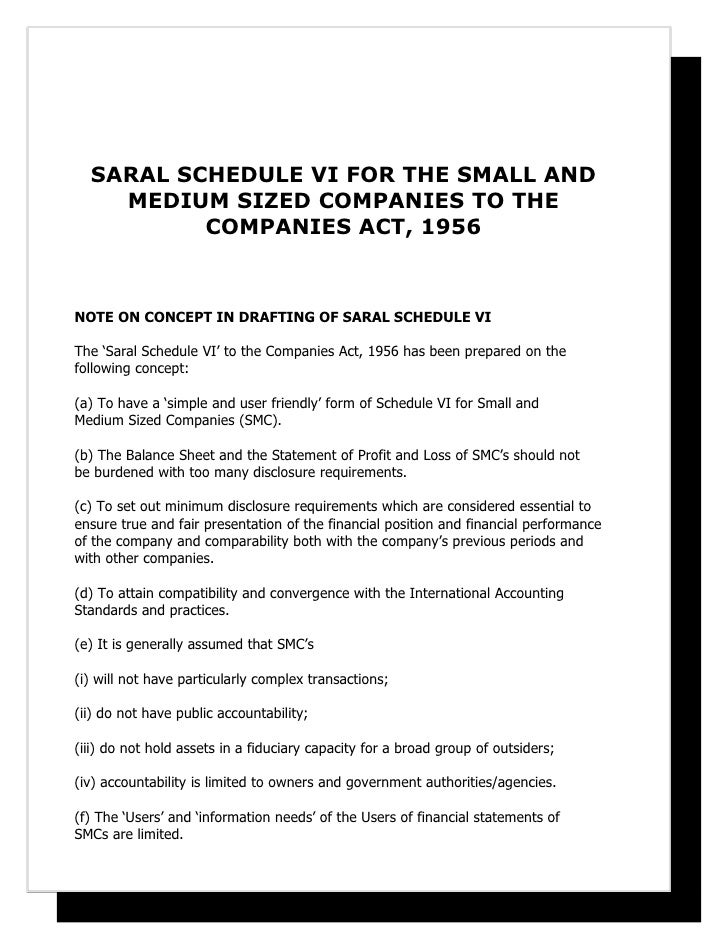

Ace Schedule Vi Of Companies Act 1956

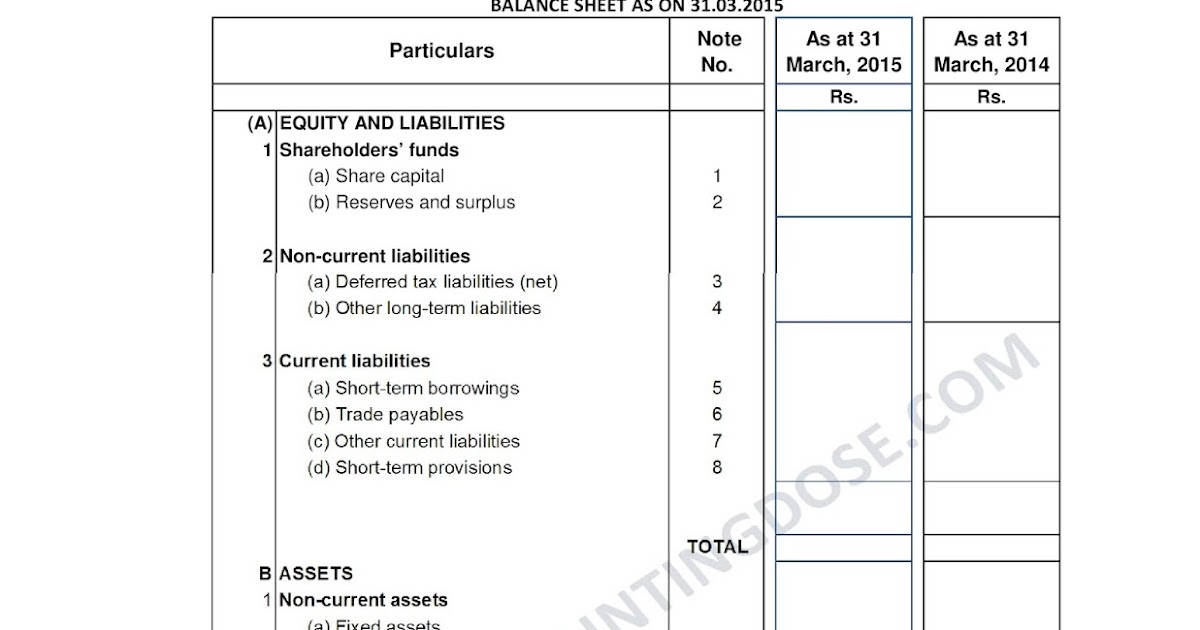

The Schedules referred to above accounting policies and explanatory notes that may be attached shall form an integral part of the balance sheet.

