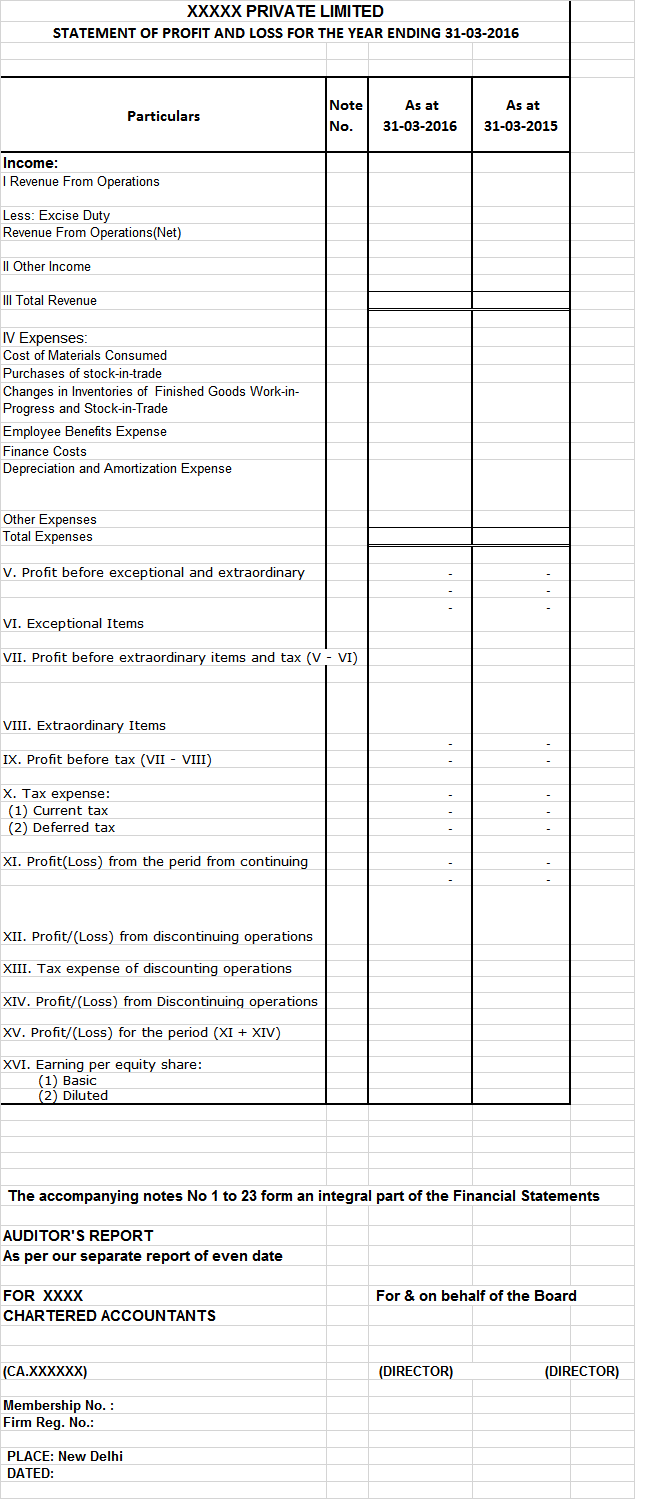

Smart Balance Sheet Format In Excel Sch 3 Mca

This example of a simple balance sheet.

