Fine Beautiful Asset Retirement Obligation Example

Some examples specific to the oil and gas industry include oil well plugging and.

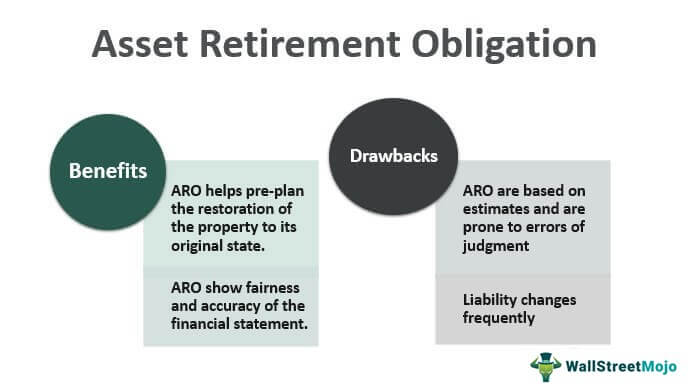

Asset retirement obligation example. Companies in several industries have to bring an asset back to its original state. Related articles Asset Retirement Obligations ARO are commonly associated with industries such as oil and gas mining waste disposal or nuclear energy. From Wikipedia the free encyclopedia An Asset Retirement Obligation ARO is a legal obligation associated with the retirement of a tangible long-lived asset in which the timing or method of settlement may be conditional on a future event the occurrence of which may not be within the control of the entity burdened by the obligation.

For AROs related to acquired tangible capital assets the event is the acquisition of the tangible capital asset. 45000 1 03 25 94220. Some examples specific to the oil and gas industry include oil well plugging and abandonment and underground storage tank removal.

This publication is designed to assist professionals in understanding the accounting for asset retirement. Asset Retirement Obligations ARO are commonly associated with industries such as oil and gas mining waste disposal or nuclear energy. An asset retirement obligation ARO represents the legal commitment to remove certain improvements or modifications to an asset at the end of the assets use.

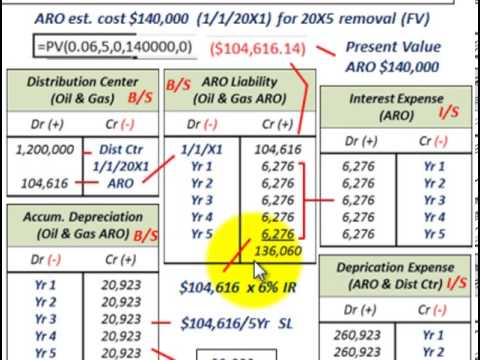

An asset retirement obligation ARO is a liability associated with the eventual retirement of a fixed asset. This standard is equivalent to US. Five years into the lease the company finishes constructing a.

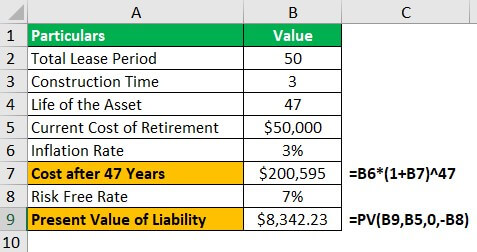

Asset Retirement Obligation is a legal and accounting requirement in which a company needs to make provisions for the retirement of a tangible long-lived asset to bring the asset back to its original condition after the business is done using the asset. Under US GAAP if a company enters into a lease for a building constructs. An asset retirement obligation ARO is a legal obligation that is associated with the retirement of a tangible long-term asset.

Businesses may incur retirement obligations at the inception of an assets life or during its operating life. A business should recognize the fair value of an ARO when it incurs the liability and if it can make a reasonable estimate of the fair value of the. The liability is commonly a legal requirement to return a site to its previous condition.