Fine Beautiful Ending Retained Earnings For A Period Is Equal To

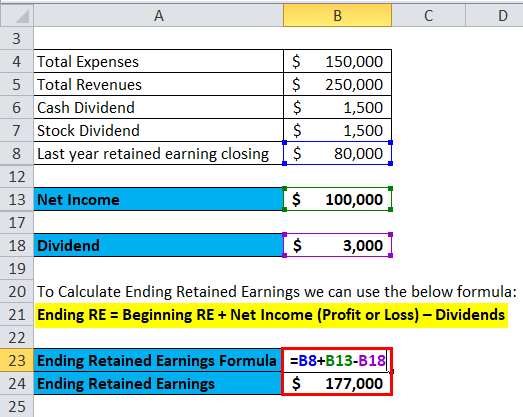

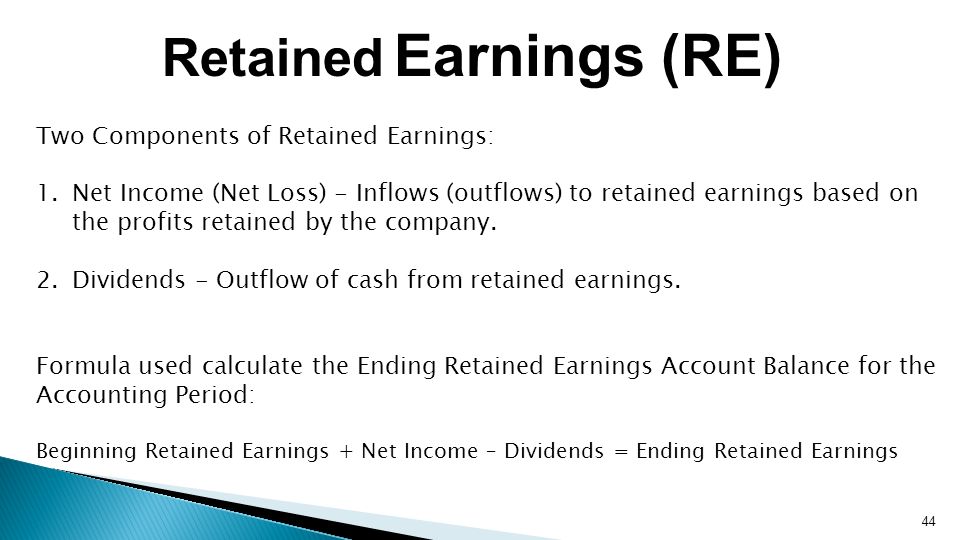

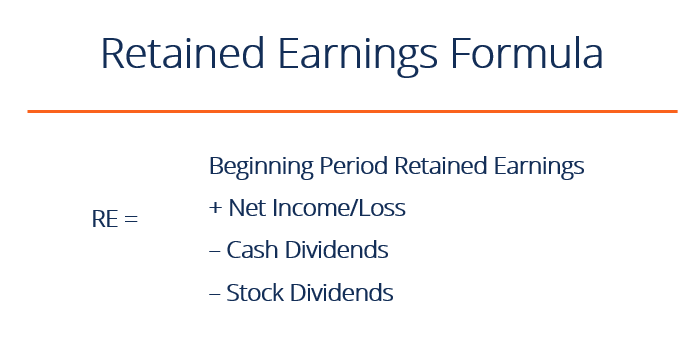

Beginning retained earnings Net income Dividends.

Ending retained earnings for a period is equal to. Statement of retained earnings is a report that reconciles the retained earnings of a company at the start of an accounting period to retained earnings at the end of the accounting period. Is equal to Retained Earnings at the beginning of the period minus net income or plus net loss for the period. During the year the business recorded 315000 in revenues and 165000 in expenses and 30000 of dividends.

Retained Earnings at the end of a period. The retained earnings account is a permanent account that records a businesss total profits still owed to its shareholders. Retained earnings at the end of the period is equal to a retained earnings at the beginning of the period plus net income minus liabilities b retained earnings at the beginning of the period plus net income minus dividends c net income d assets plus liabilities.

The Year End report Retained Earnings balance is. Beginning retained earnings Net income Dividends b. Retained earnings Net income - Dividends.

Ending retained earnings for a period is equal to. On 12312016 the ending Retained Earnings GL balance is. We can come to a conclusion that during the whole existence of your company it has earned enough to keep 190000 after covering day-to-day expenses dividends paid to.

As a result your retained earnings balance at the end of the next year will equal to 190000. End of Period Retained Earnings At the end of the period you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period adding any net income or net loss and subtracting any dividends. Is equal to the balance in the Retained Earnings account in the adjusted trial balance at the end of a period.

Jimmys Repair shop started the year with total assets of 150000 and total liabilities of 120000. Ending retained earnings for a period is equal to the beginning. Appears in the Income Statement for the period.