Fabulous Balance Sheet Format As Per Indian Accounting Standards

Reserves are created out of profits only.

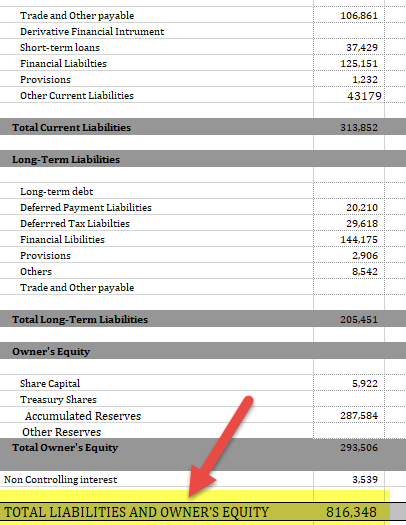

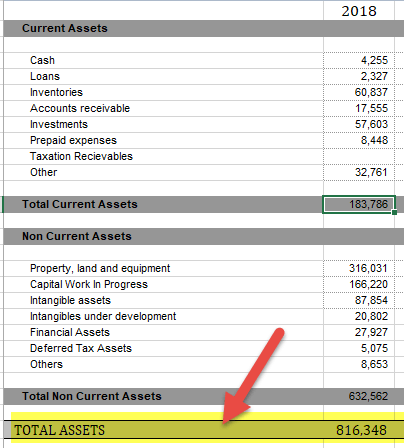

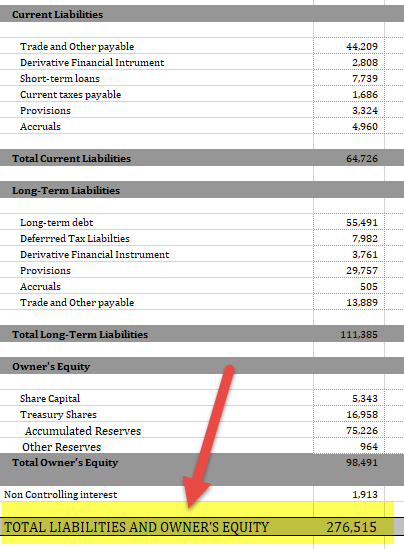

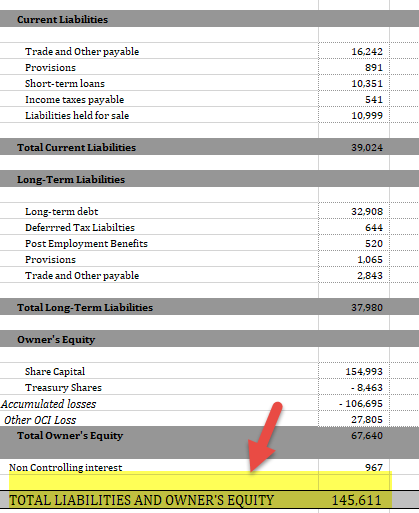

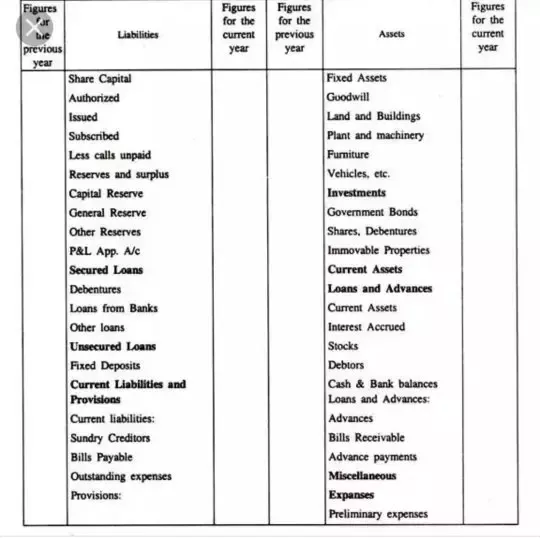

Balance sheet format as per indian accounting standards. The division III of Schedule III provides a balance sheet format and defines minimum disclosure requirements for NBFCs. Format of Balance Sheet India Accounting. The Ministry of Corporate Affairs MCA issued a road map for implementation of the Indian Accounting Standards Ind AS converged with the International Financial Reporting.

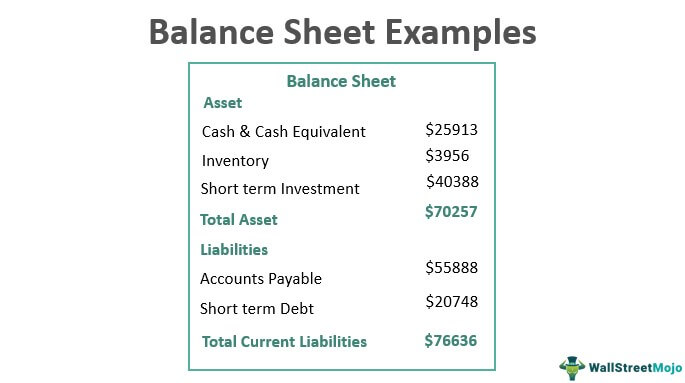

General Instruction for preparation of Balance Sheet. In the Balance sheet items are. Form and contents of Balance sheet and Profit Loss Account of a company under Schedule VI to the Companies Act 1956 revised.

On the discretion of the owner out of profits. Ministry of Corporate Affairs MCA Government of India has on 3 March 2011 hosted on its website the revisedSchedule VI to the Companies Act 1956 which deals with the Form of Balance sheet Profit Loss Account and disclosures to be made therein. A Balance Sheet as at the end of the period.

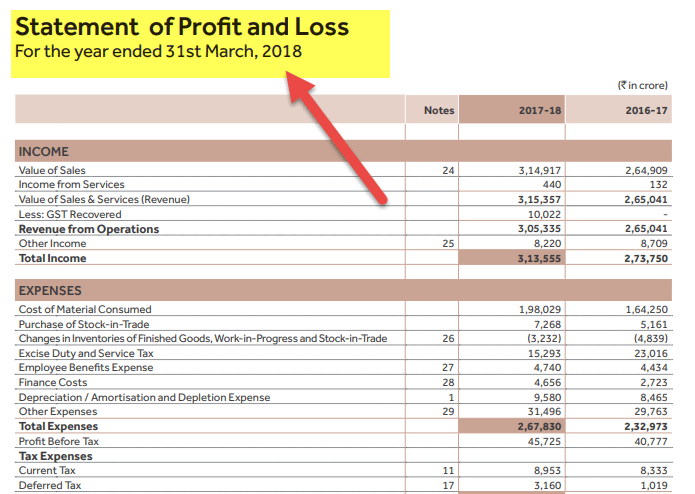

Unlike the previous form the present one is devoid of details the latter being shown in the schedules. Revenue items are classified as expense and income. Reserve is shown as liability in the balance sheet Provision is shown as a reduction from the asset.

Thus both revenue and expense is required to be recognised even though the Indian Accounting Standard is silent on such issue. So companies which will be required to prepare financial statements as per Ind AS will be required to prepare statement of cash flows as per Ind AS 7. Provision is to be made even if there is a loss.

The Balance Sheet of a banking company is to be prepared in Form A given in Third Schedule to the Act. For the purpose of rounding off the figures appearing in the Financial Statements for. Income is defined as increase in economic benefit during accounting period in the form of inflows or enhancements of assets or decreases in liabilities that result in increase in equity other than those relating to contributions from equity participants.