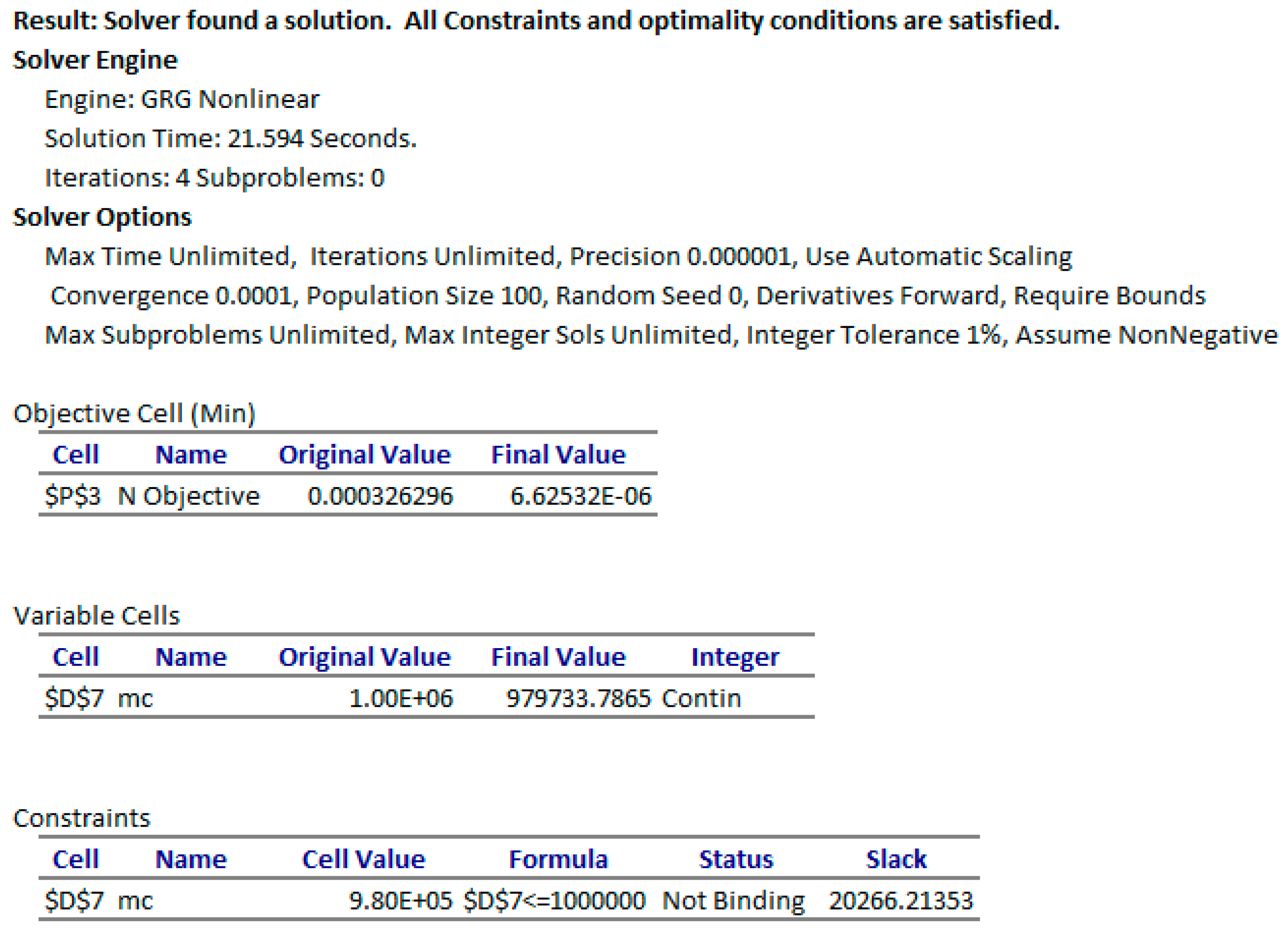

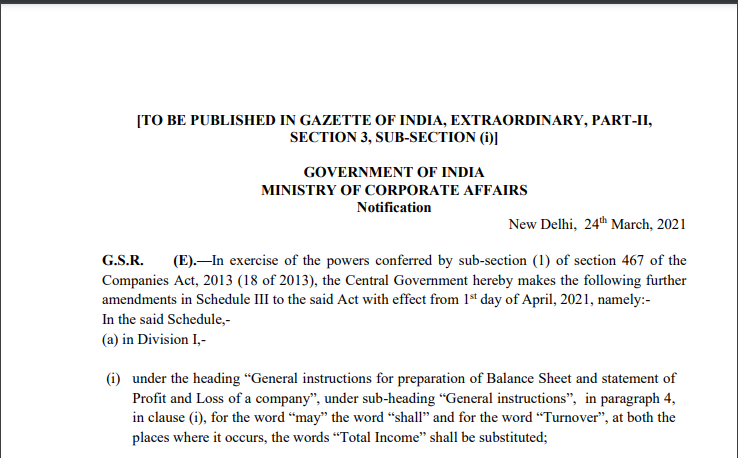

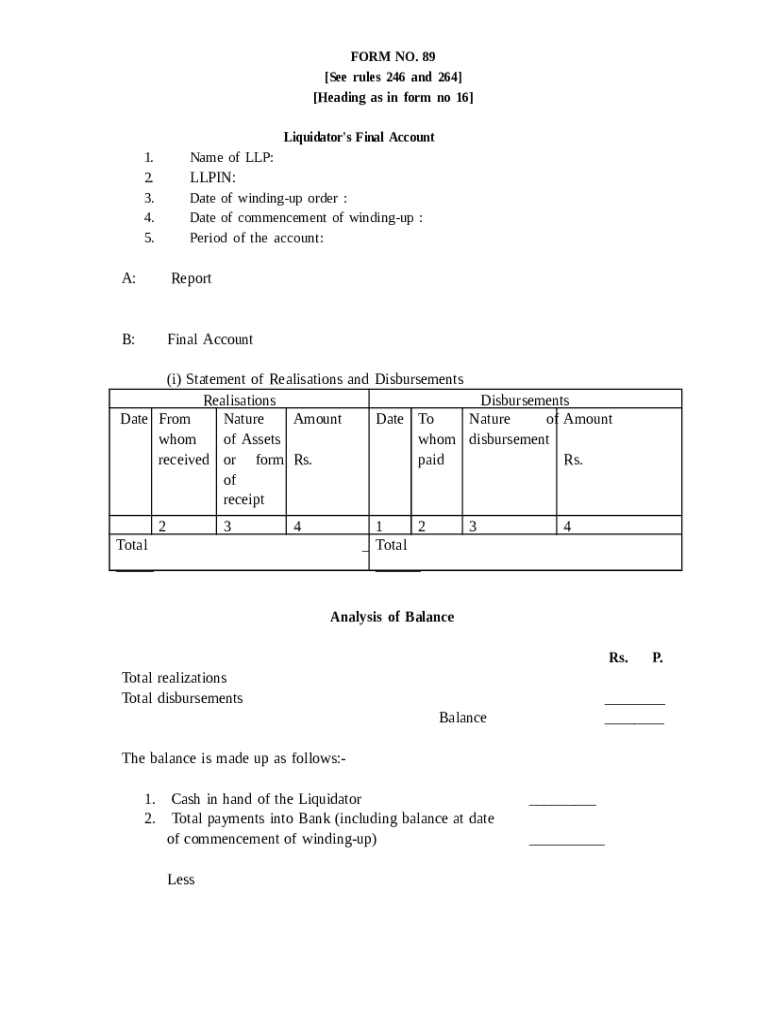

Balance sheet format in excel sch 3 mca. Under the heading II Assets under sub-heading Non-current assets after the words Property Plant and Equipment the words and Intangible assets shall be inserted and for the words Tangible Assets the words Property Plant and Equipment shall be substituted. 2 It is expected realised with in normal operating cycle. Including undisputed and disputed trade receivables considered good and doubtful with ageing classified as less than 6 months 6 months to 1 year 1-2 years 2-3 years and 3 years or more along with disclosures separate disclosure for information of unbilled.

Always for a correctly created balance sheet the total of the left side is equal to the total of the right side. Revised form 3cd in ms excel format for ay 2020 21. An Ind AS balance sheet starts with disclosures of Assets followed by disclosures of Equity Liabilities.

