Top Notch Off Balance Sheet Items Ppt

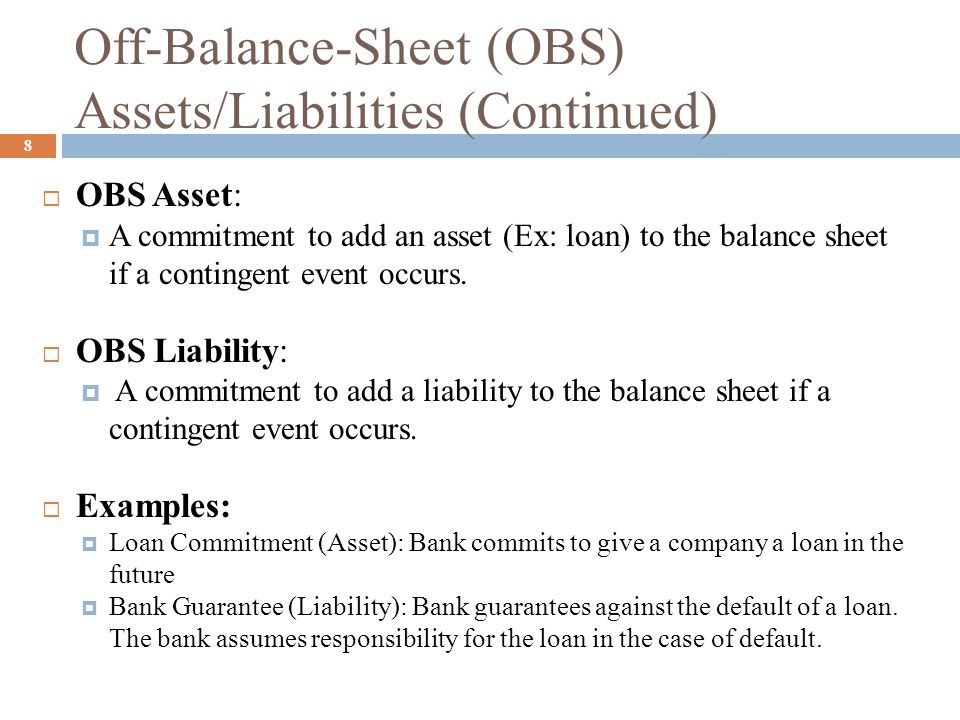

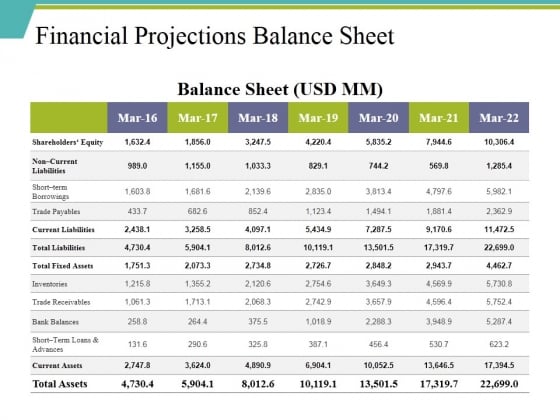

Off-balance sheet items refer to those assets and liabilities that arent shown on a balance sheet.

Off balance sheet items ppt. 21 August 2008 Off-Balance-Sheet Financing A form of financing in which large capital expenditures are kept off of a companys balance sheet through various classification methods. Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. They are neither the assets nor the liabilities.

Understanding Off-Balance Sheets By Prof. An item that when aOff-balance-sheet assets. Among the above examples operating leases are the most common examples of off-balance-sheet financing.

Off-balance sheet OBS assets are assets that dont appear on the balance sheet. Companies will often use off-balance-sheet financing to keep their debt to equity DE and leverage ratios low especially if the inclusion of a large expenditure would break negative debt covenants. It is an off balance sheet item in which rentals expenses are shown in lessees books of account and asset is shown in lessors books of account.

The goal of the credit equivalent amount is to translate the value of such instruments into risk equivalent credits. Off balance sheet items are in contrast to loans debt and equity which do appear on the balance sheet. Basel 2 provides definitions of such items in various paragraphs of the Basel 2 document 7 which include the following.

