Supreme Tax Basis Balance Sheet Example

In a tax basis balance sheet you report the depreciated value of assets.

Tax basis balance sheet example. In a tax basis balance sheet the liabilities of a company are reported at their true current value assuming the business paid for the liability immediately. Income before current year tax expense 1289500 455400 Income tax expense 451700 300900 Net income 837800 154500 Retained earnings beginning of year 1057500 1053000 1895300 1207500 Less. Used under the accrual basis.

Below that is liabilities and stockholders equity which includes current liabilities non-current liabilities and finally. This form contains the following RollForward members in the columns across. However if the company bought the fleet five years ago the tax basis value will no longer be 200000.

Now that stay of execution is over and starting with tax years ending on or after December 31 2020 all capital accounts must be reported on the tax basis. Tax basis is the carrying cost of an asset on a companys tax balance sheet and is analogous to book value on a companys accounting balance sheet. Take a non-business example to maybe better this.

Here is a cash basis accounting balance sheet example. To complete his personal tax return. In the good old days partner capital accounts on Schedule K-1 could be reported on GAAP 704b or even other methods in addition to reporting on the tax basis.

So for example when I adjust taxable income for a timing item say depreciation the offset to the income statement is the asset affected by the adjustment to income creating a deferral. The business structures flexibility Protection of the. Accuracy of Tax Accounts A proper implementation of a tax basis balance sheet must include a review of tax basis of assets and liabilities and a reconciliation of the activity in the income tax accounts.

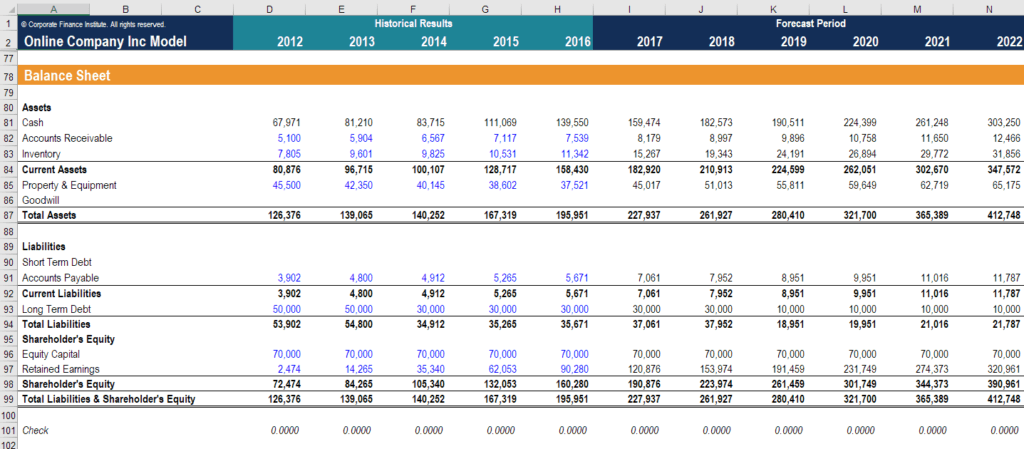

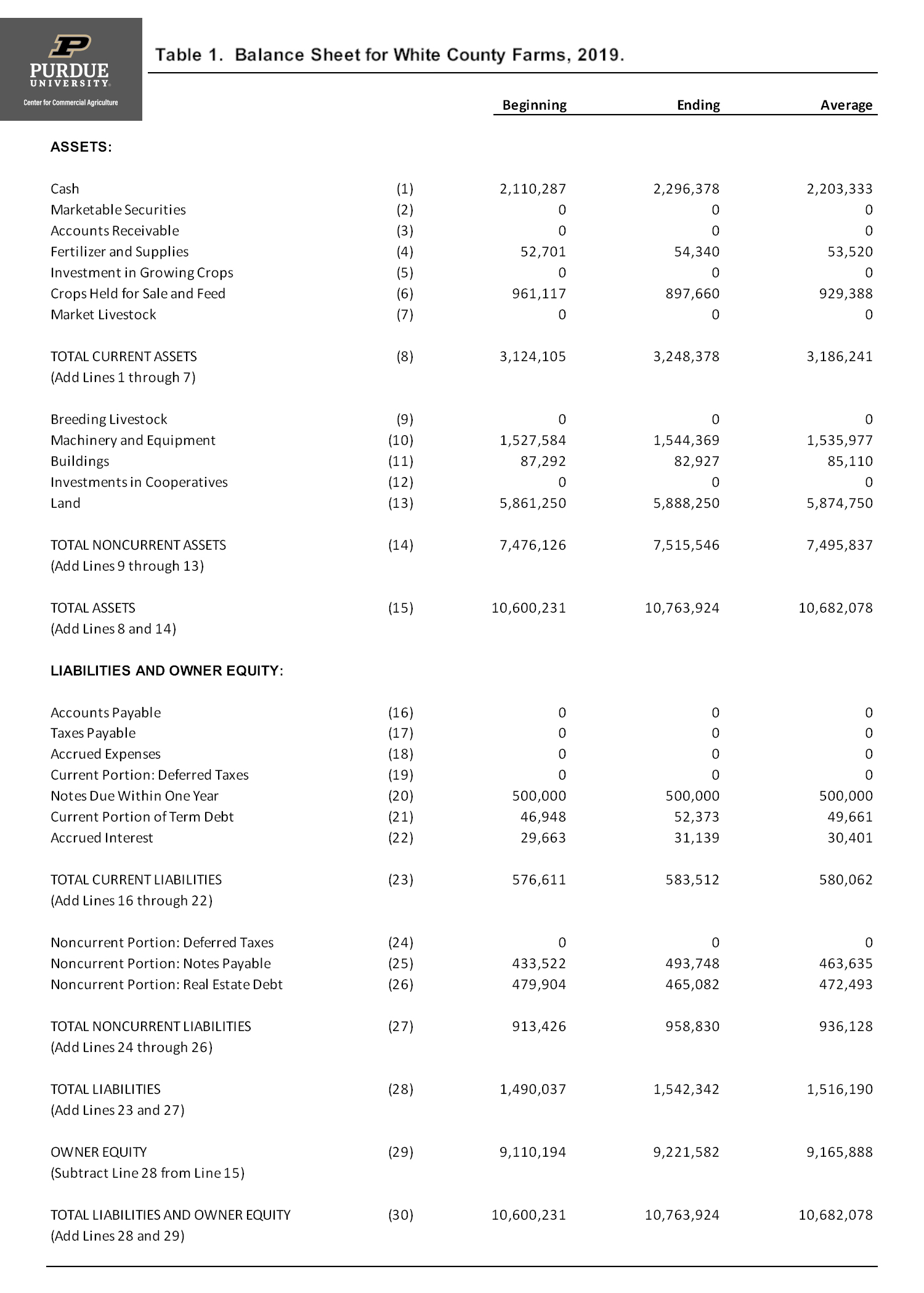

This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities. This example of a simple balance sheet is fully customizable and ready to print. The tax basis balance sheet can be used to enter adjustments and the actual tax basis of assets liabilities based on the return as filed.