Wonderful Offsetting Of Financial Assets And Liabilities Examples

Offsetting Identifying recognising and measuring both an asset and a liability as separate units of account but presenting them in the statement of financial position as a single net amount.

Offsetting of financial assets and liabilities examples. DisclosuresOffsetting Financial Assets and Financial Liabilities Amendments to IFRS 7 was issued in December 2011 and is effective for annual periods beginning on or after 1 January 2013 and interim periods within those annual periods. The offsetting model in IAS 32 Financial Instruments. Or subject to master netting arrangements or similar.

Presentation requires an entity to offset a financial asset and financial liability when and only when an entity currently has a legally enforceable right of set-off and intends either to settle on a net basis or to realise the financial asset and settle the financial liability simultaneously. Requirements for financial assets and liabilities that are. A financial assets and financial liabilities eligible for set-off are submitted at the same point in time for processing.

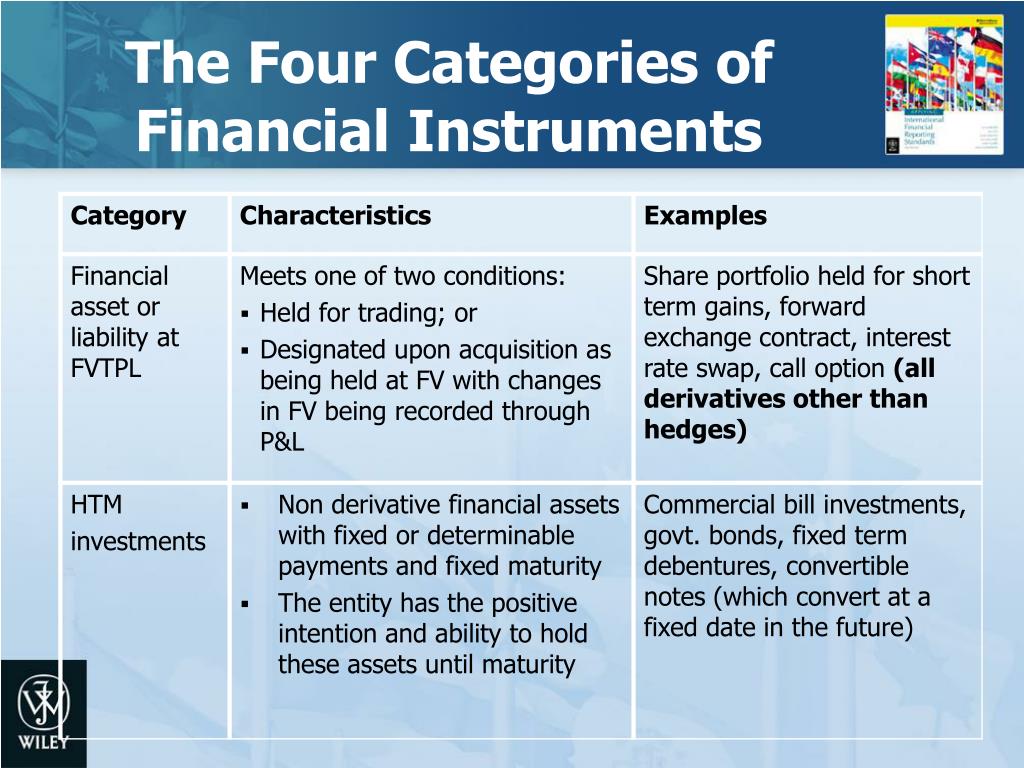

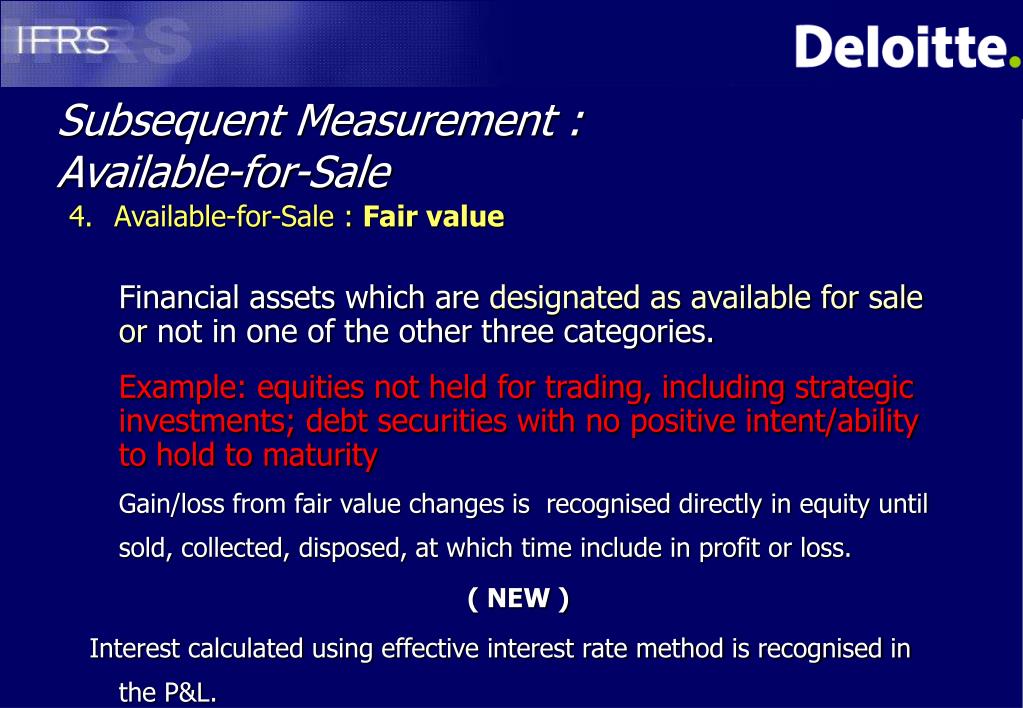

A to settle the financial asset and financial liability on a net basis or b to realise the financial asset and settle the financial liability simultaneously. IFRS 9 makes other changes to the IAS 39 requirements for classifying and measuring financial assets and liabilities. IFRS Taxonomy 2017 Illustrative examples.

Financial assets subject to offsetting enforceable. Financial assets which are and forever will be at FVPL. Allowing trade receivables that dont have a significant financing.

Offsetting assets and liabilities. Liability when the entity has an unconditional and legally enforceable right to set off the financial asset and financial liability and intends either. When a company offsets the two reporting them as one entry it.

Offsetting financial assets and. Currently has a legally enforceable right to set off the recognised amounts. In fact it requires offsetting in certain circumstances.