Brilliant Micro-entity Balance Sheet Example

A full set of micro-entity accounts includes the following elements.

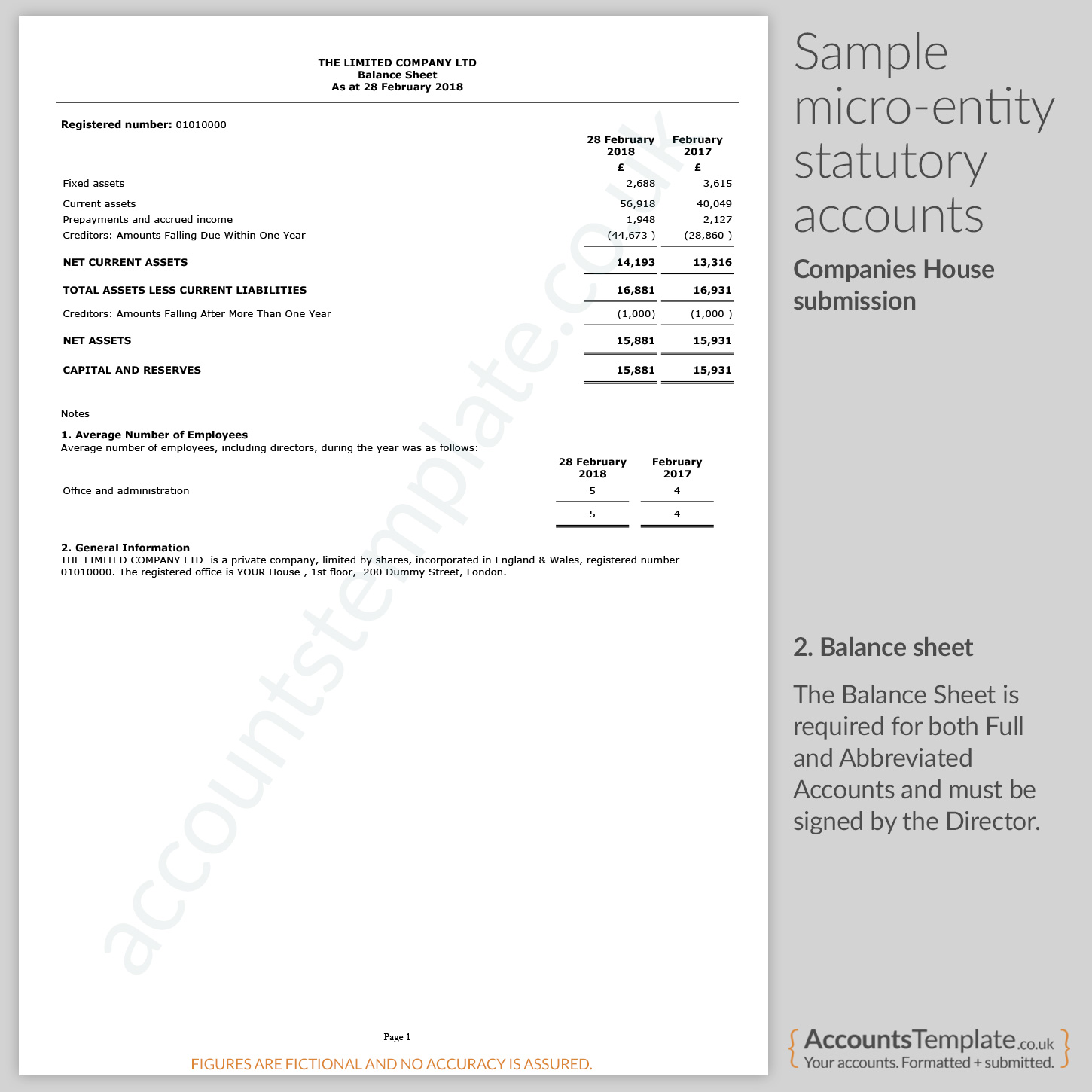

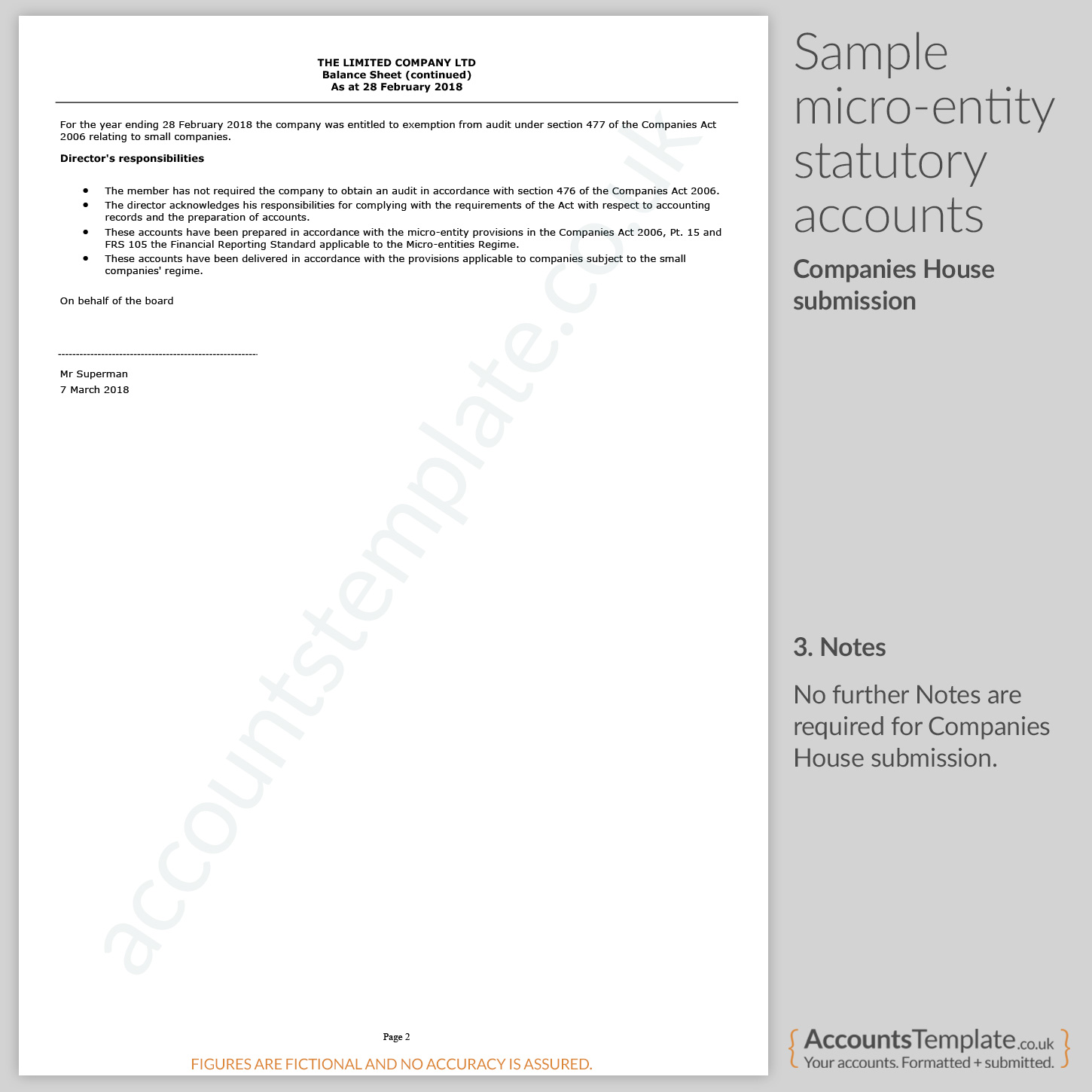

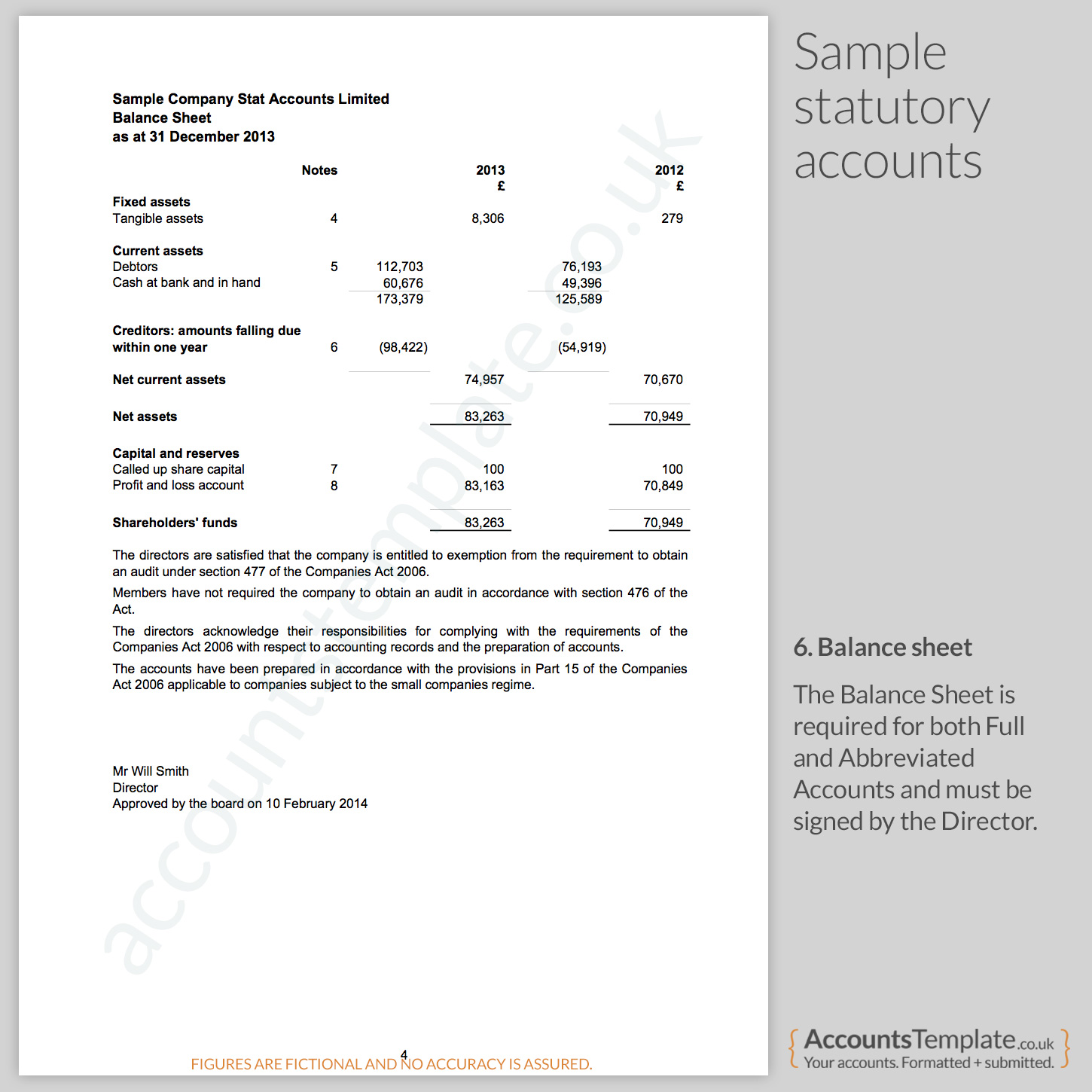

Micro-entity balance sheet example. With Sage Final Accounts you can prepare final accounts for your clients using just your Internet browser. And e on first-time adoption of this FRS an explanation of how the transition has affected its financial position and. It need only file its balance sheet including the information disclosed at the foot of the balance sheet at Companies.

