Favorite How To Calculate Total Assests In German Balance Sheet

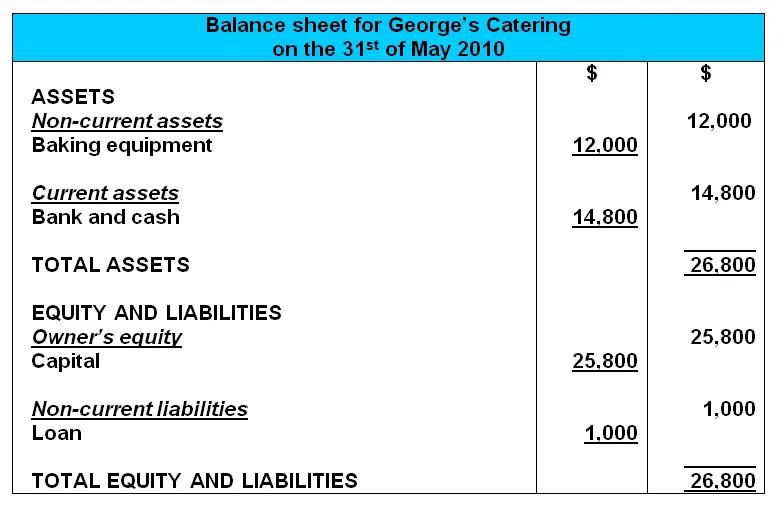

Total assets always equals total liabilities plus shareholders equity.

How to calculate total assests in german balance sheet. Prepare Proforma Balance Sheet from the following information for the year 2008. Total debt would be calculated by adding the debt amounts or 100000 50000 200000 350000. There is a broad range of assets that your business may own create or benefit from including real estate cash office equipment goodwill investments patents inventory and so on.

The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholders equity. The stock of durables in particular durable consumer goods such as cars is also included in the household sectors balance sheet thus providing a comprehensive picture of the sectoral and overall asset situation. Now you will get current cost of fixed asset.

Next subtract your liability from your assets to find ownership equity which is the amount of money youve invested in the business. The balance sheet is formatted to display the companys assets balanced against its liabilities and shareholders equity. Total Assets Total Assets is the sum of a companys current and noncurrent assets.

The business must now record the changes in fair value of the asset in this case the accounts receivable and the foreign exchange forward contract. Shareholders equity is the money attributable to a business owners meaning its shareholders. Essentially an asset is any resource with financial value that is controlled by a company country or individual.

They essentially comprise all produced and non-produced non-financial assets such as real estate machinery and equipment and land. This may be made clear by the following example. Calculated by dividing a companys annual earnings by its total assets ROA is displayed as a percentage.

Type of Asset. Your balance sheet lists all of your. At the balance sheet date of December 31 2018 the exchange rate has changed.