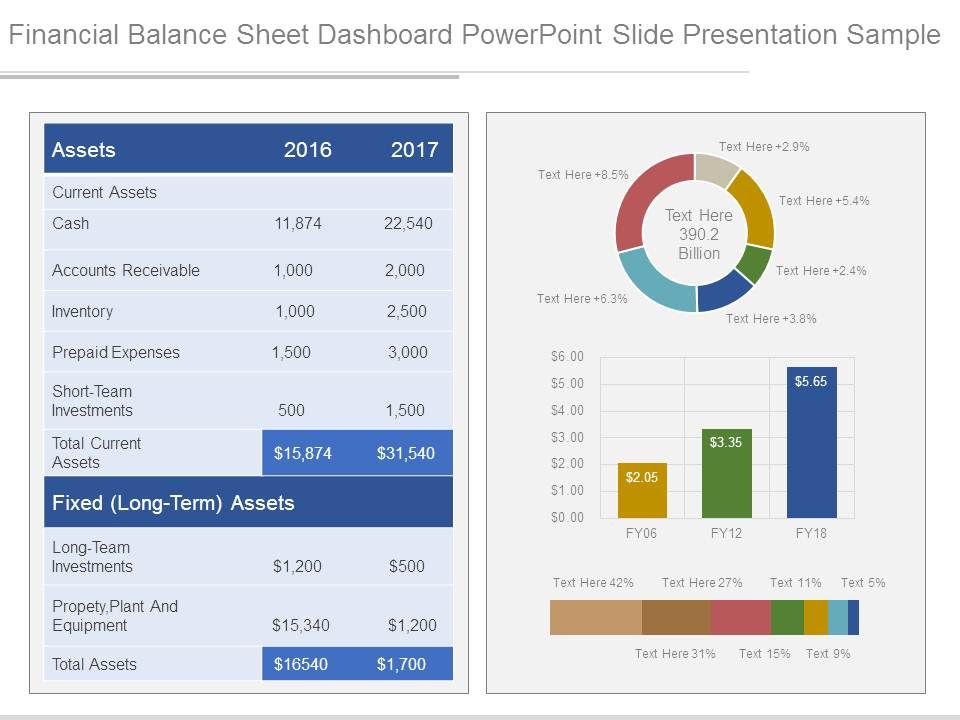

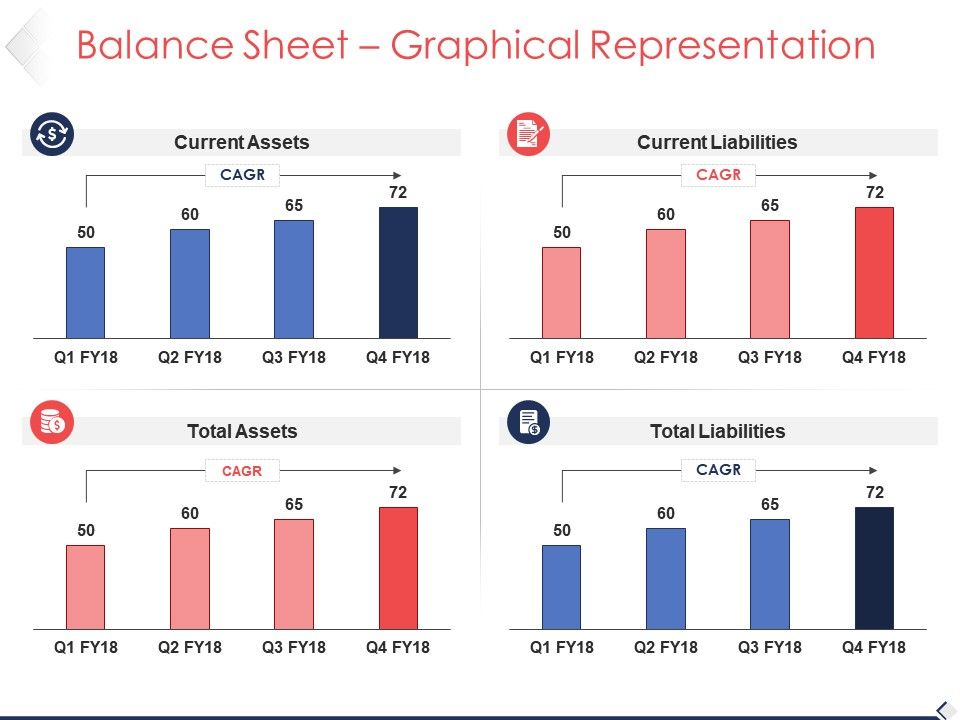

Specific items of the balance sheet Detailed revenue categories Sales units Number of customers Alternative or Supplement. For off balance sheet activities for which the reporting entity has provided non-contractual support information about the extent of and reasons for that support and whether it led to controlling the structured entity. Equity Accounting Financial Statements.

Cash in transit also forms part of notes to accounts but does not recorded in the balance sheetso it is off balance sheet item. Off balance sheet items are usually items that are contingent in nature ie the happening is uncertain and hence it cannot be considered as an asset or liability for sure. One regards future obligations and one regards potential off-balance sheet risks.