Fine Beautiful Examples Of Temporary Differences That Create Deferred Tax Assets

On 1 January 2019 the right-of use asset.

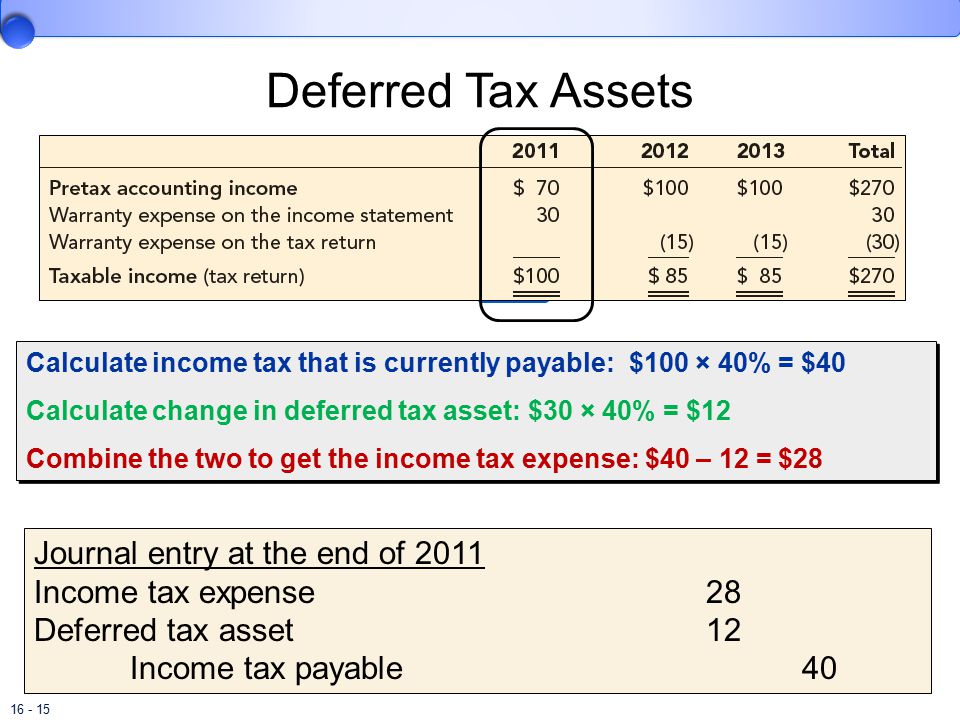

Examples of temporary differences that create deferred tax assets. Example and journal entry. The company records 240 800 30 as a deferred tax. Recognising deferred tax on leases.