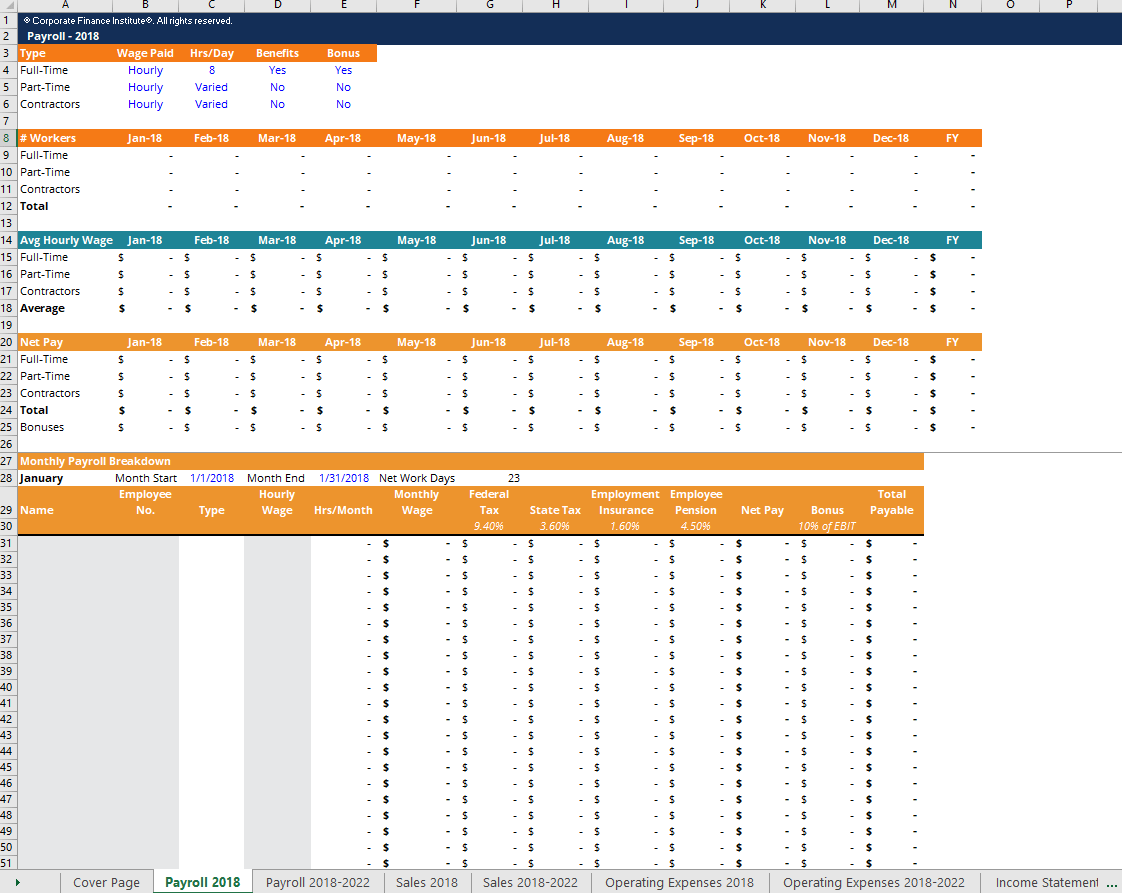

Moreover this Balance sheet template gives you. The classification of line items in balance sheet is divided in two categories- iEquity and Liabilities ii Assets. On 26 May 2016.

