Beautiful Change In Tax Rate Deferred Tax

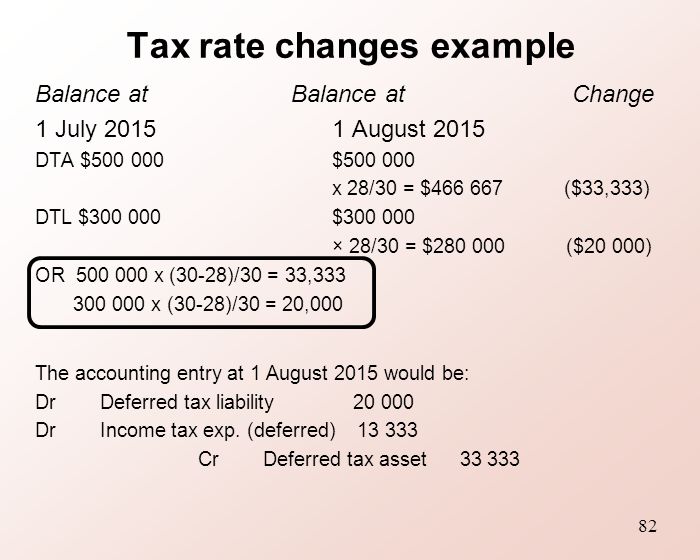

It must adjust the DTL as per the change in the tax rate.

Change in tax rate deferred tax. However they would need to forego certain existing tax incentives any carry-forward MAT credit and any carry forward loss. Measurement of deferred tax. 2833500 x05 141675 or 1275075 - 11334 141675 JULY 23 YEAR 3 TAX EXPENSE - DEFERRED 141675 DIT 141675 fTHIS ENTRY MUST BE MADE AFTER THE LEGISLATION IS PASSED AND BEFORE YEAREND SO THAT INTERIM STATEMENTS THIRD.

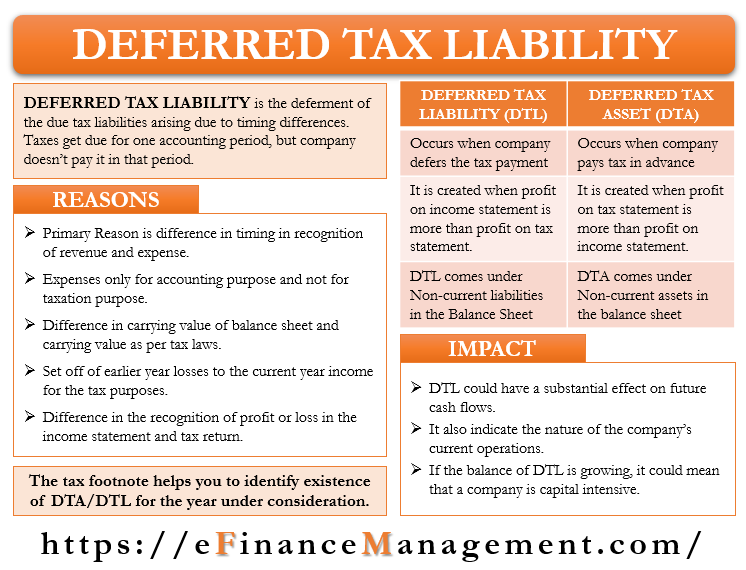

However Finance Bill 2021 announced increases to corporation tax from April 2023 meaning that Companies will now pay between 19 and 25 corporation tax depending on the size of the profits of the Company and any. If the tax authorities change the income tax rate to 35 then the deferred tax liability is. Income Tax Expense taxes payable Change in DTL Change in DTA.

If you want to classify deferred tax settings see Classifying Deferred Tax Assets and Liabilities. ONLY A FUTURE TAX RATE CHANGE THAT HAS BEEN ENACTED INTO LAW CAN BE USED IN COMPUTING DIT. In recent years deferred tax has been measured at the current corporation tax rate of 19 as there had been no legislation to suggest corporation tax rates would increase.

A company must account for any change in the tax rate after it calculates its deferred tax liabilities. OR b Opening balance is a deferred tax liability and the tax rate increases. The Government estimates that the 19 percent CT rate will continue to apply to around 70 percent of active companies.

Increases decreases in the tax rate will lead to increases decreases in reported amounts for deferred tax assets and liabilities. Course Hero member to access this document. Tax rates dictate the amount of deferred taxes to be recorded because it determines the amount of taxes to be paid.

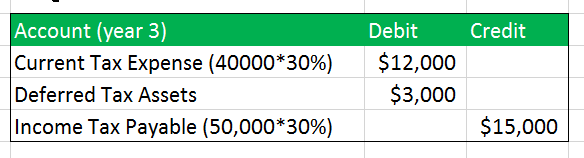

We have a decrease in deferred tax liability of 4125 and we must pay 10000 30 3000-41251125. Click Package and then select Deferred Tax. The first year the tax decrease that the asset is 2500 25 of 10 000 -1875 the deferred tax liability increase -625 The second year is 2500- 80000-81000 25 1875 -1125 Its the same amount for every year.