Simple Non Current Assets Held For Sale Disclosure Example

Non -current assets and disposal groups are separated from other assets as their nature and use have now changed.

Non current assets held for sale disclosure example. IFRS 5 Non-current Assets Held for Sale and Discontinued Operations specifies the accounting for assets held for sale and presentation and disclosure of discontinued operations. This condition is regarded as met only when the sale is highly probable and the asset. The asset or disposal group must be available for immediate sale.

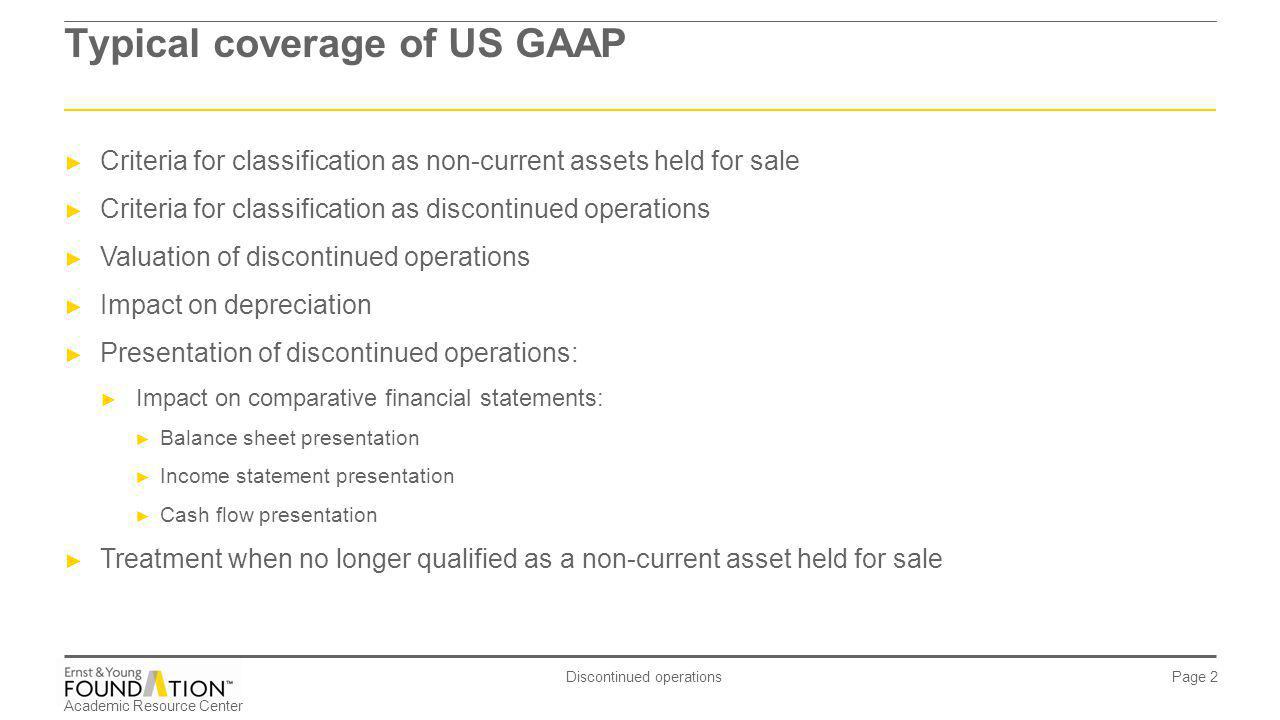

Non-current assets or disposal groups held for sale and discontinued operations Non-current assets or disposal groups are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. Conditions for classifying a non-current asset as held for sale. In general terms assets or disposal groups held for sale are not depreciated are measured at the lower of carrying amount and fair value less costs to sell and are presented separately in the statement of financial position.

Trade and other payables 167 29. When non-current assets or disposal groups are classified as held-for-sale they are measured at the lower of the carrying amount and fair value less cost to sell. In this case these sales represent one of primary activities and the related assets are inventories in fact.

Convertible loan notes 172 32. Classify a non-current asset or disposal group as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use. Finance leases 169 30.

Disclosures required by IFRSs whose scope does not exclude non-current assets or disposal groups classified as held for sale. For example a car dealer presents all vehicles. Likewise the presentation and disclosure of noncurrent assets and disposal groups held for sale - which is covered in Part B willalso assist users in their investment decisions.

ZAssets classified as held for sale are not amortised or depreciated. Deferred tax 161 27. Bank overdrafts and loans 165 28.