Amazing Partnership Balance Sheet Sample

Salary allowances of 15000 12000 and 5000 for Dee Sue and Jeanette respectively.

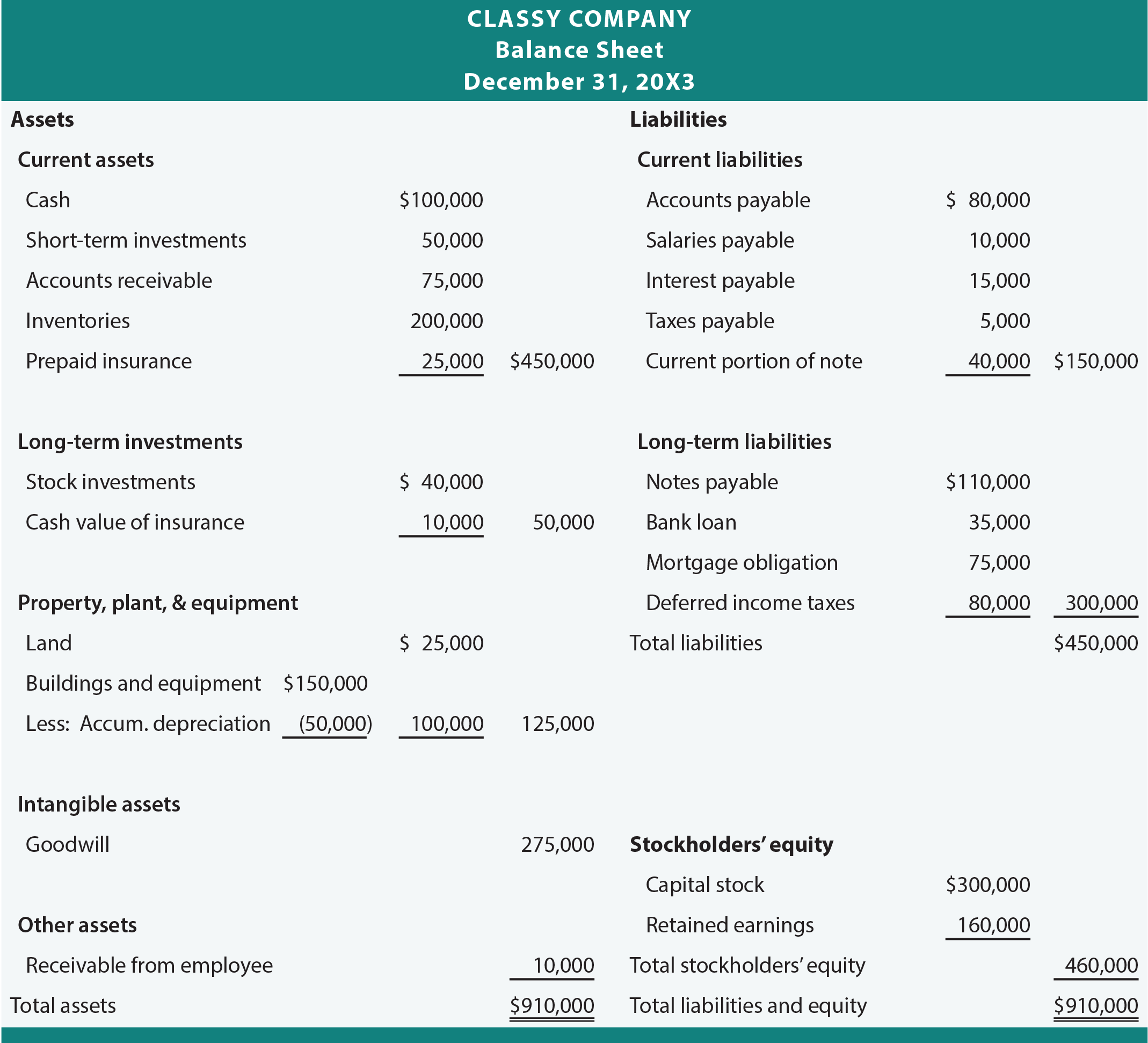

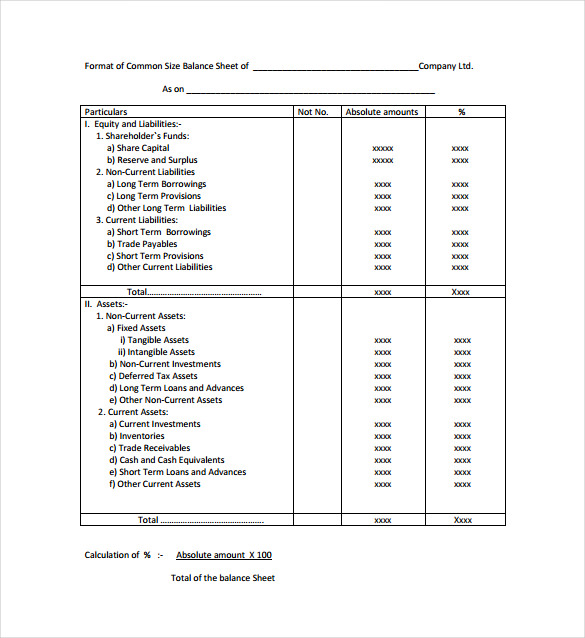

Partnership balance sheet sample. Partner A contributes 100 and a truck with a FMV of 50 to form the AB partnership. In the center of the right hand two columns of the body of the balance sheet center the title Owners Equity after the total liabilities. ABC Partnership Balance Sheet as at 31 December 2007 Notes 2007 2006 Fixed assets Plant machinery and motor vehicles 3 - - Other fixed assets 4 - - - - Current assets Stock and work in progress - - Debtors and prepayments - - Bankbuilding society balances - - Cash in hand - - - - Current liabilities Trade creditorsaccruals - -.

Saar invested 50000 in cash and other assets Loretto invested 30000 cash and Abdullah invested 40000 cash in their accounting firm. Stock value if any in the balance sheet should be same as closing stock reflected in profit and. Assume the partnership agreement for Dees Consultants requires net income to be allocated based on three criteria including.

