Ace Ifrs 17 Balance Sheet Example

A short webcast guides you through the summary.

Ifrs 17 balance sheet example. The aim of IFRS 17 is to standardize insurance accounting globally to improve comparability and increase transparency and to give users of accounts the information they need to understand the insurers financial position performance and risk exposure. The Transition balance sheet will impact performance for years to come. IFRS Balance Sheet template is available in the following formats.

C all paragraph numbers are related to IFRS 17. We have not intended to build a realistic insurance or investment operation existing in a realistic market. IFRS 17 and IFRS 9IFRS 15 Revenue from Contracts with Customers IFRS 15.

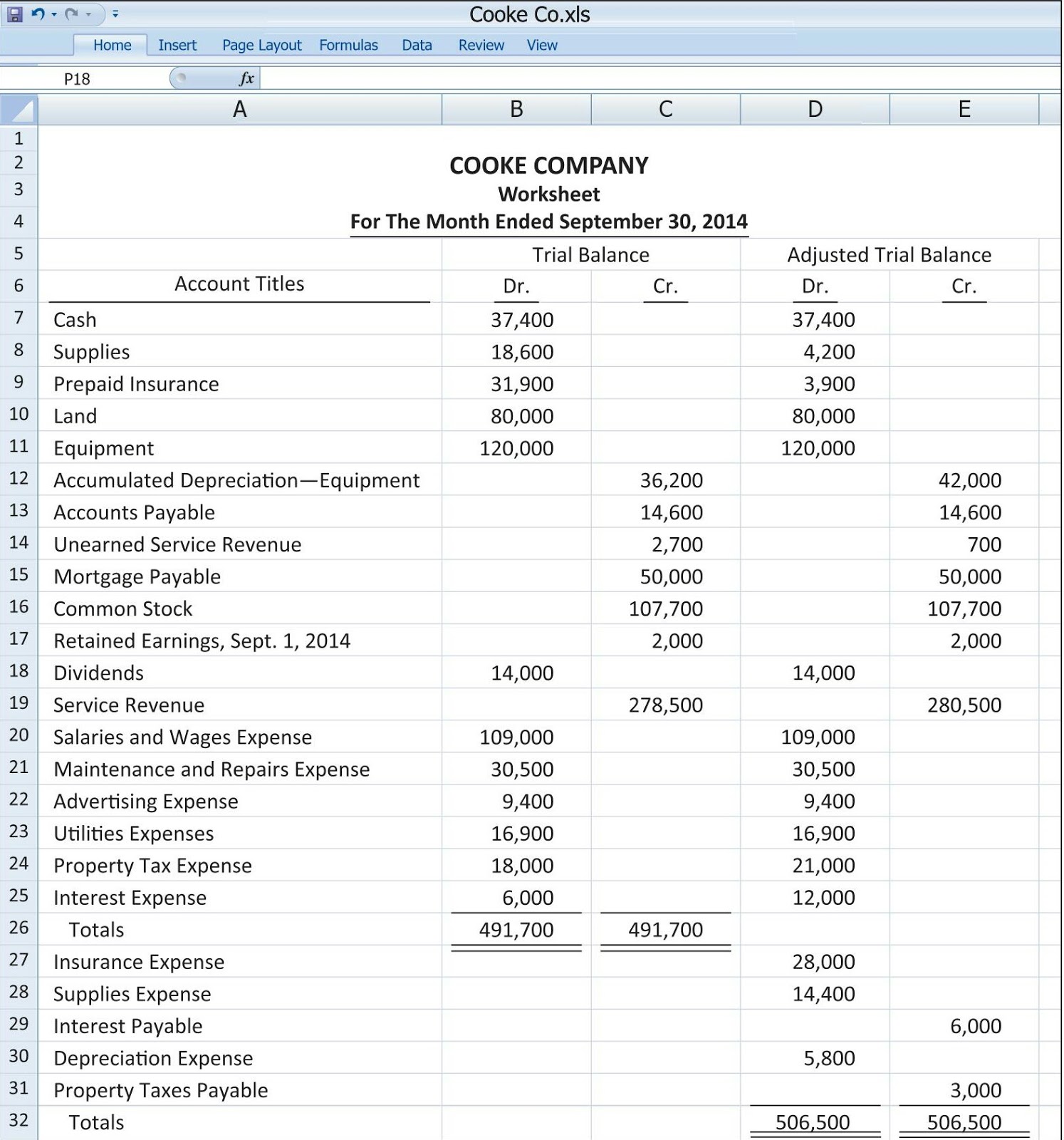

This is on the basis of all the cash flows expected to arise. Calculate interest expense for 2018 and 2019. The lease payment payable in advance each year was 3 500.

A credit amounts are presented as positive and debit amounts are presented as negative in brackets. The amounts disclosed in the Illustration have been modeled purely for illustrative purposes to provide a user with a basis from which to assess the. A process to allocate new policies to a profitability group 3.

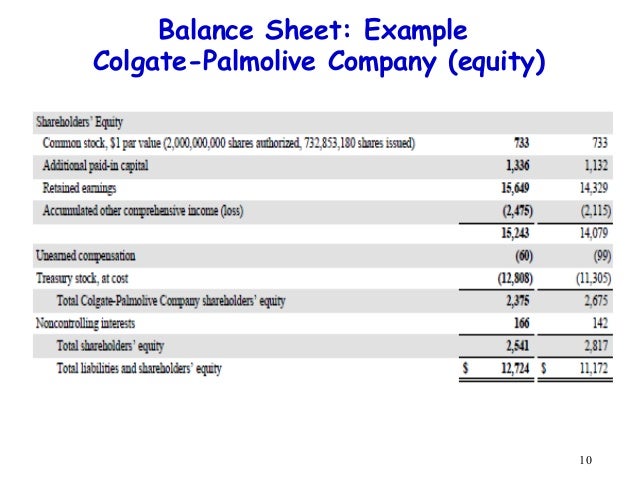

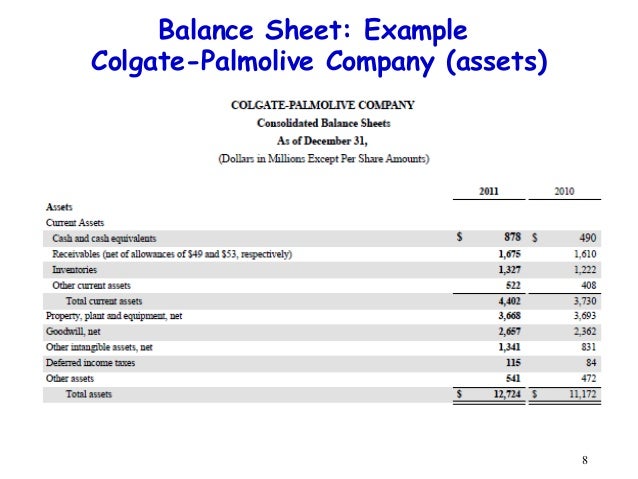

A roll forward and analysis of movement of the CSM from one period to the next on historic assumption sets. But the significantly lower tracking of movements in liabilities for profit recognition under IFRS 17 is likely to drive a number of new system developments. Common presentation in the balance sheet in applying IFRS 4.

B specific requirements in IFRS 17 see Examples 418. Premium receivable and Claims payable Issues Paper Introduction 1 IFRS 17 will require separate presentation of portfolios of insurance contracts in an asset and liability position. The IFRS 17 balance sheet and income statement include.