Smart Deferred Tax Double Entry

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

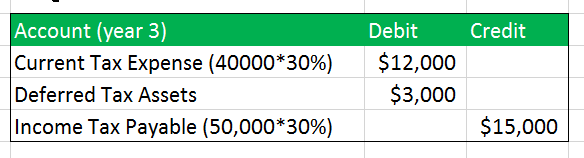

The double entry bookkeeping journal to post the deferred tax liability would be as follows.

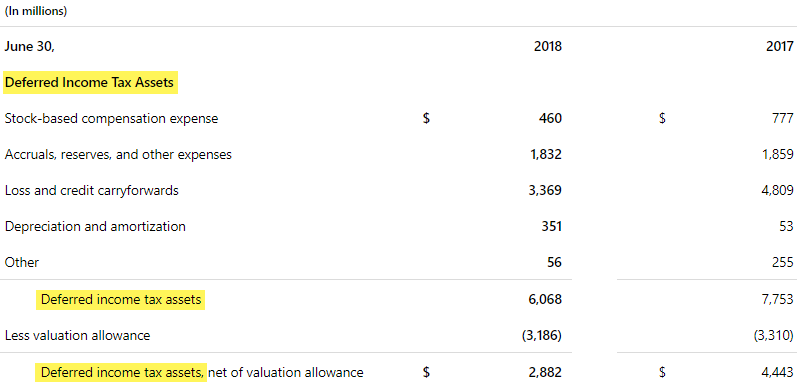

Deferred tax double entry. The Deferred Tax is created at normal tax rate. Firms carrying a full valuation allowance report no deferred tax assets on their balance sheets. Needless to say it is only correct to make such an adjustment if it is in fact the case that without it sales would be recognised in the wrong period.

To Deferred Tax Liability Ac 2 Deferred Tax Asset Ac. A deferred tax liability is a liability recognized when tax paid in current period is lower that tax that would be payable if calculated under accrual basis. When using double-entry bookkeeping there are two steps for recording an income tax refund.

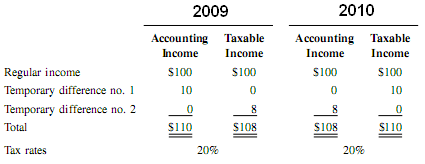

If depreciation equals to capital allowance profit after depreciation capital allowance will be the same so we will credit tax payable instead of deferred tax liability. To Profit Loss Ac. The temporary timing differences which created the deferred tax liabilities in years 1 and 2 are partially reversed in year 3 as the book depreciation is now higher than the tax depreciation.

The double entry to recognise income received in one period that relates to the following period is Dr Sales Cr Deferred income. Deferred Tax Liability Journal Entry. The book entries of deferred tax is very simple.

It arises when tax accounting rules defer recognition of income or advance recognition of an expense resulting in a decrease in taxable income in current period that. Deferred Taxation Accounting Equation The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal. Deferred tax must be recognised when the tax allowance for the cost of an item of property plant and equipment PPE is received either before or after the depreciation of the fixed asset is recognised in profit or loss.

Dr Deferred Tax Asset SFP Cr Tax IS This will have the effect of eliminating the tax charge for now so matching the fact that IFRS is not showing the income yet either. For any given accounting period the amount of income a business is taxed on is set out in its tax return and is based on rules established by the tax authorities. Dr Tax expense in Income Statement 25.