Stunning Format Of Consolidated Balance Sheet Of Holding Company

Intrinsic share value of the holding company can be calculated directly from the Consolidated Balance Sheet.

Format of consolidated balance sheet of holding company. The consolidated balance sheet of this holding company is going to show 12 million in assets 2 million in debt and a 10 million net worth or book value. Iii Return on Investments in Subsidiaries. Minority shares in B Ltd.

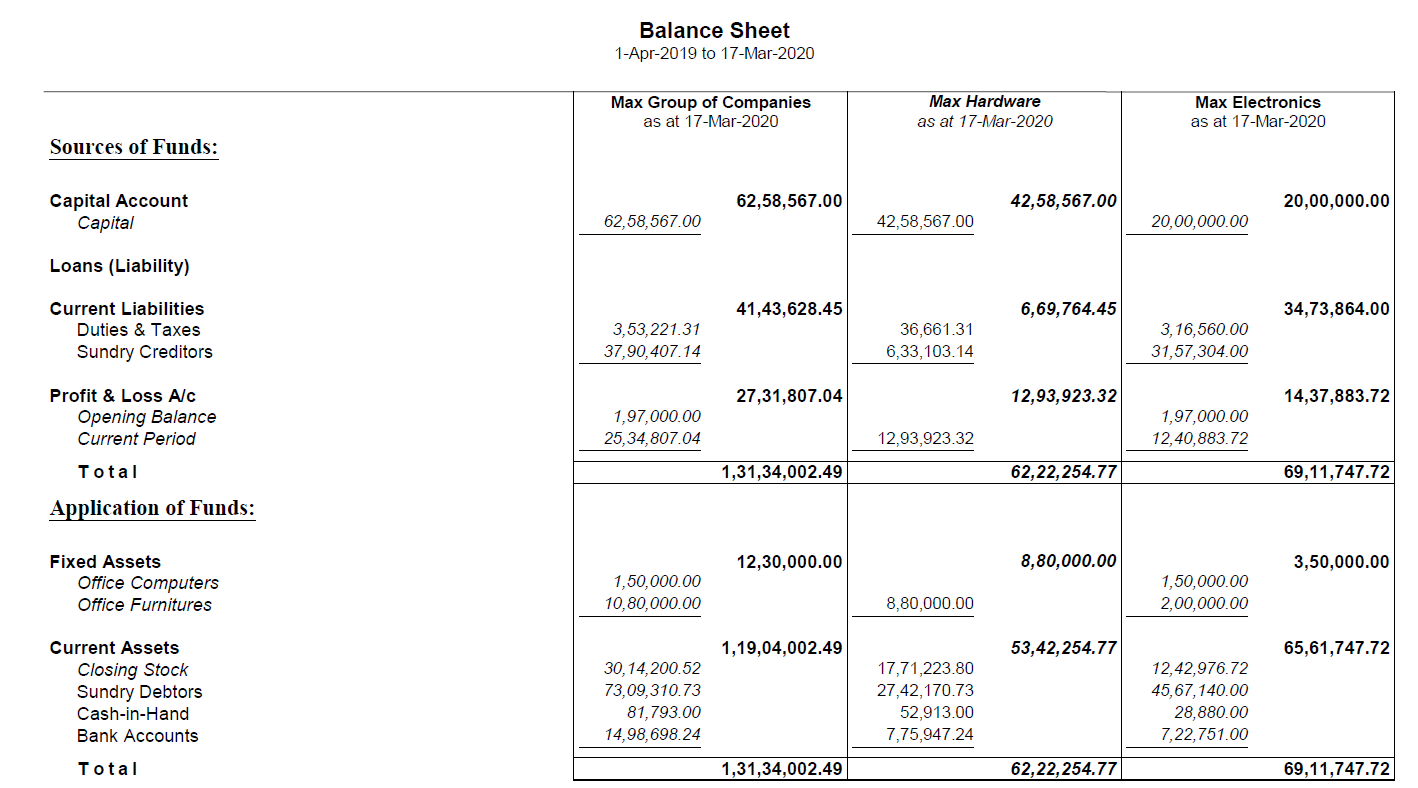

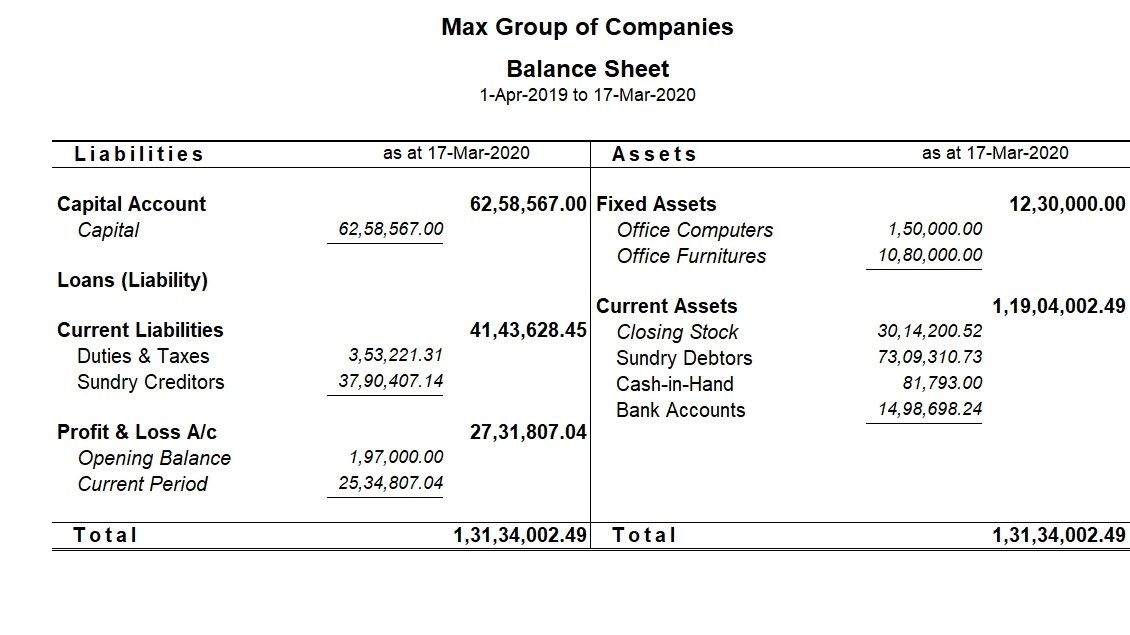

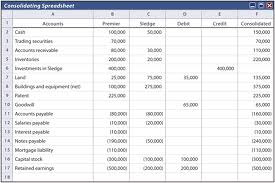

When holding com-panies with total consolidated assets of 500 million or more own or control or are owned or controlled by other holding companies ie are tiered holding companies only the top-tier holding company must file the FR Y-9C for the consolidated holding. The concept is simple yet powerful that allows you to consolidate the accounts of any number of companies at any time and maintain them separately. The respective balance sheets on March 31 2012 were.