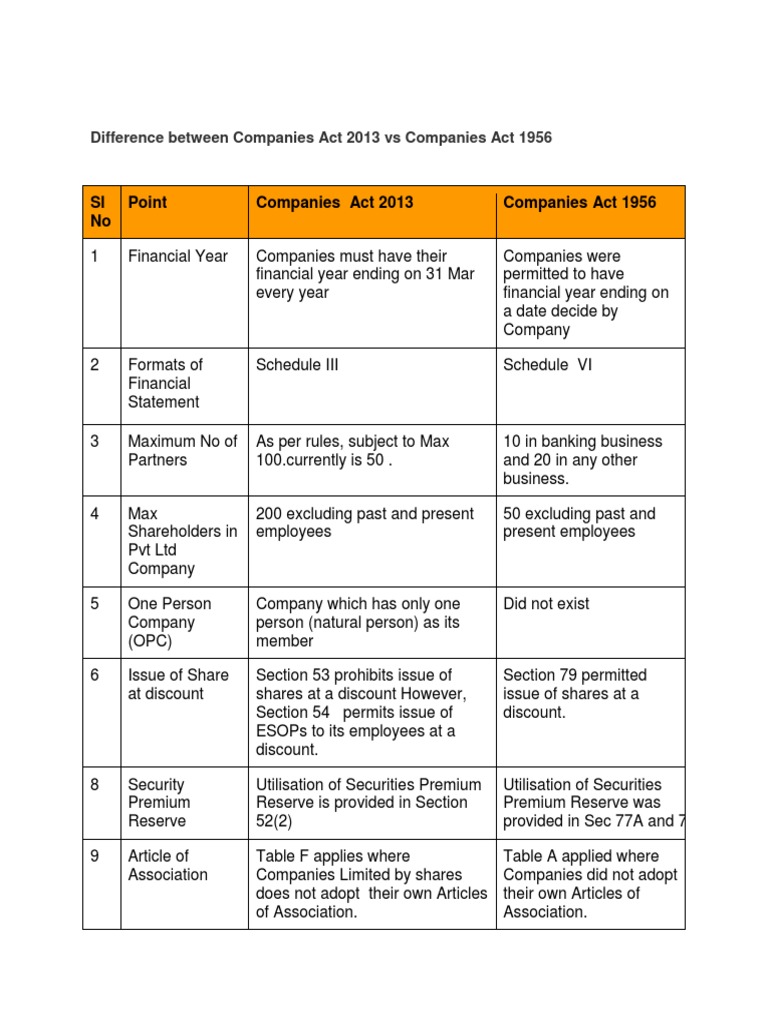

Schedule vi of companies act 1956. The Revised Schedule VI to the Companies Act 1956 became applicable to all companies for the preparation of Financial Statements beginning on or from 142011. Short title commencement and extent 2. Section 218 Penalty for improper issue circulation or publication of balance sheet or.

