Wonderful Ifrs 16 Deferred Tax Example Uk

LesseeT Lessor L 5-year lease.

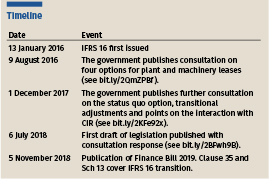

Ifrs 16 deferred tax example uk. Recognising deferred tax on leases. Cover some of the more complex areas of preparation of a deferred tax computation for example the calculation of deferred tax balances arising from business combinations. Deferred Tax Published 15 November 2017 last updated 5 March 2018 5 Illustrative example.

The lease contract started on 1 January 2017 and the lease was recognized as operating lease since then. Unrelieved tax losses and deferred tax liabilities As at 31 December 20X7 Entity A has unrelieved corporation tax losses of 50000. The company has rented an office with 5 years and the payment 120000 is at the end of each year.

The balance of rs. By ensuring that tax rules align with IFRS 16 this measure helps business implement IFRS 16. Deferred tax calculation example uk.

This is designed to ensure a level playing field between businesses operating under UK GAAP or IFRS. Amendments to IFRS 16. In my understanding we will have to.

The introduction of IFRS 16 will also impact tax accounting as depending on the local tax law deferred tax and the ETR may be impacted. Quick question about the example. When lease payments are made.

Instead a right of use asset and lease liability should be recognised in respect of all leased assets including assets leased under what would be considered to be an operating lease under IAS 17. Ts tax rate is 50. It will replace IAS 17 Leases for reporting periods beginning on or after 1 January 2019.