Cool Balance Sheet Approach Deferred Tax

Ind AS 12 is totally focused on the Balance Sheet approach.

Balance sheet approach deferred tax. Deferred tax assets and liabilities are the direct results of deferred taxes which are based on temporary differences in recorded revenues or expenses between accounting books and tax returns. Our results suggest that the increment to deferred tax balances upon adopting the balance sheet approach has value relevance with such value relevance driven by the deferred taxes on certain. Visit httpsbitly2TMi3uo for more infoHOW DOES TABALDI HELP YOU PASS FAC3701Tabaldi helps students pass.

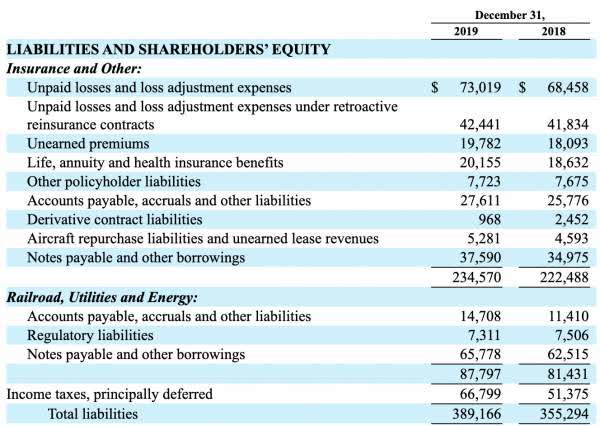

If any amount is expensed out in Profit Loss Ac but not deducted for Income tax purpose it will create Deferred Tax Asset. Deferred tax liabilities it refers to theliability element included in the balance sheet liability approach. As we have seen IAS 12 considers deferred tax by taking a balance sheet approach to the accounting problem by considering temporary differences in terms of the difference between the carrying values and the tax values of assets and liabilities also known as the valuation approach.

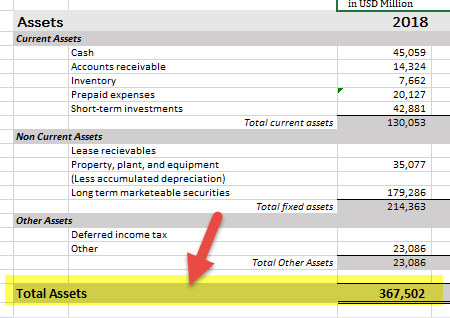

Why is there difference when we calculate Deferred tax assetliability by comparing depreciation as per books and. Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed. Which amount will appear where in balance sheet.

The proof brings the Book v. In other words any difference in the tax basis of accounting income and taxable income. Note that there can be one without the other - a company can have only deferred tax liability or deferred tax.

It requires recognizing the tax consequences of the difference between the carrying amounts of assets and liabilities and their tax base. The numbers appearing in the tax balance sheet is termed as tax base. The approach adopted for computation is different.

It is created when taxable income is less than book income that is less tax is paid today but that tax would have to be paid in future. It makes no difference that writing down allowances varies between asset classes. Once we are successful in identifying.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)