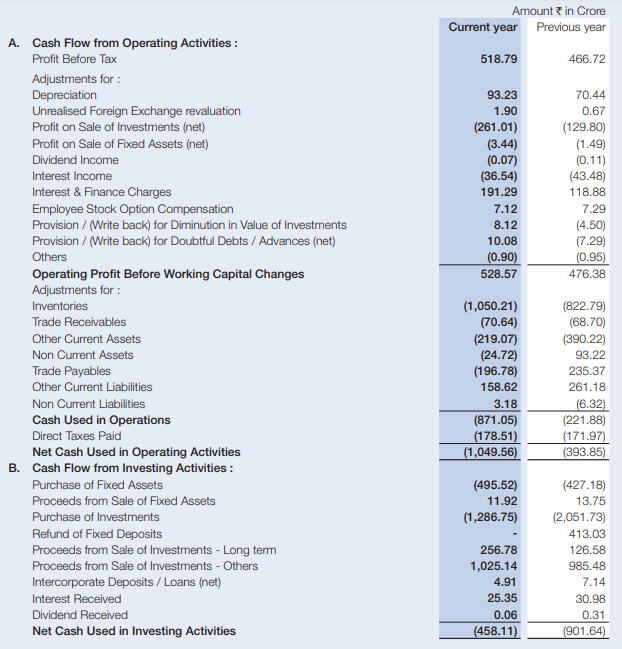

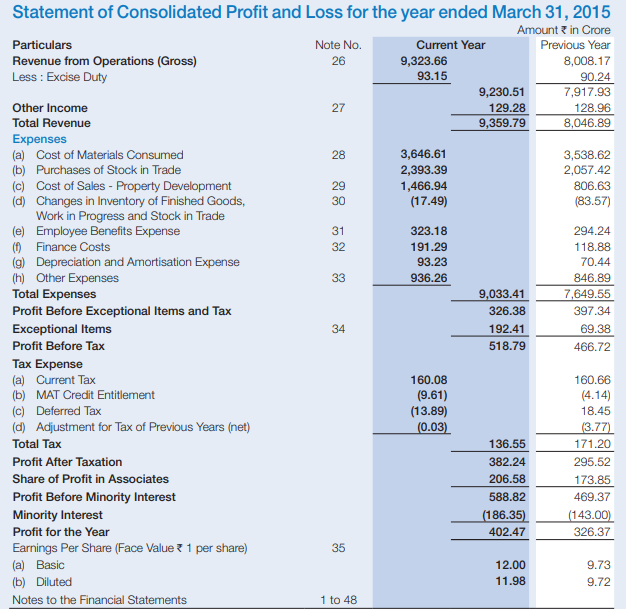

Ii Intrinsic value of share. Holding Company Financial Statements. And its subsidiary company as per.