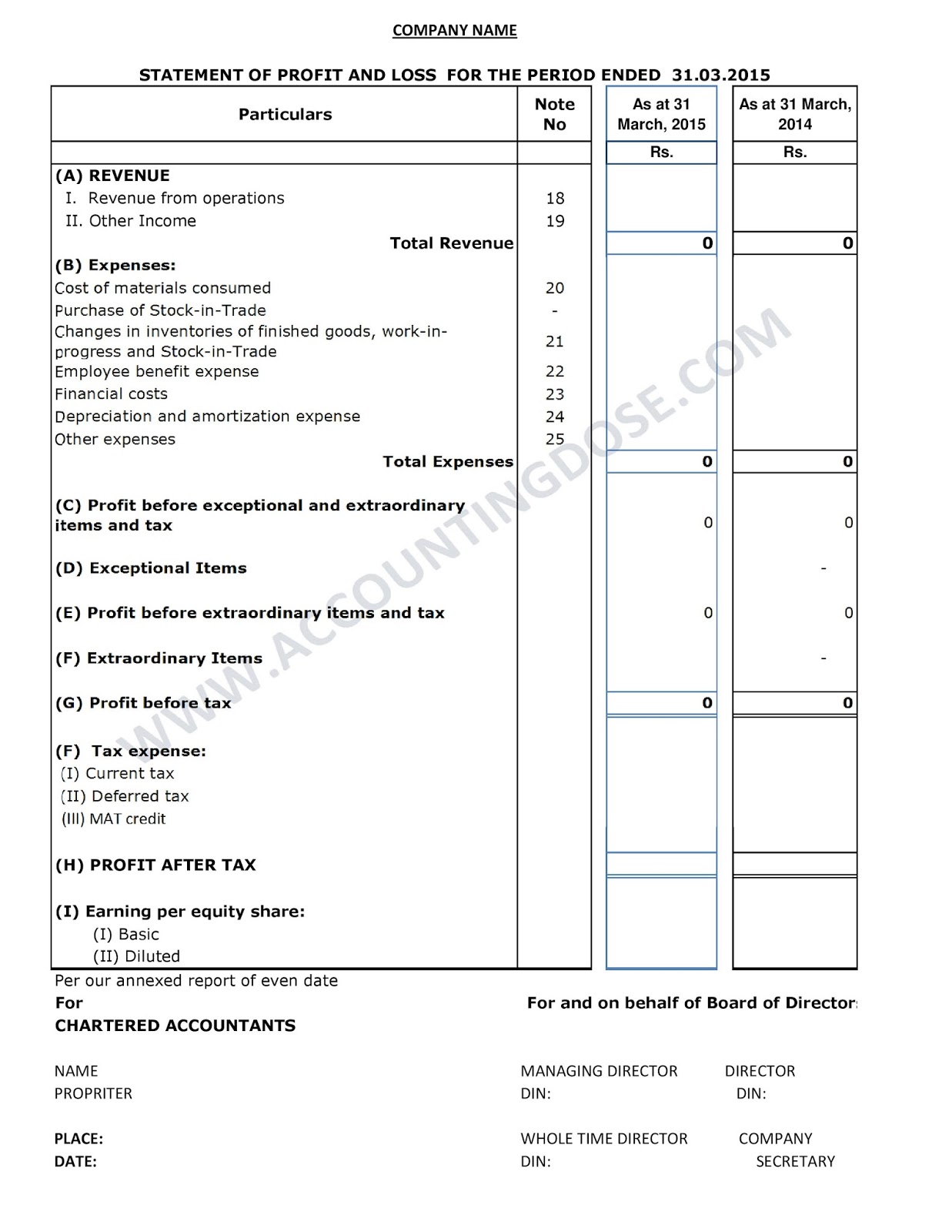

DISCLOSURE REQUIREMENTS AS PER SCHEDULE VI PART II OF THE COMPANIES ACT 1956. COMPANIES ACT 1956 Act No. Schedule VI shall stand modified accordingly.

