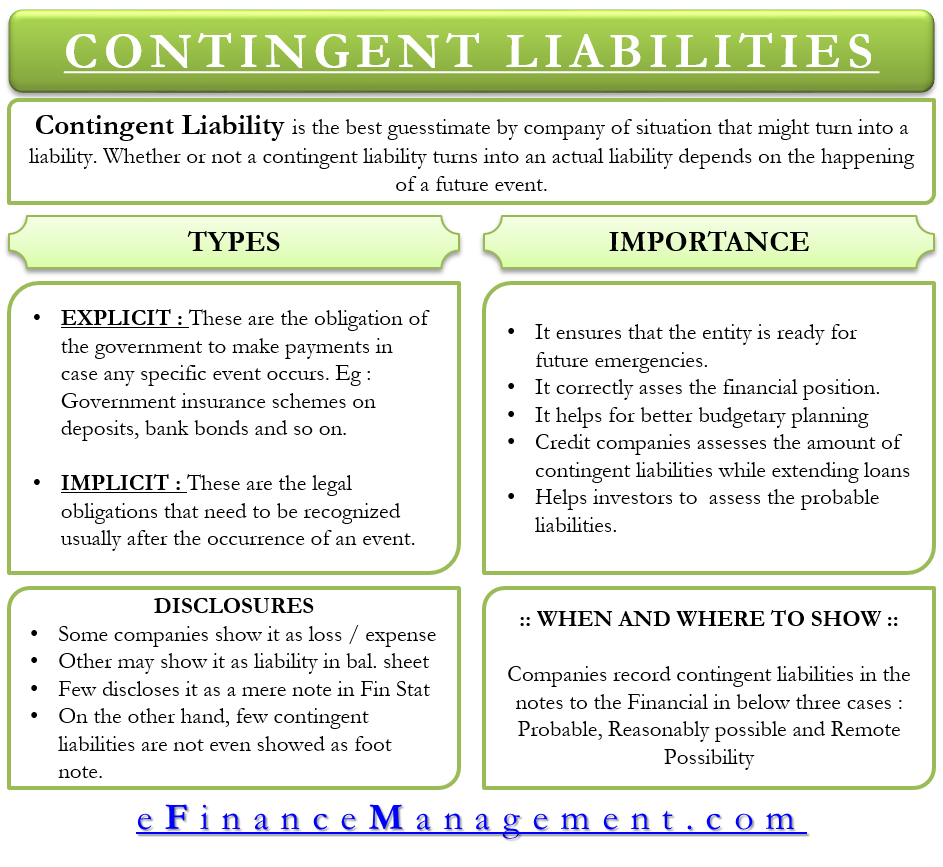

Contingent liabilities meaning also signifies the fact that they change according to the amount of money estimated and their likelihood of occurring in the future. Here we look at two of the most common types. Bank owner contingent liability has been important in the development of many industrial countries.

There are many examples of contingent liability as they can be pretty much any potential financial obligation that may or may not occur in the future. For the past 3 years this has been shown as a contingent liability. Examples long-term loans bonds payable debentures etc.

Some of the types of contingent liabilities are given below 1 Potential Lawsuits Potential lawsuits arise when an individual gives the guarantee on the other persons behalf when the actual person or individual fails to pay that the person who provided the guarantee must pay the money. The sample includes all national banks and a random selection of 45 of the existing state banks in 1900. Contingent liabilities related to banks include both explicit guarantees such as deposit insurance programs and implicit guarantees such as guarantees on bank debt that may be provided during a banking crisis.