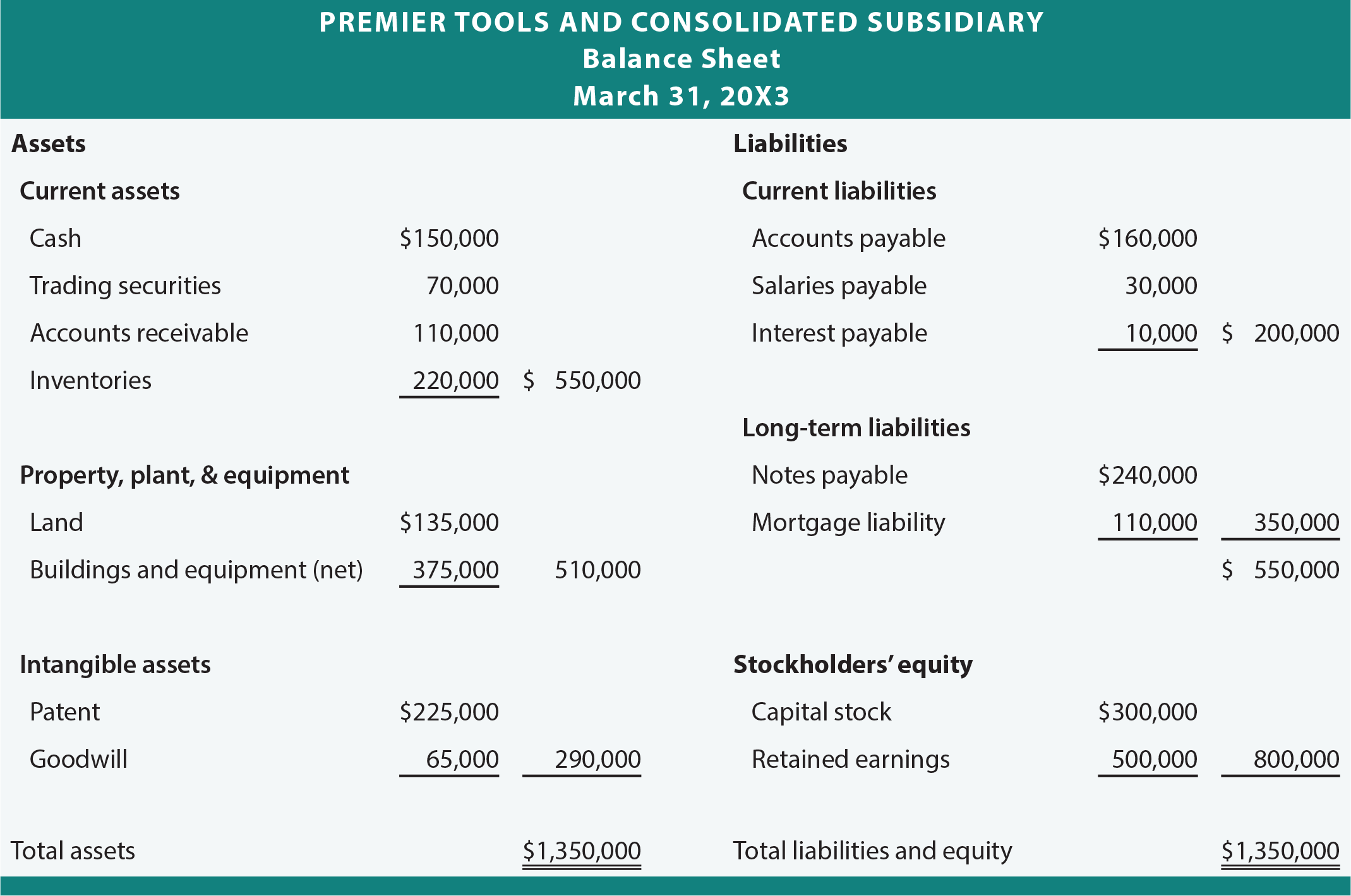

Format and example of consolidated balance sheet. Preparation of consolidated Balance Sheet of Holding Co. Share of holdings by P Ltdin Q Ltd.

CAInter consolidatedbalancesheetThis video explains about the consolidated balance. Not in force Scenario Impact 1 A Ltd holds 51 in B Ltd CFS of A Ltd including B Ltd to be presented 2 A Ltd holds 51 in B Ltd. 60000 x 2340000 Rs66667-Rs40000Rs26667 Rs60000 x 13.