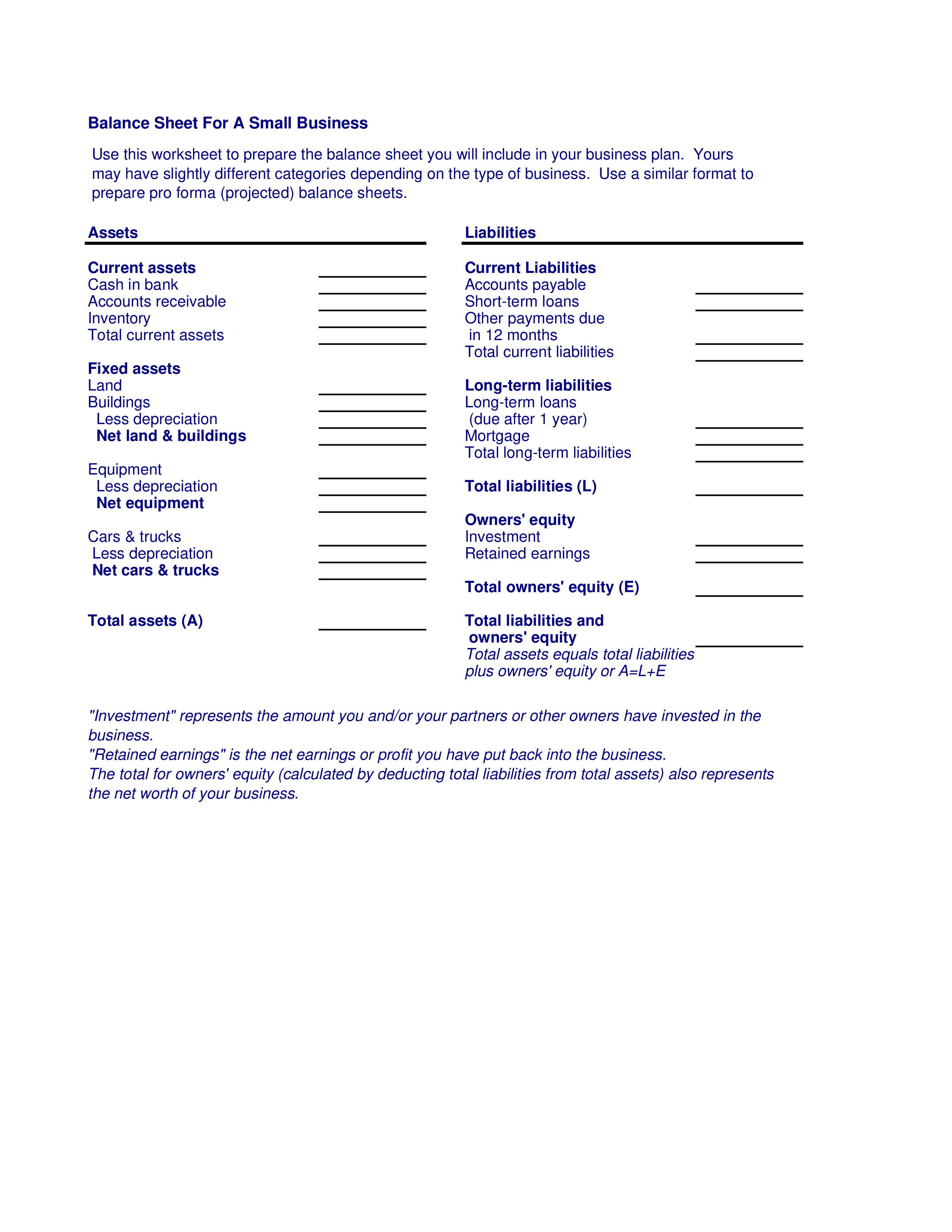

You can find our sample balance sheet at the end of the article. Balance sheet Simple Report on your assets and liabilities with this accessible balance sheet template. Financial Statements of Partnership firms.

10 interest on each partners beginning capital balance. Capital accounts for each partner is listed separately Current accounts of the partners are listed separately in special sections for example Current accounts with credit balances are listed as current liabilities Current accounts with debit balance. Thank you for visiting.

