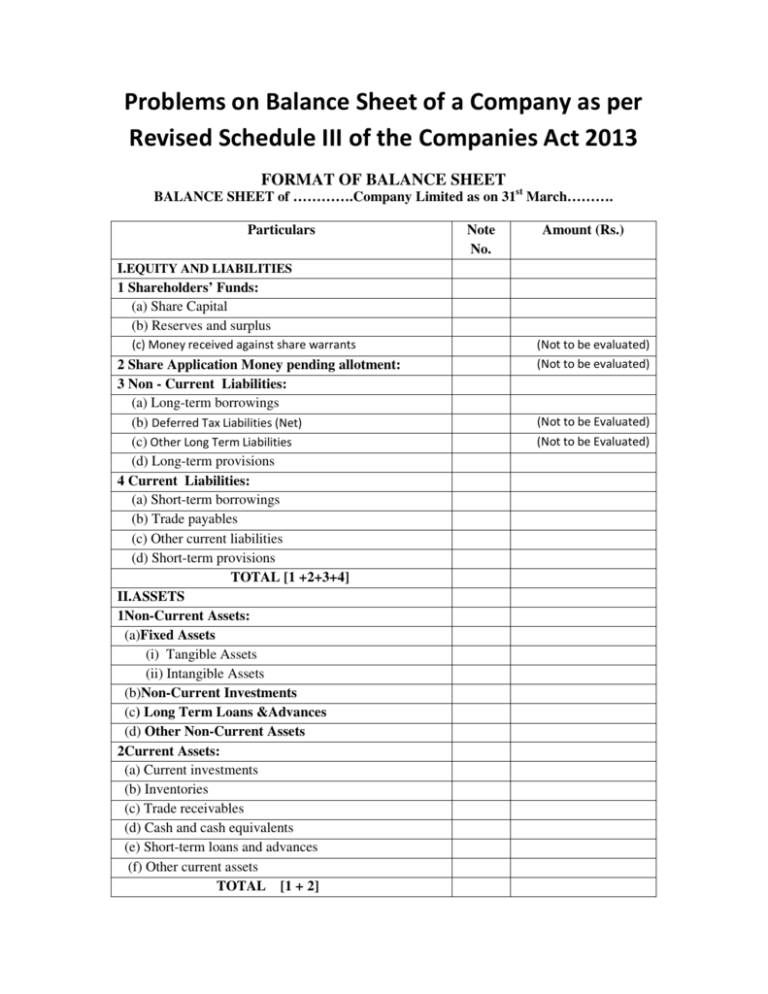

Beautiful Schedule Vi Of Companies Act

The proposed revision of schedule VI to the Companies Act 1956 stipulates multi-step format for the presentation of profit and loss account.

Schedule vi of companies act. The Ministry of Corporate Affairs MCA vide Notification No. Explanation VI For the purposes of this Schedule B Remuneration means remuneration as defined in clause 78 of section 2 and includes reimbursement of any direct taxes to the managerial person. Remuneration payable to a managerial person in two companies.

The disclosure requirements specified in Schedule VI are in addition to the disclosure requirements of the Companies Act as well as the Accounting Standards. 447E dated 28th February 2011 have revised Schedule VI of the Companies Act 1956 The Act which provides the instructions for the preparation of the Balance Sheet and Statement of the Profit Loss of the Company. B every material feature including credits or receipts and debits or expenses in respect of non-recurring transactions or transactions of exceptional nature.

Including products regulated by the Rubber Board constituted under the Rubber Act 1947 XXIV of 1947. To facilitate the preparation. It requires companies to disclose gross profit in the profit and loss account.

It also requires allocation of operating expenses into selling and marketing expenses and administrative expenses. Rubber and allied products. SCHEDULE VI See sections 55 and 186 The term infrastructural projects or infrastructural facilities includes the following projects or activities 1 Transportation including inter modal transportation includes the following a roads national highways state highways major district roads other district roads and village roads including toll roads bridges.

Others Specify nature Total Note 16 Disclosures regarding Trade Receivables Note i Disclosure pursuant to Note noP i ii iii and iv of Part I of Schedule VI to the Companies Act 1956 As at 31 March As at 31 March Trade Receivables 2012 2011 Trade receivables outstanding for a period less than six months from the date they are due for payment Secured considered good Unsecured. DISCLOSURE REQUIREMENTS AS PER SCHEDULE VI PART II OF THE COMPANIES ACT 1956. Hence all disclosures as required by the Companies Act and Accounting Standards shall be made in the notes to accounts in addition to the requirements set out in this Schedule.

Revised Schedule VI however do not apply to companies as referred to in the proviso to Section 211 1 and Section 211 2 of the Act ie any insurance or banking company or any company engaged in the generation or supply of electricity or to any other class of. The Revised Schedule VI to the Companies Act 1956 became applicable to all companies for the preparation of Financial Statements beginning on or from 142011. Roads and other infrastructure projects corresponding to para No.