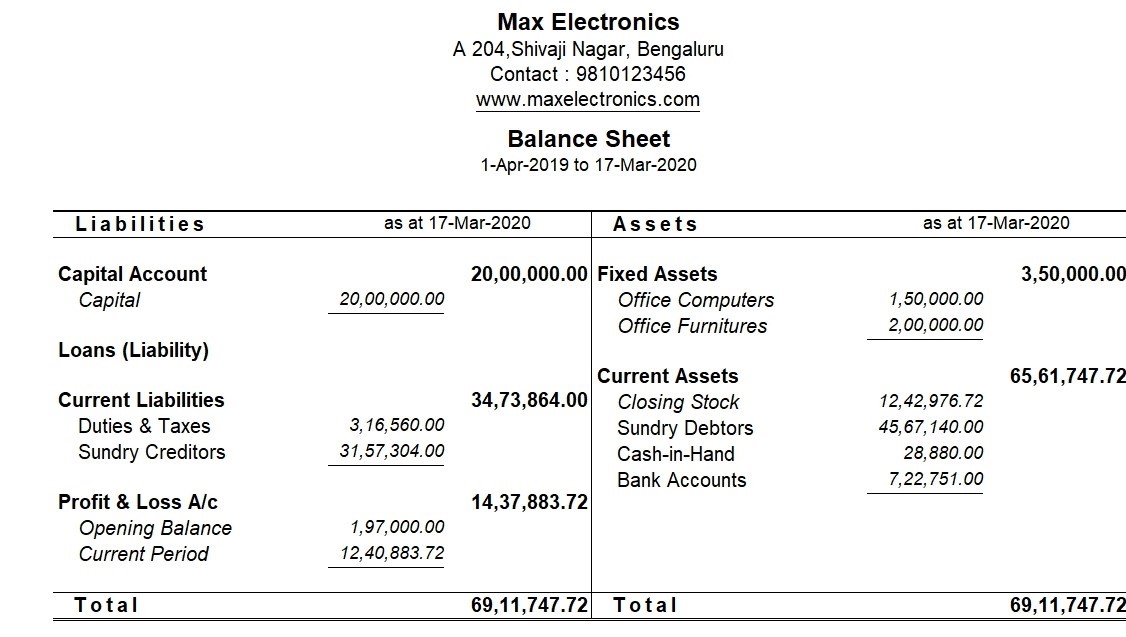

12000 shares out of 15000 shares 80 Share of holdings by Outsiders in Q Ltd. So its return on investments in subsidiaries should not be measured in. A consolidated balance sheet is usually prepared by the business operating as a group of companies that have more than one subsidiary and it portrays the combined details of assets and liabilities.