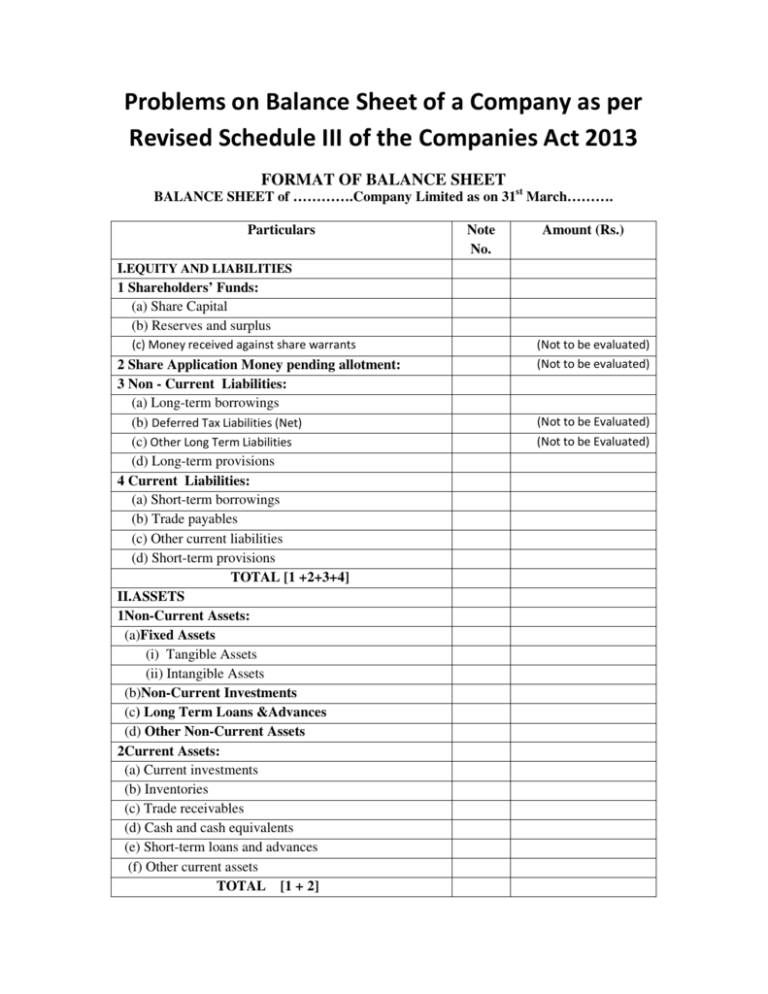

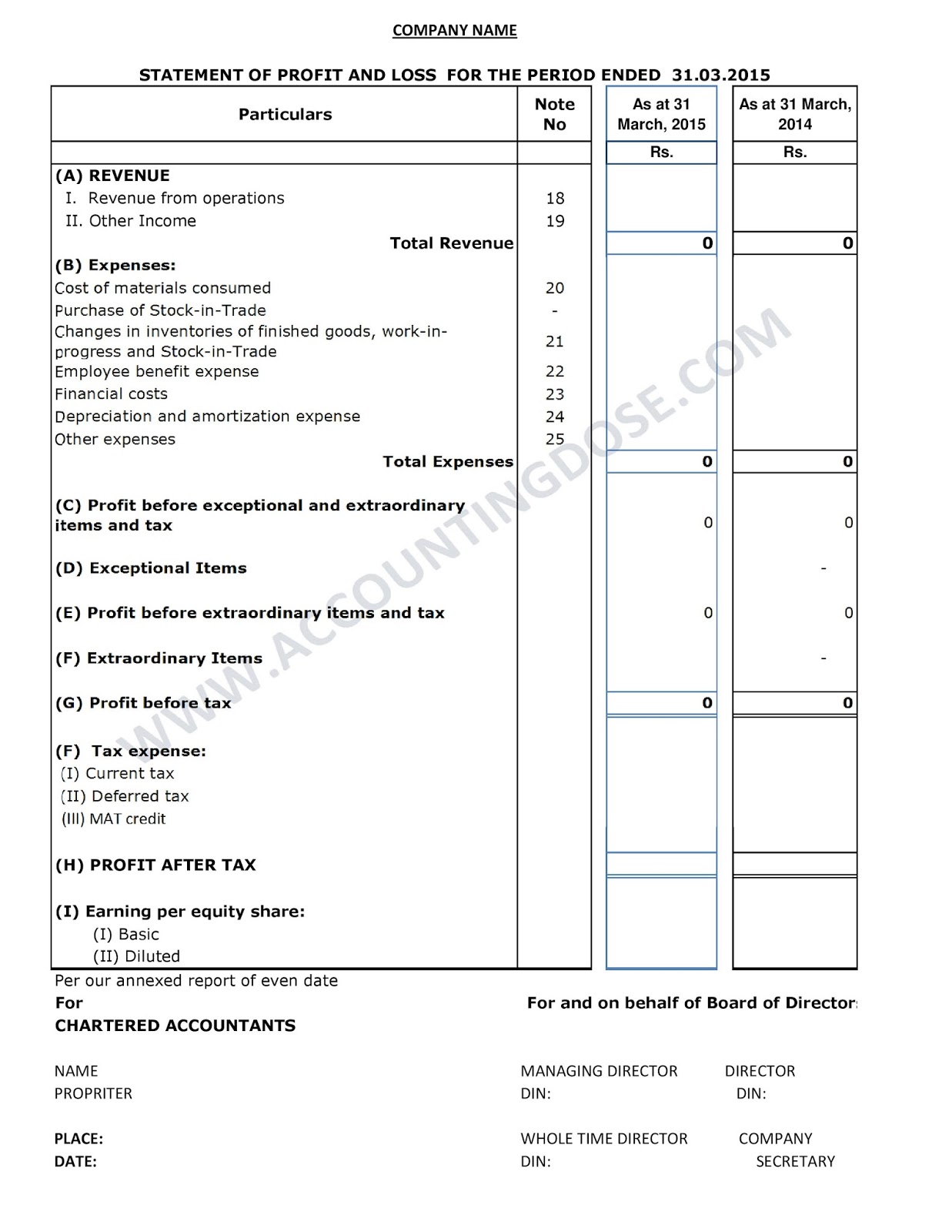

Supreme Balance Sheet As Per Schedule Vi

Usefulness of balance sheet.

Balance sheet as per schedule vi. General Introduction to Schedule VI to the Companies Act-1956 2. Investors creditors and internal management use the balance sheet to evaluate how the company is growing financing its operations and distributing to its owners. As per revised schedule VI any item of income or expense which exceeds one per cent of the revenue from operations or Rs100000 earlier 1 of total revenue or Rs5000.

Loss does not mention any appropriation item on its face. Provisions of Schedule VI will prevail over Accounting Standards. TOOLS FOR FINANCIAL STATEMENT ANALYSIS 1.

Prepare the Balance Sheet as at 31st March 1998 as required by Part I Schedule VI of the Companies Act. Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act 1956 revised. Except in the case of the Balance Sheet laid before the compan.

Provisions of Accounting Standards will be in addition to the disclosure norms as per Schedule VI. Current and non-current classification has been introduced for presentation of assets and liabilities in the Balance Sheet. Both horizontal and vertical forms were allowed.

In our view Miscellaneous Preliminary Expenditure should be disclosed as follows in revised schedule VI -. The Balance Sheet includes. Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act 1956 revised.

BALANCE SHEET DISCLOSURE REQUIREMENT AS PER SCHEDULE VI PART I OF THE COMPANIES ACT 1956 1GeneralThe Balance Sheet of the Company shall be either in horizontal form or vertical form. Ministry of Corporate Affairs MCA Government of India has on 3. Major changes related to the Balance sheet.