Top Notch Acquisition Balance Sheet Example

Bigco wants to buy Littleco which has a book value assets net of liabilities of 50 million.

Acquisition balance sheet example. I knew it creates Goodwill but I thought it was because purchase price is usually bigger than the value of company. Access valuations EBITDA revenue multiples. Preparation of Balance Sheet Horizontal and Vertical Style.

Ad Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place. Summary Post-Acquisition Balance Sheet Projections 44 Summary Post-Acquisition Retained Earnings Projections 45. Hereafter called the Company.

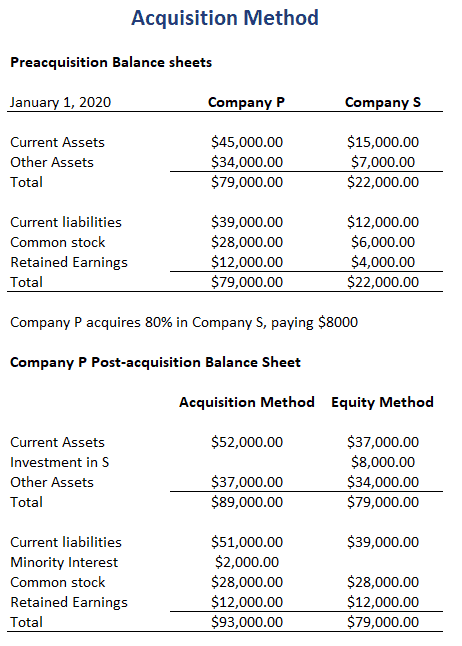

Non-controlling interest in Company Ps consolidated balance sheet is equal to 25 of Company Ss net assets 10 million minus 7 million ie. Acquirers must identify all the assets they are acquiring both tangible Tangible Assets Tangible assets are assets with a physical form and that hold value. Like paying control premium and stuff.

On December 31 2000 for 200000 in stock but used the purchase method to account for the acquisition. The equity component that represents Company Ps interest is hence 1225 million total equity of 13 million minus non-controlling interest of 075 million. Since cash was used 100000 would be subtracted from Company As cash asset account on the balance sheet.

Why would acquirer be willing to pay 100 million for a company whose balance sheet tells us its only worth 50 million. Financing Adjustments STEP 25. Exhibit 1 Pro forma balance sheet effect of recording an acquisition using the purchase method Assume that XYZ Inc.

Ad Access MA financials deal terms companies strategic acquirers and advisory firms. The following trial balance is prepared after preparation of income statement for F. You can see that we zero-out TargetCos stockholders equity because BuyerCo is purchasing that equity.