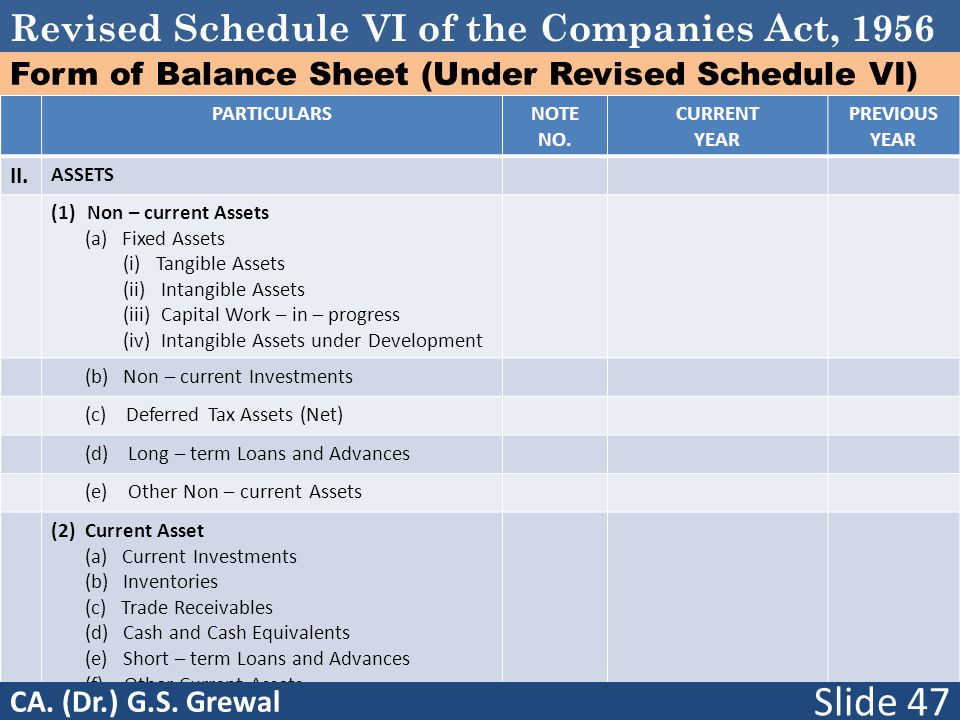

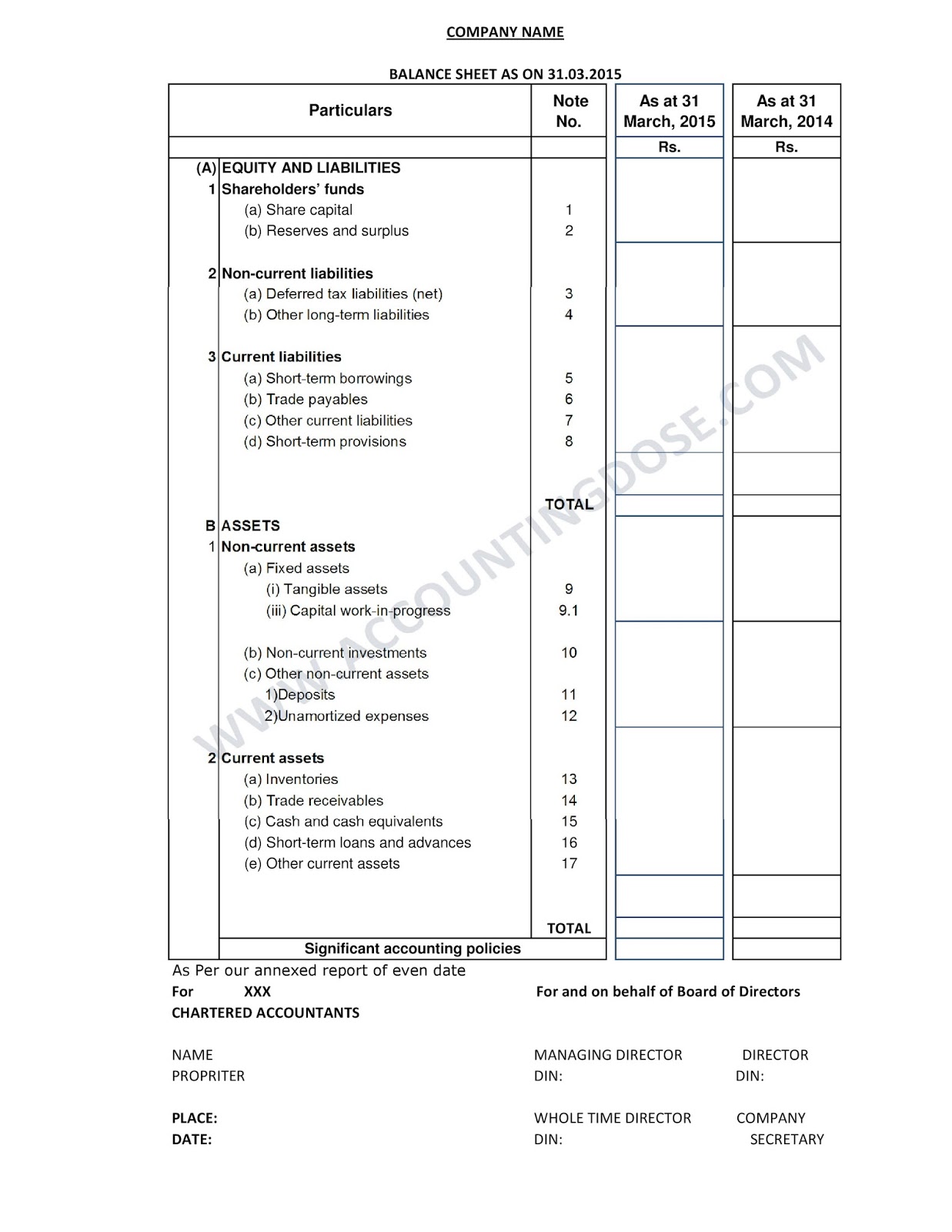

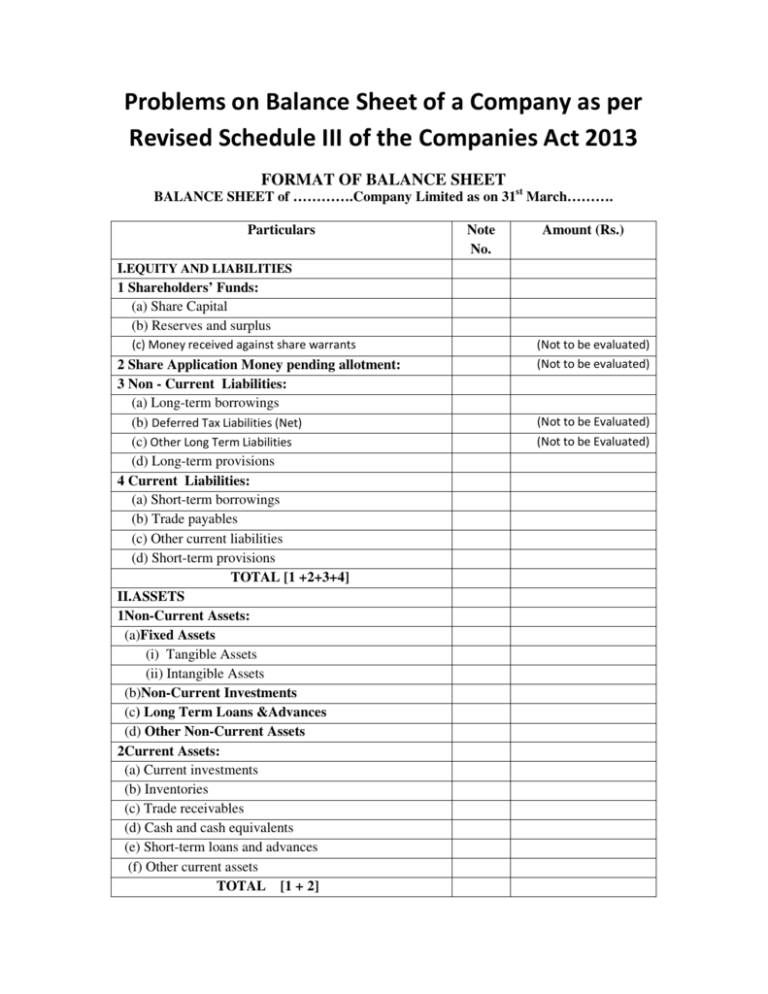

SCHEDULE VI - Form of Balance-sheet The balance sheet of a company shall be either in horizontal form or vertical form - Companies Act 1956 X X X X Extracts X X X X Notification No. Norman Ralph Augustine CA. Form of Balance-sheet The balance sheet of a company shall be either in horizontal form or vertical form.

R iv of Part I of Schedule VI to the Companies Act 1956 As at 31 March As at 31 March Long Term Loans Advances to Related Parties Directors Other officers of the Company Firm in which director is a partner Private Company in which director is a member Either severally or jointly Note 19 Disclosure regarding Other Current Assets Note i Disclosure pursuant to Note no. To facilitate the preparation. Revised Schedule VI clarifies that the requirements mentioned therein for disclosure on the face of the financial statements or in the notes are minimum requirements Revised Schedule VI has eliminated the concept of.

The Schedules shall incorporate all the information required to be given under A-Horizontal Form read with notes containing general instructions for preparation of balance sheet. Public financial institutions 5. 1 OF 1956 PART I.

It is a major step and members of the profession have a greater role and responsibility in its preparation. SCHEDULE VII VIII. Section 216 Profit and loss account to be annexed and auditors report to be attached to balance sheet.