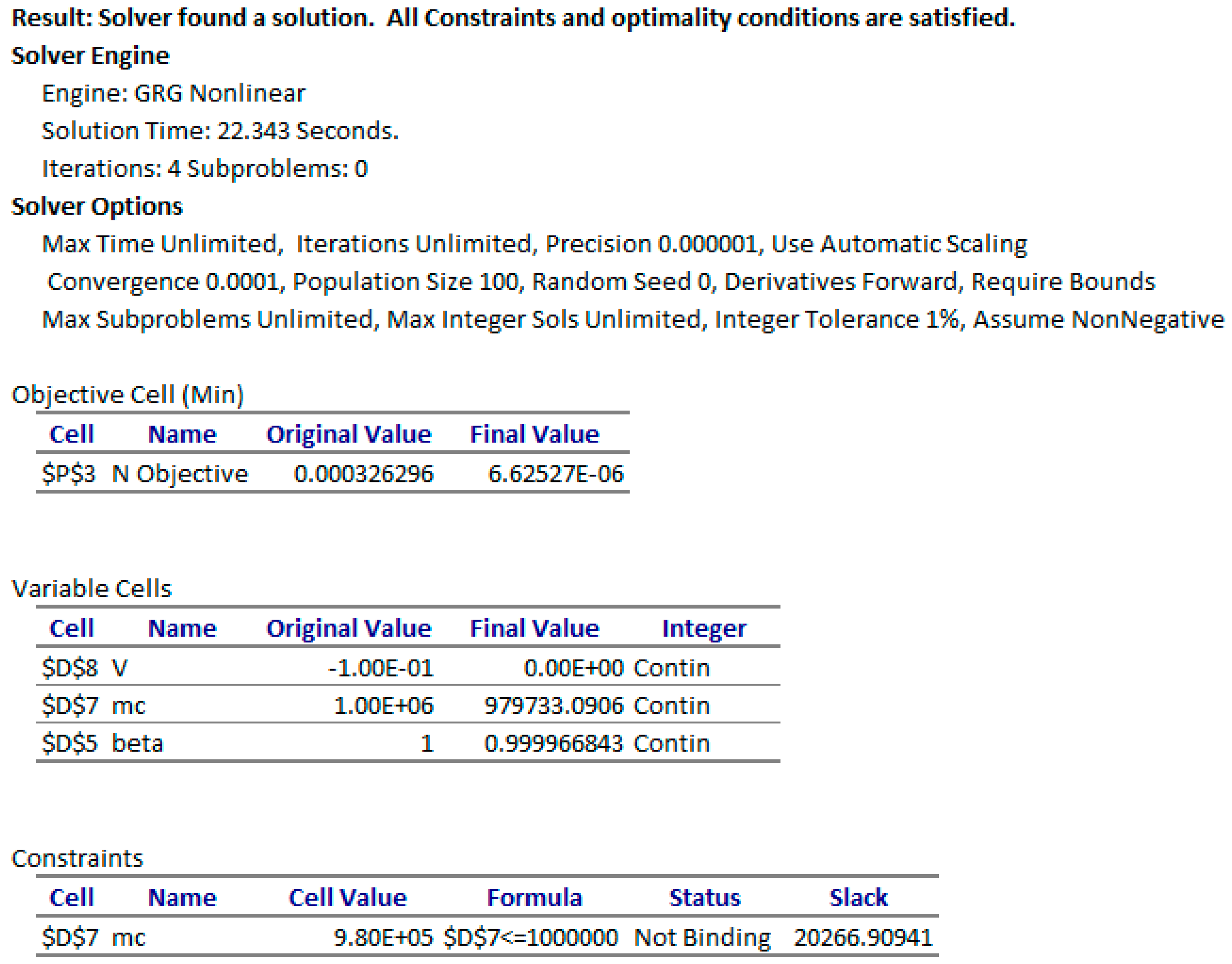

Revised Schedule III in excel. This requirement is only for Companies Private Limited and Limited Companies and not for PartnershipProprietorship. The ministry of corporate affairs government of india has revised this schedule to keep pace with privatization and globalization and bring the disclosures in.