I hold 1 share unpaid at 1 value. Statement on the balance sheet above the directors signature that the accounts have been prepared in accordance with the micro-entity provisions. 1 Section C and are reproduced in Table 61.

A company must not have more than one of the following. FRS 105 is a UK accounting standard for micro-entities regime. Micro-entities are very small companies.

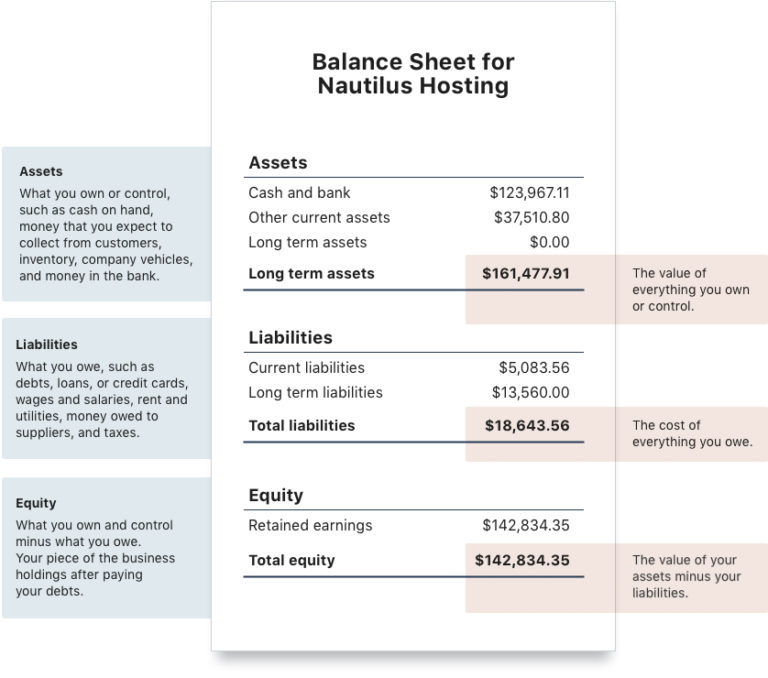

Called up share capital not paid - MISSING. 316000 or less on its balance sheet. The numbers involved are simple and pretty tiny but Im confused about the general structure of the balance sheet which is unless Im mistaken all that needs to be returned to Companies House at least for a micro-sized company like mine and what should be put where.

A turnover of 632000 or less. It can choose to not file the profit and loss account ie. Your company will be a micro-entity if it has any 2 of the following.

It is the balance sheet that tells you about risk not profit and loss. We have been able to file dormant accounts up until now but in 2017 received 6000 for extending a. For example here are the fields to be completed on Companies house for a balance sheet.