Recommendation Schedule Vi Companies Act

447E dated 28th February 2011 replaced the existing Schedule VI ofthe Companies Act.

Schedule vi companies act. Revised Schedule VI of Companies Act 1956 1. The Revised Schedule VI is flexible in the case of applicability of Accounting Standards and the Act. While we try to keep the legislation accurate and up to date we give no warranty as to the accuracy or currency of the legislation.

It is also imperative to note at the very outset that like its predecessor Revised Schedule VI doesnt apply to banking or insurance companies. SCHEDULE VI See sections 55 and 186 The term infrastructural projects or infrastructural facilities includes the following projects or activities 1 Transportation including inter modal transportation includes the following a roads national highways state highways major district roads other district roads and village roads including toll roads bridges highways road transport. Norman Ralph Augustine CA.

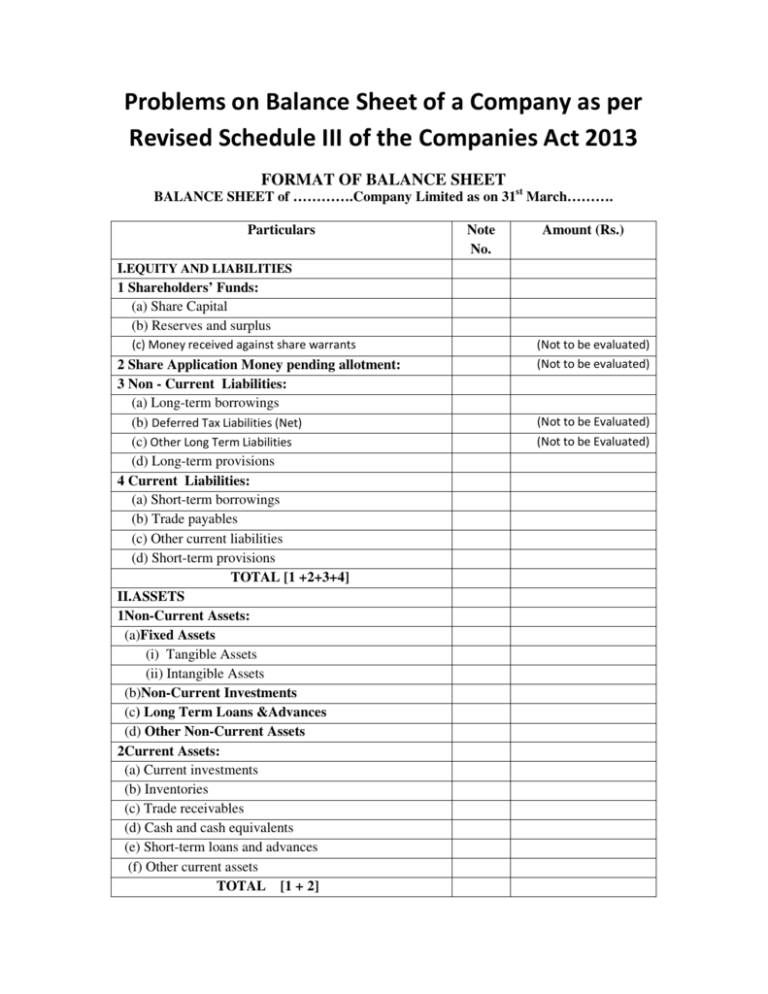

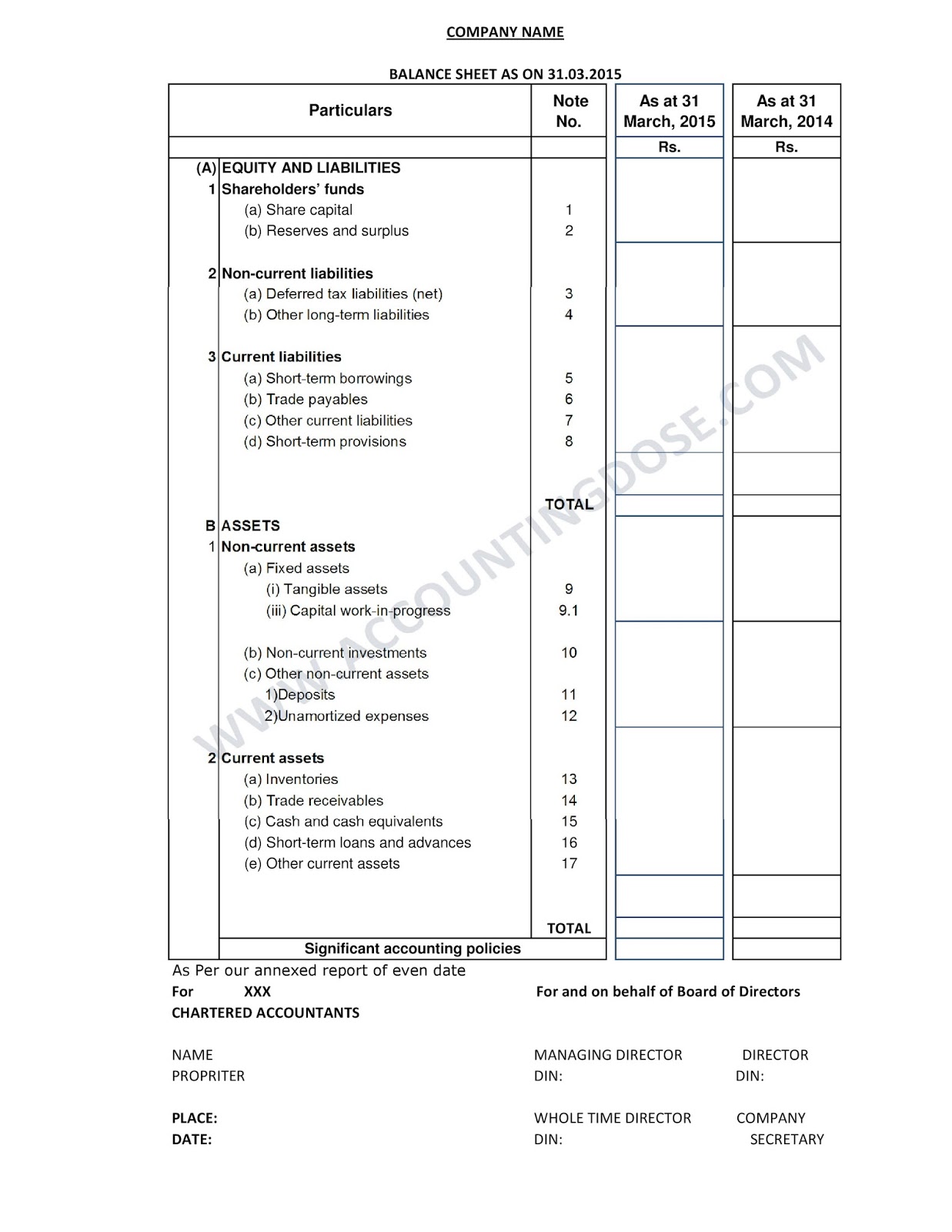

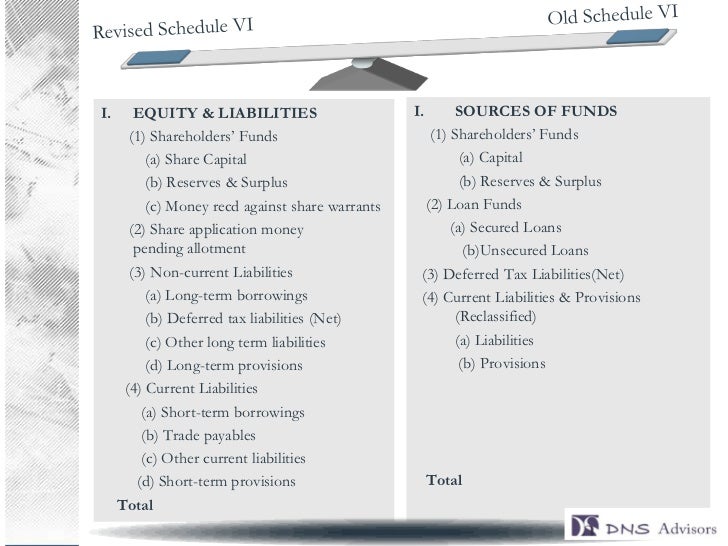

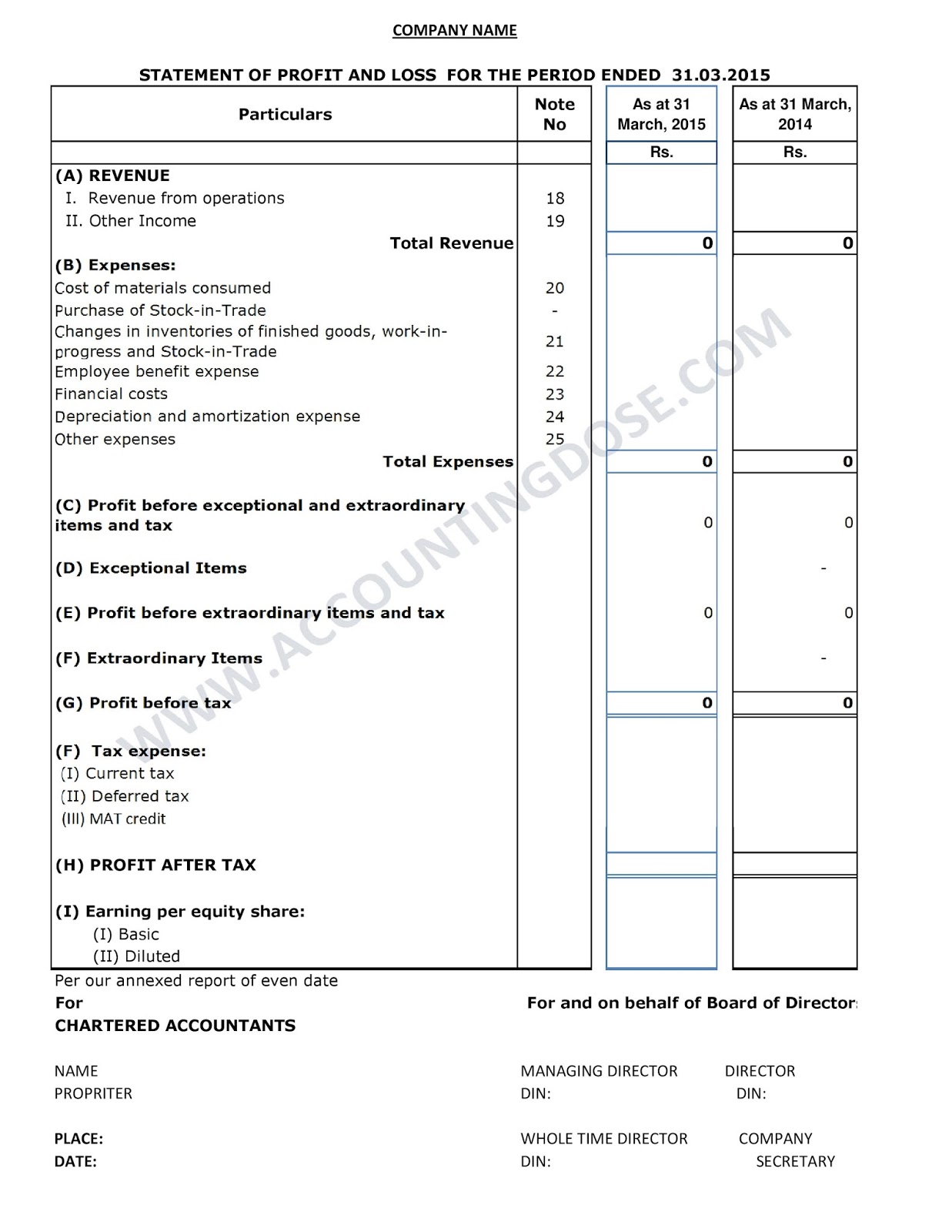

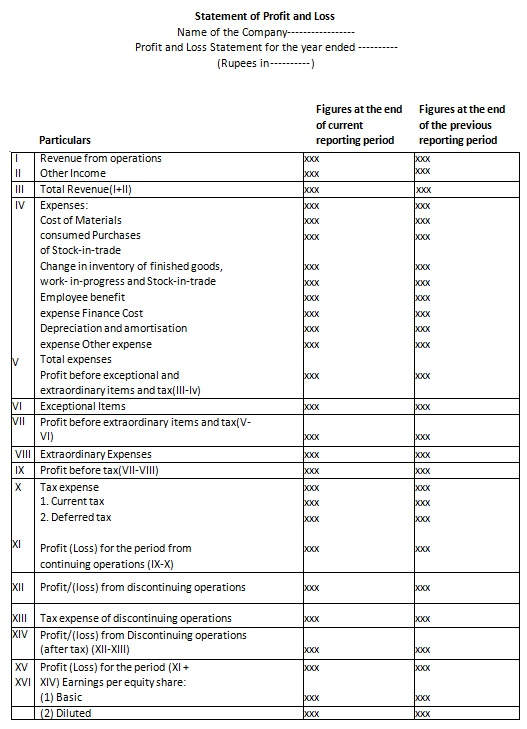

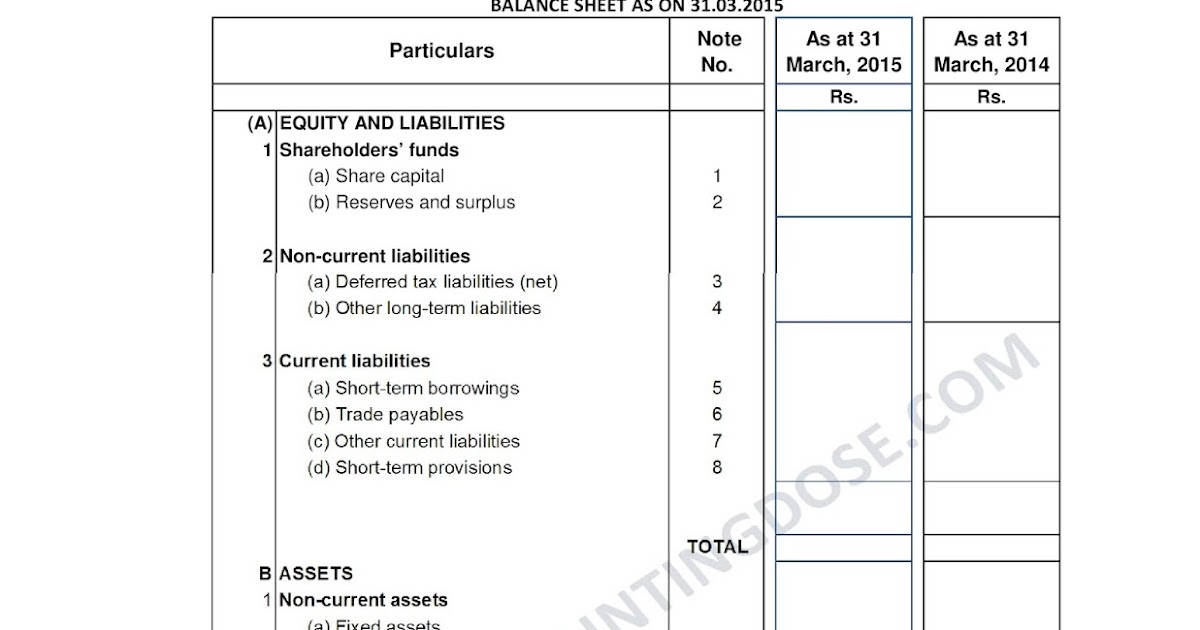

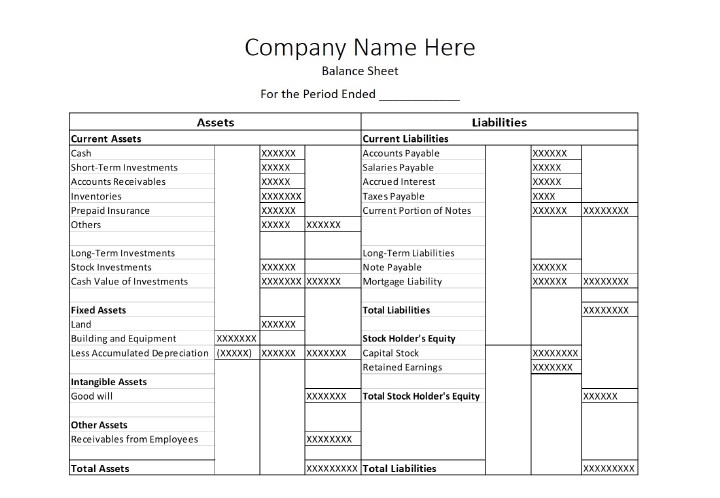

Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment or disclosure including addition amendment substitution or deletion in the head or sub-head or any changes inter se in the financial statements or statements forming part thereof the same shall be made and the requirements of this Schedule shall stand. Section 211 1 of the Companies Act 1956 requires the companies to draw up their financial statements as per the form set out in Revised Schedule VI. In case of conflict requirements of the Companies Act 1956 Accounting Standards shall prevail over Schedule VI Information currently disclosed as schedules and notes to accounts now clubbed as notes to accounts Consistency in definition of terms used will carry the meaning as defined by the applicableAccounting Standards.