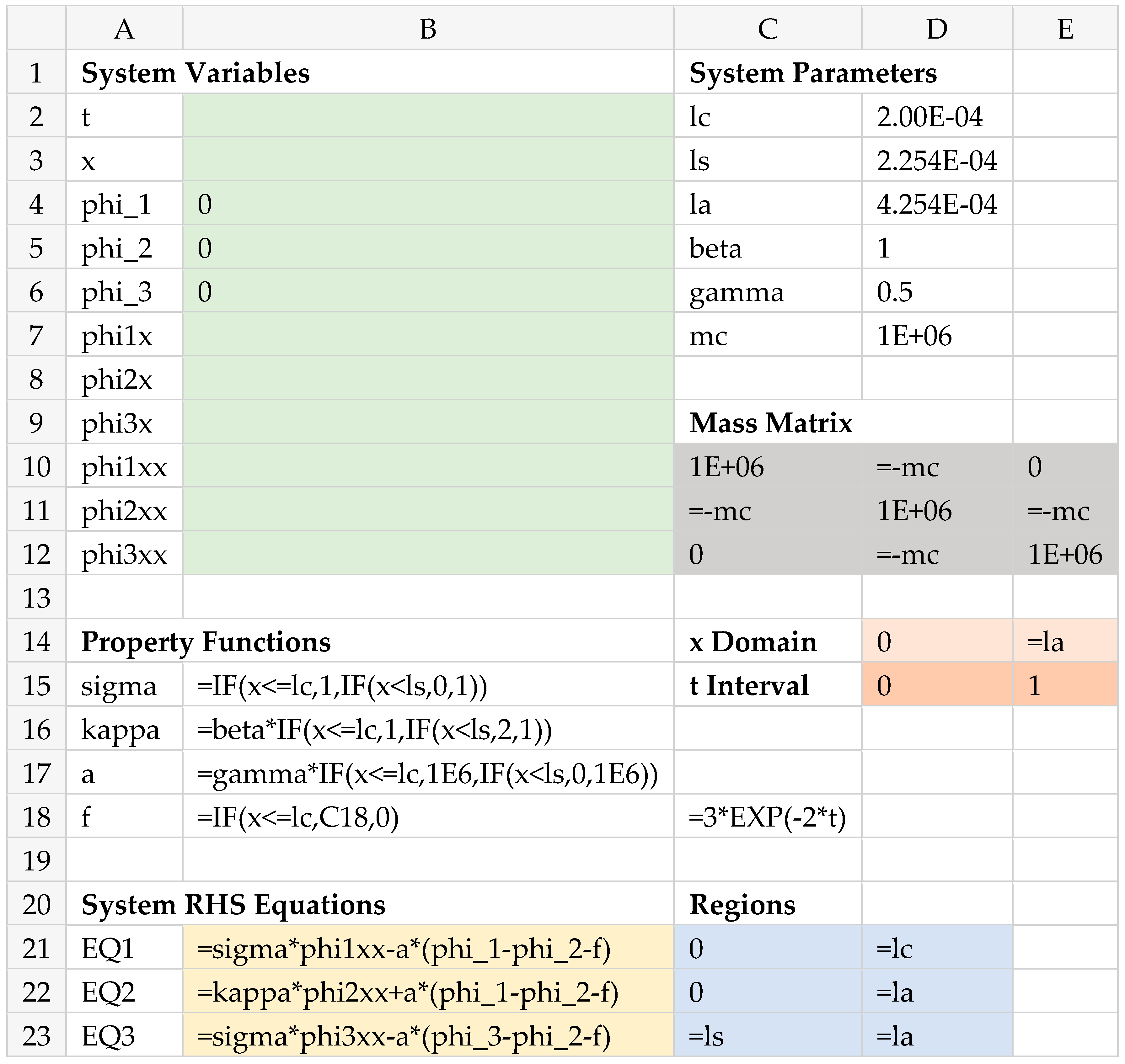

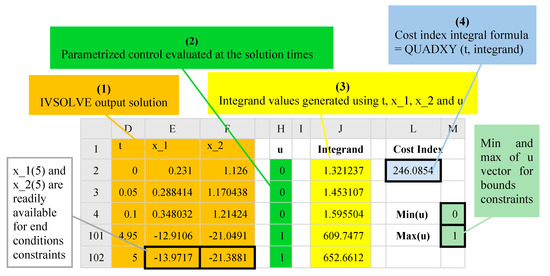

There are two formats of presenting assets liabilities and owners equity in the balance sheet account format and report format. This is also known as the T-shaped or horizontal format for balance sheet format. Excel Format of Schedule III As per the Companies Act 2013.

1 It is expected realised with 12 months after reporting date. Schedule III specifies the general instruction on format for preparation of balance sheet statement of profit and loss of the company and the financial statements of subsidiaries. Schedule III does not permit companies to avail of the option of presenting assets and liabilities in the order of liquidity as provided by Ind AS 1 Presentation of Financial Statements.