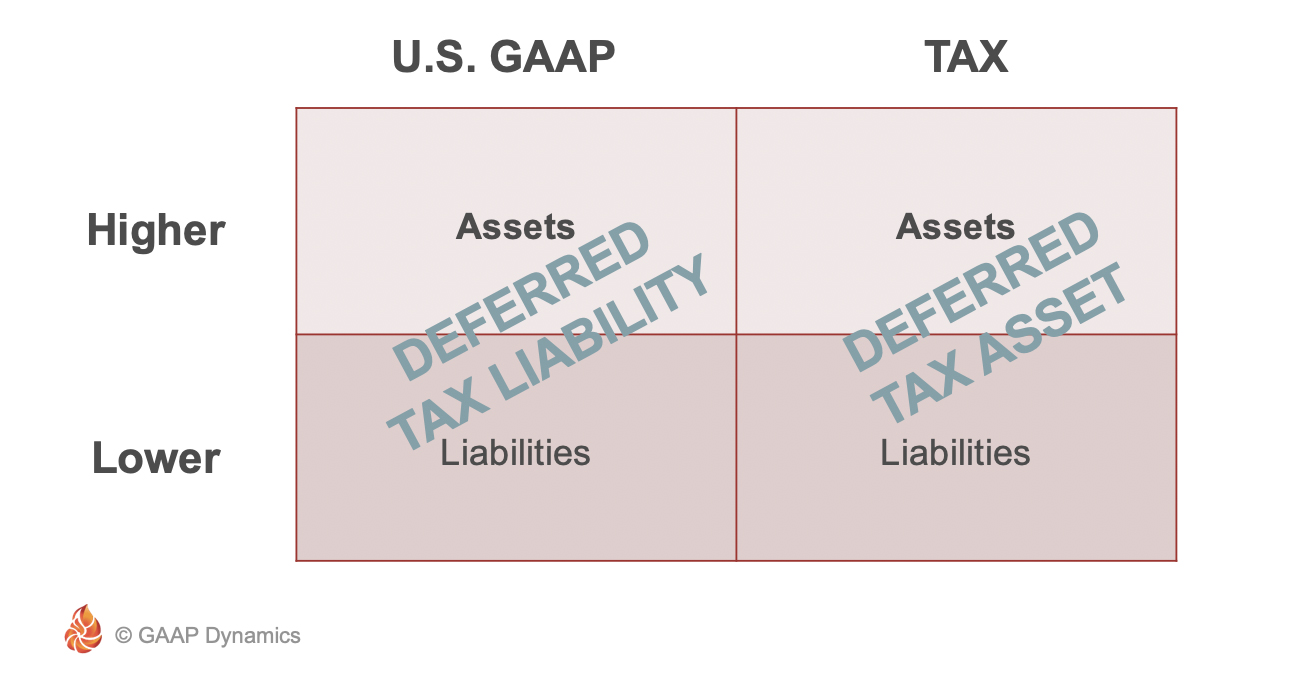

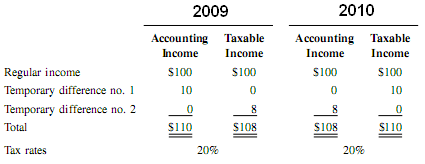

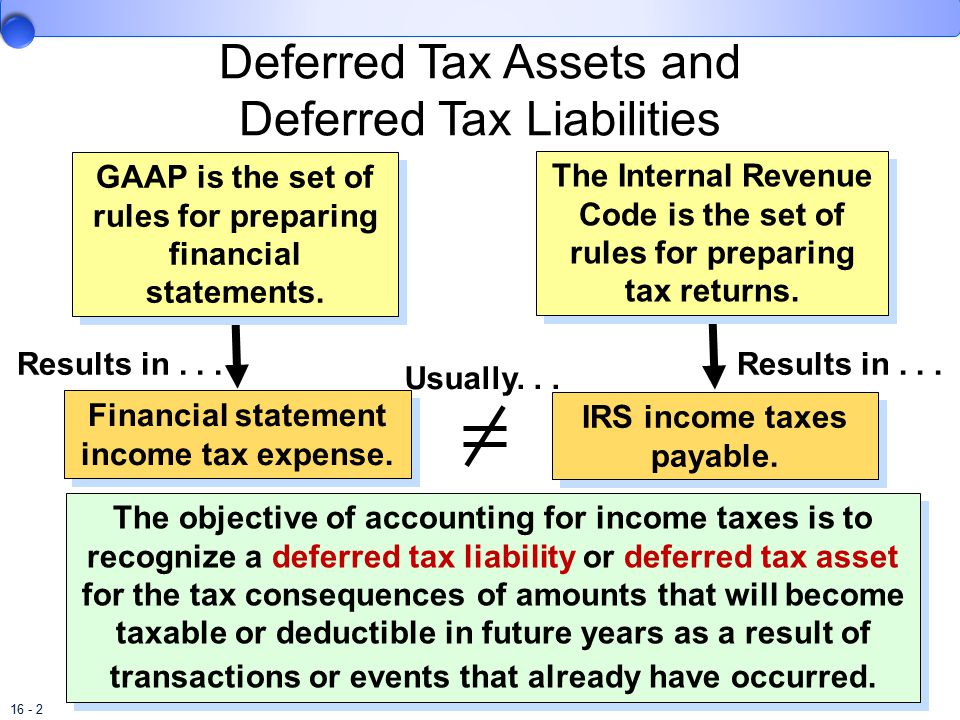

A common example that is used for understanding deferred tax is of temporary differences arising due to different rates of depreciation used in income tax and books of accounts. Deferred Tax Asset. Carrying value of liability in accounting base is bigger than its tax base.