Partners interest charge from the individual shares at the end of the statement. Trial balance as on June 30 2002. All information shown on the balance sheets for the AbleBaker Book Store should agree with its books of record.

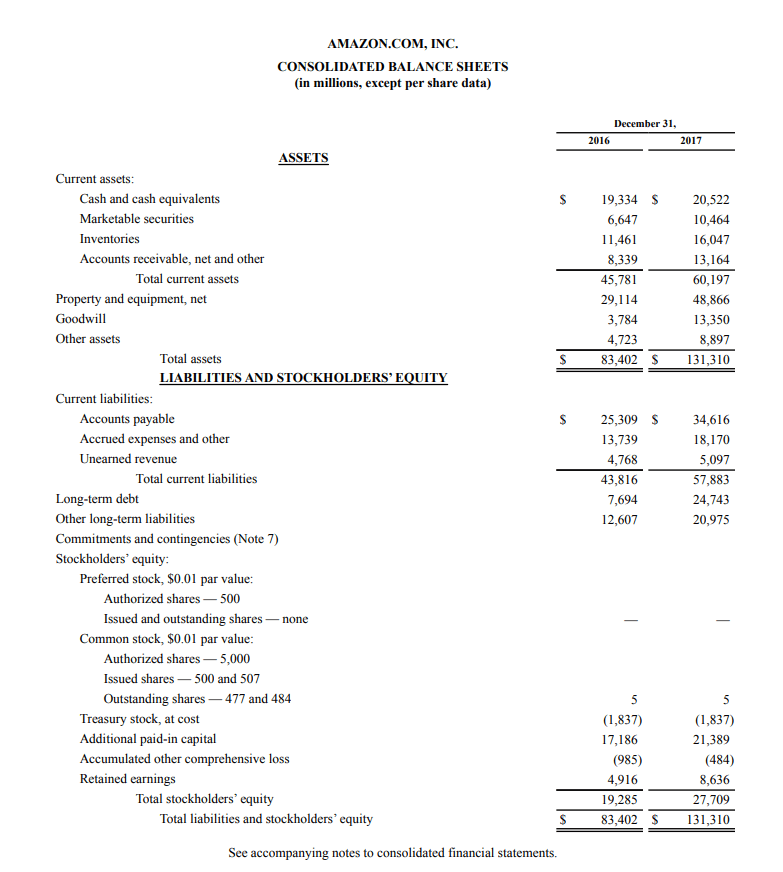

Partners salaries 50000 80000 -130000 Interest on capital 10000 15000 25000 Drawings 60000 80000 -140000. Books on June 30 2002. Every time a company records a sale or an expense for bookkeeping purposes both the balance sheet and the income statement are affected by the transaction.