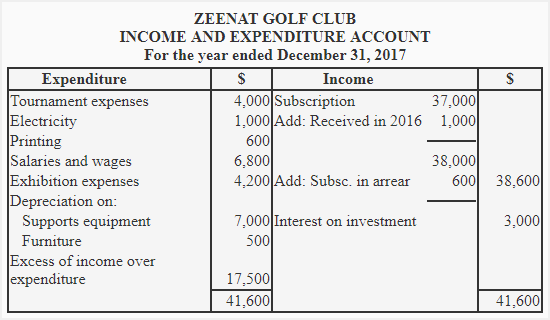

Ideal Income And Expenditure Account Format Of Co-operative Housing Society

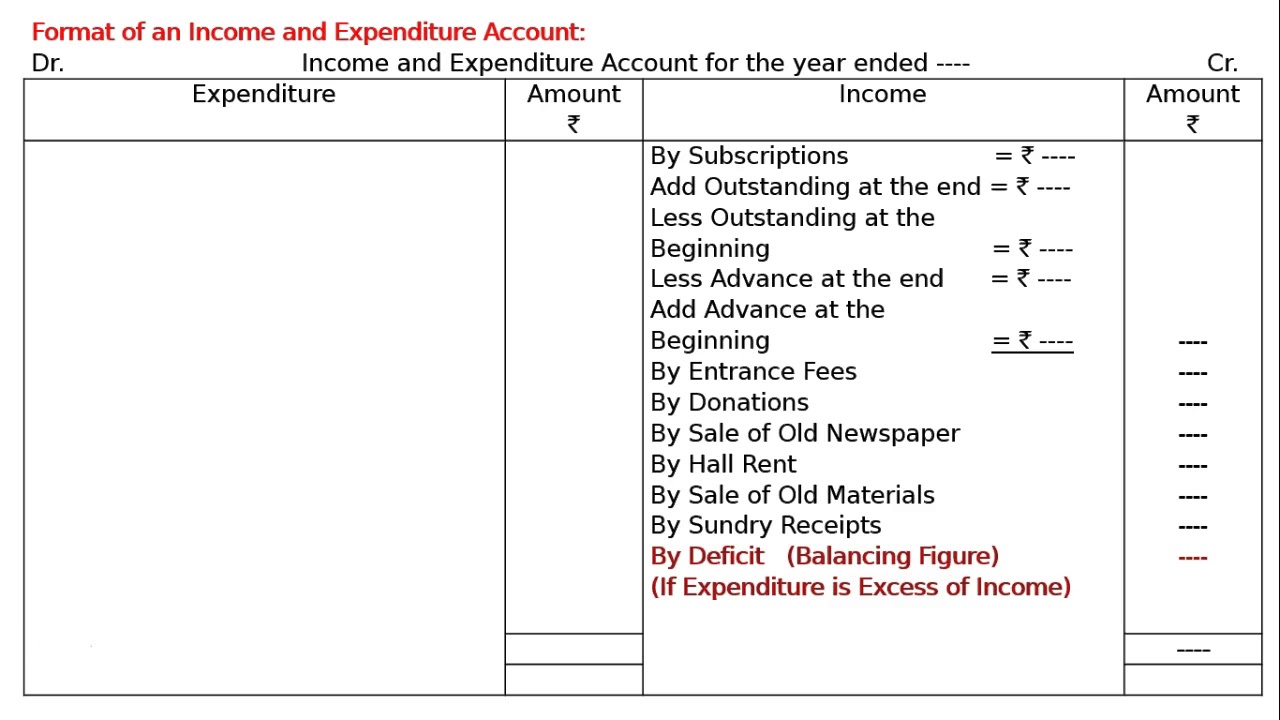

Interest income includes interest fixed deposits interest from a savings bank account and interest from members on arrears.

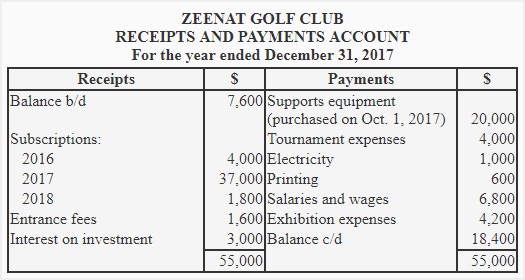

Income and expenditure account format of co-operative housing society. Examples of a ready-to-use spreadsheet. Income Expenditure Account of a Co-operative Housing Society - Free download as PDF File pdf Text File txt or read online for free. Add- Current Year Balance.

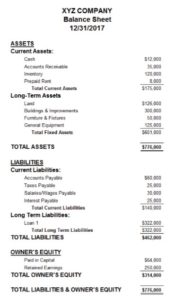

Do note that as per section 115BAD residential co-operative societies can opt to pay tax at the rate of 22 from AY 2021-22. This is a wrong perception since though certain types of income of CHS are exempt there are other incomes. Profit Loss Ac and Balance Sheet Format for Co-operative Societies including Co-operative Housing Societies under Maharashtra Co-operative Societies Act.

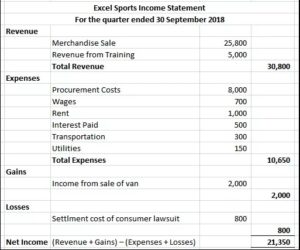

If for example the sales were as follows- 3 months 6 months 9 months 12 months Sales ksh 120000 180000 240000 320000 You can use these variations to calculate this years variation. This includes miscellaneous income received by the Society. In general the perception is that income of Cooperative Societies is not chargeable to tax and therefore many societies do not bother to take PAN No.

However the total income will be computed without allowing exemptions or deductions available to cooperative societies. A Statutory Reserve Fund and other reserves and funds shall be shown separately. Sign of CST of society.

To be able to use these models correctly you must first activate the macros at startup. As per section 35 of Co-operative Societies Act 1912 distribution of the profit should not be more than 625. Within 45 days of the close of every co-operative year the Secretary of the Society or any other person authorised by the Committee in that behalf shall finalise the accounts of the preceding co-operative year prepare the Receipts and Payments Statement the Income and Expenditure Statement for the said year and the Balance Sheet as at the close of the said year in the forms prescribed under Rule.

Lost years figures. We are recognized as one of the best co-operative Housing Society Accounting Services in Thane. Our society has been audited under the provisions of Maharashtra Co-operative Societies Act 1950 and the rules made thereunder and the present auditor has completed 3 years of his audit.