Recommendation S Corp Balance Sheet Example

.png)

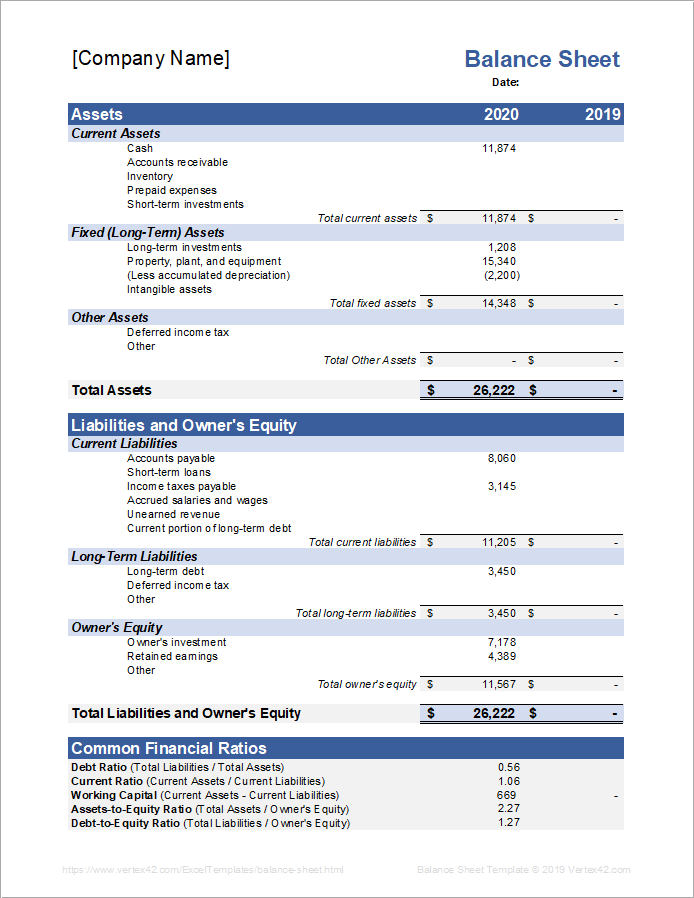

What goes on a balance sheet.

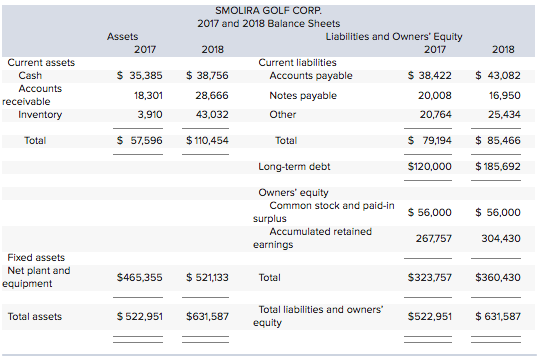

S corp balance sheet example. Every time a company records a sale or an expense for bookkeeping purposes both the balance sheet and the income statement are affected by the transaction. S-Corporation Equity. Calculating Beginning Balance Sheet 19 Ending Balance Sheet 20 Schedule M-1 tie return to books 22 Schedule M-2 Undistributed Income 23 BIG Tax 24 External Basis 26 Example of Excess Distributions -- Debt Relief 27 Example of Excess Distributions Loan to Shareholder 28.

I own a personal service S corp the owner and only employee for electronic engineering consulting. Correctly identifying and liabilities Types of Liabilities There are three primary types of liabilities. Below is an example of a corporate balance sheet for Walmart circa 2016.

This is because the S-Corp designation is a taxation rather than accounting issue. The equity section of the balance sheet for an S-Corporation is the same as the equity section for a regular corporation. Near the end of the post I briefly mentioned Schedule L the balance sheet.

I have no accounting background and the terms I see are complete gobbledegook to me. Fellman Rose Kerber Other titles. Edit with Office GoogleDocs iWork etc.

Heres an excerpt from that section. Last year I wrote a post about the S Corp tax return aka IRS Form 1120-S. Thats why you hired us.

Examples include real estate and. The Balance Sheet Mirrors the Accounting Equation. This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)