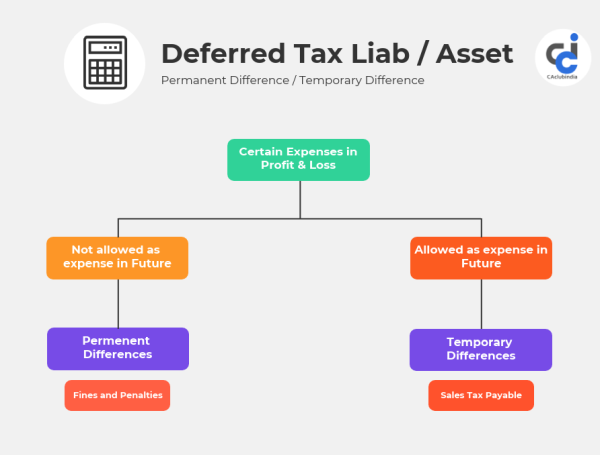

Fines and Penalties Meals and Entertainment Political Contributions Officers Life Insurance and Tax-exempt Interest. LesseeT Lessor L 5-year lease. Examples of situations when deductible temporary differences arise and deferred tax asset is recognised are as follows.

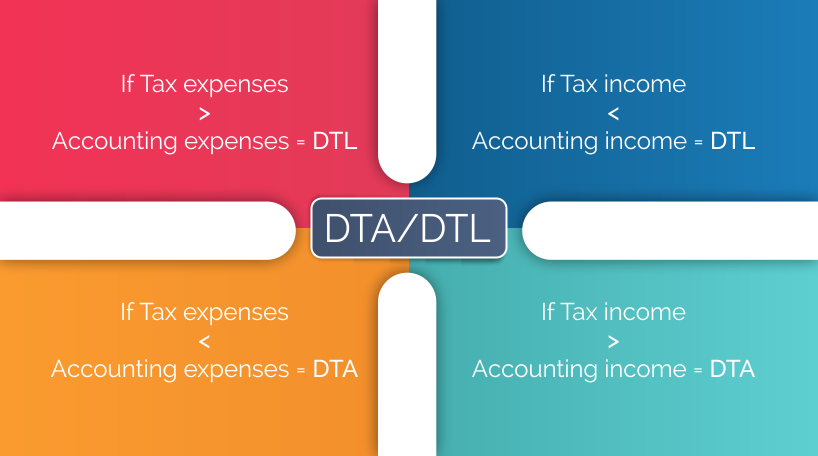

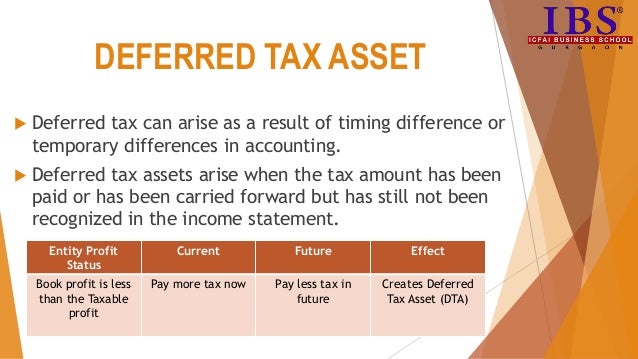

Transitively having lower book income than tax income will result in the creation of a deferred tax asset. They are caused by a Credit balance in carrying amount of assetliability in financial statement compared to tax base. Options B and C are correct statements.

Can P recognise a deferred tax asset. P also has a taxable temporary difference TTD. Deferred tax liability Lets consider an example where the pretax accounting income is 40 million net permanant differences are 15 million ie.

Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked out based on accrual basis or where loss carryforward is available. They lead to deferred tax assets. There are numerous types of transactions that can create temporary differences between pre-tax book income and taxable income thus creating deferred tax assets.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)