To harmonise the disclosure requirements with the AccountingStandards and to converge with the new reforms the Ministry of Corporate Affairs videNotification No. Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in the treatment of disclosure in the. There are changes that may be brought into force at a future date.

1 Subject to subsections 2 and 3 where a company is ordered to be wound up by the Court under section 1251n of the Insolvency Restructuring and Dissolution Act 2018 on the ground that it is being used for purposes against national security or interest the Court may on the application of the Minister make an order referred to in this section as a disqualification order disqualifying any person who is a director of that company. Except for addition of general instructions for preparation of Consolidated Financial Statements CFS the format of financial statements given in the Companies Act 2013 is the same as the revised Schedule VI notified under the Companies Act 1956. Revised Schedule VI shall be for the year commencing on or after 01042011.

1 Except in the case of the first profit and loss account laid before the company after the commencement of the Act the corresponding amounts for the immediately preceding financial year for all items shown in the profit and loss account shall also be given in the profit and loss account. Other loans and advances Note ii Disclosure pursuant to Note no. It provides that a company engaged in the setting up of and dealing with infrastructural projects may issue preference shares for a period exceeding twenty years but not exceeding thirty years subject to the redemption of a minimum ten percent of such preference shares per year from the twenty first year onwards or earlier on proportionate basis at the option of the preference shareholders.