Beautiful Forecasted Contribution Margin Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

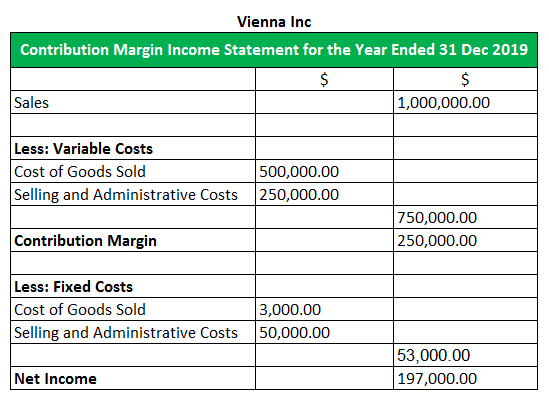

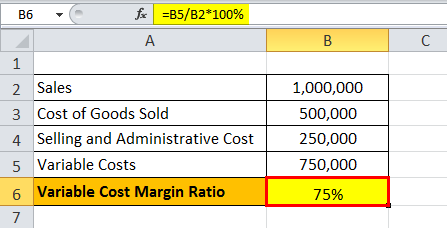

In a contribution margin income statement variable cost of goods sold is subtracted from sales revenue to obtain gross contribution.

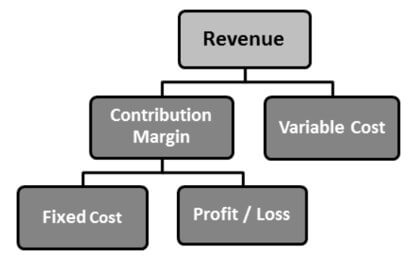

Forecasted contribution margin income statement. Contribution margin is essentially a companys revenues minus its variable expenses and it shows how much of a companys revenues are contributing to its fixed costs and net income. Rent utilities payroll and other administrative expenses not related to sales or production are considered fixed costs. Then all fixed expenses are subtracted to arrive at the net profit or net loss for the period.

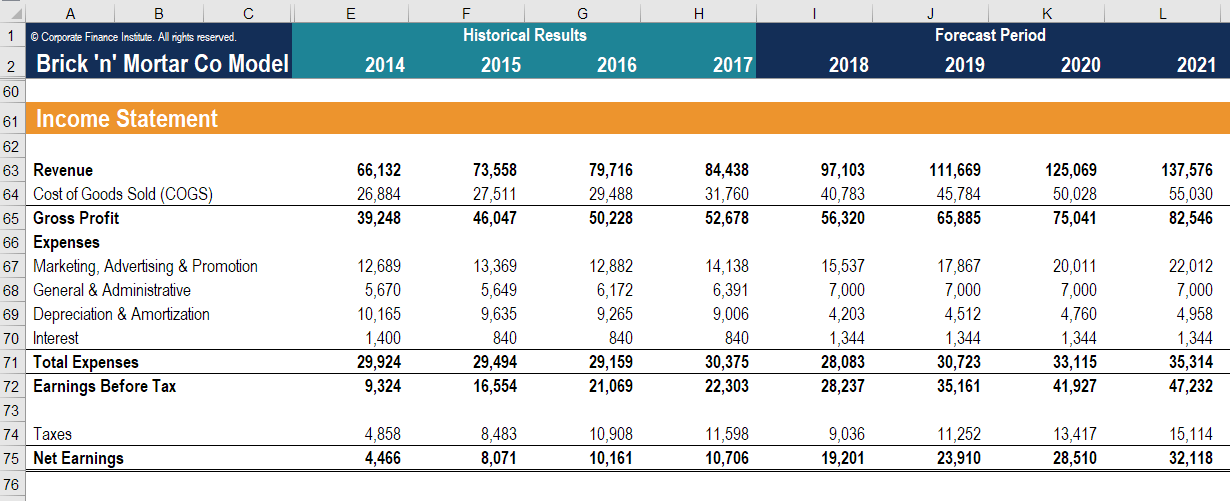

Prepare forecasted financial results for next year following the format of the contribution margin income statement shown with columns for each of the two products assume a 32 tax rate. The marketing manager believes that increasing advertising costs by 101000 in 2020 will increase the companys sales volume to 11500 units. Prepare a forecasted contribution margin income statement for 2012 that shows the expected results with the machine installed.

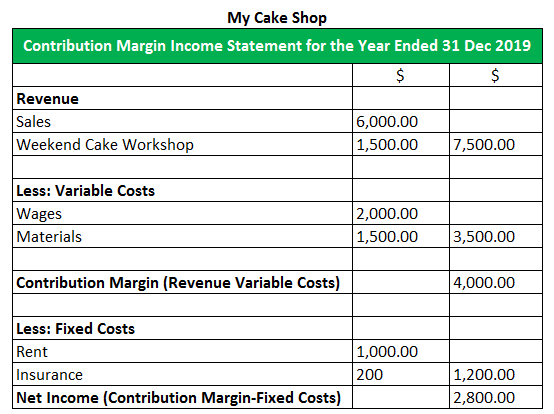

The statements should report sales total variable costs contribution margin total fixed costs income before taxes income taxes 30 rate and net income This year Burchard Company sold 36000 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs. Contribution Margin Income Statements.

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. Thus the arrangement of expenses in the income statement corresponds to the nature of the expenses. Assume that the unit sales price and the number of units sold will not change and no income taxes will be due.

Pro Forma Income Statement. Prepare a forecasted contribution margin income statement with two columns showing the Requlred Informatlon expected results of plan 1 and plan 2. Assume that the unit selling price and the number of units sold will not change and no income taxes will be due.

Fixed costs 3700000 Income before taxes 1300000 8. Total contribution margin Sales Variable costs. The contribution margin per unit is defined as the difference between selling price per unit and the variable cost per unit.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)