Supreme Deferred Gst Example

Not for business use Input tax claims which are disallowed.

Deferred gst example. Haibo Pty Ltd Haibo imports dog food to sell in its pet shop entering it for home consumption on 1 April 2020. For example if the lease rate increases after a number of months the average rent expense is still charged in all months with a portion of this charge being included in the deferred rent liability. The freight forwarder invoiced BlueSky for the freight charges import duty and other fees but the 40000 GST that is normally payable on the import was deferred.

They do the prefilling so you have to be particularly careful of cut off dates etc. Such as if the Corporation has unclaimed input tax credits from the previous four years. Allocate codes that are relevant to the item in the invoice line ie.

The deferred tax liability on Special Reserve in the above example will be 2 lac 30 060 lac. Sarah is a computer wholesaler who imports computers and then sells to computer retailers. See for example Bremner v The Queen 2009 FCA 146.

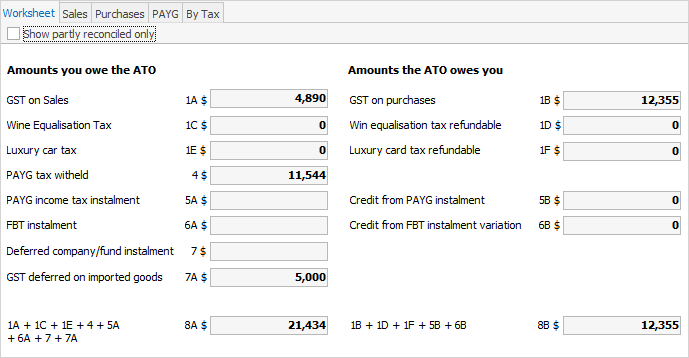

Deferred GST allows you as an importer to defer payment of GST on all taxable importations into Australia. The GST deferred on this shipment is 2000. Monthly reporting accrual accounting and electronic lodgement.

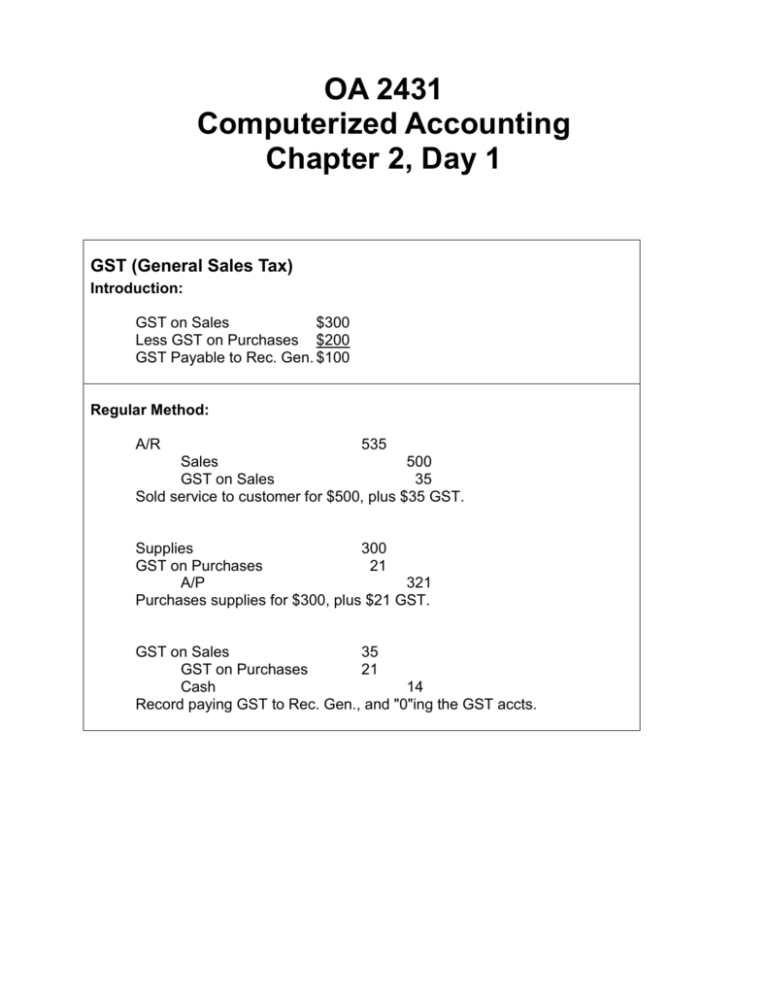

GST type is Exempt youre claiming GST in the invoice lines that relate to the items themselves. Here is an example. GST incurred on the purchase of goods and services for private use ie.

Haibo is registered for GST. In the above example 100 represents a liability to the ATO and a tax credit. Depreciation is a temporary difference and thus concept of deferred tax will come into picture.