Outstanding Section 8 Company Balance Sheet Format

Format of the balance sheet.

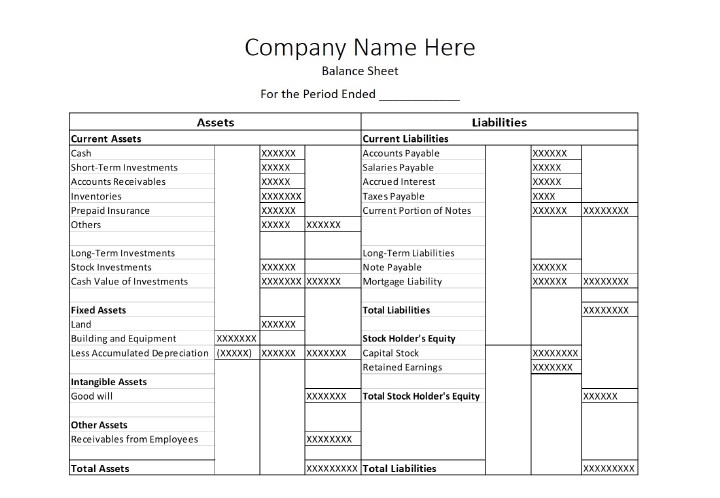

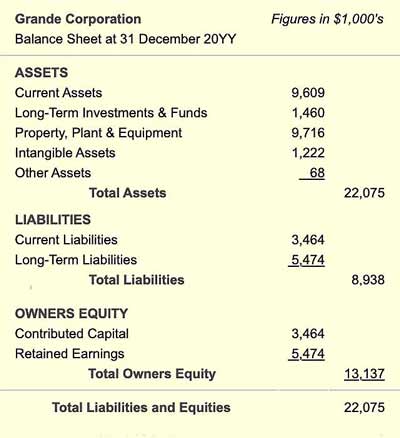

Section 8 company balance sheet format. The balance sheet also called the statement of financial position is the third general purpose financial statement prepared during the accounting cycle. 1 Basis of Accounting. 81 Report Listing 811 nVision Reports 812 AP PeopleSoft Delivered Reports 813 GL PeopleSoft Delivered Reports 82 Queries 821 Query Listing 8211 GL Queries 8212 AP Queries 83 Screen Views and Other Data Research Tools 831 Compare Across Ledgers 8.

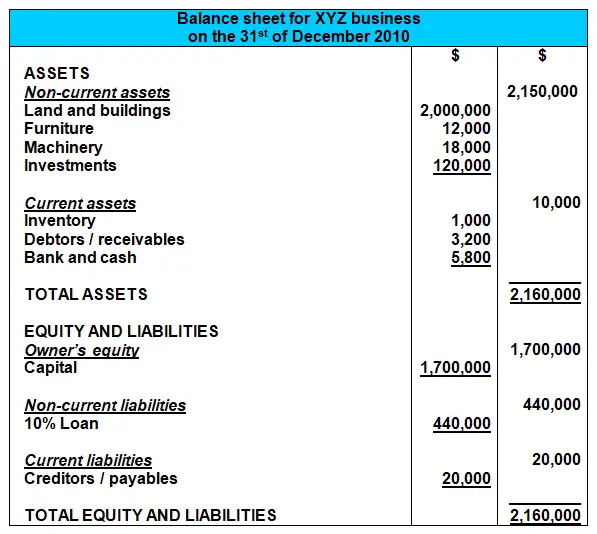

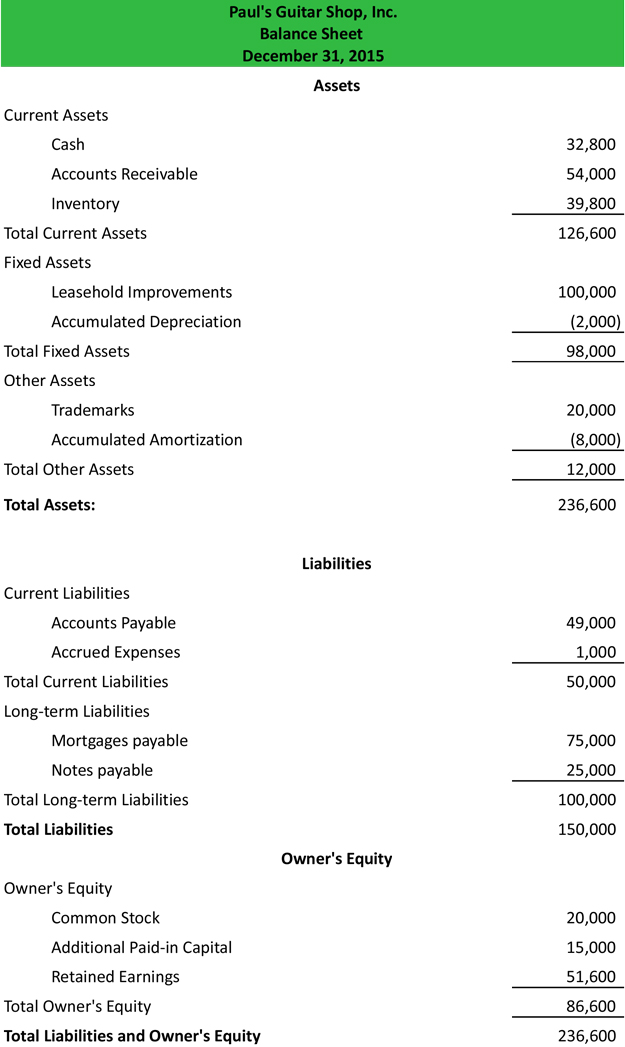

All assets and liabilities classified into current and non-current and presented separately in the balance sheet. Section-8 Companies are required to conduct an Annual General Meeting at the end of each. The information needed to prepare these formal financial statements comes from the balances found in the ledger accounts which appear on and are balanced by means of a formal trial balance.

2017-2018 A-63 ASHOK VIHAR PHASE III DELHI-110052 CIN. It is mandatory for every Section 8 Company. Details under each of the items in vertical Balance Sheet shall be given in separate schedules.

The assets are listed on the left hand side whereas both liabilities and owners equity are listed on the right hand side of the balance sheet. NOTES ANNEXED TO AND FORMING PART OF BALANCE SHEET AS AT MARCH 312010 AND INCOME AND EXPENDITURE ACCOUNT FOR THE YEAR ENDED MARCH 312010 A ACCOUNTING POLICIES. Six column worksheet The income statement and the balance sheet are always prepared at the end of each fiscal period.

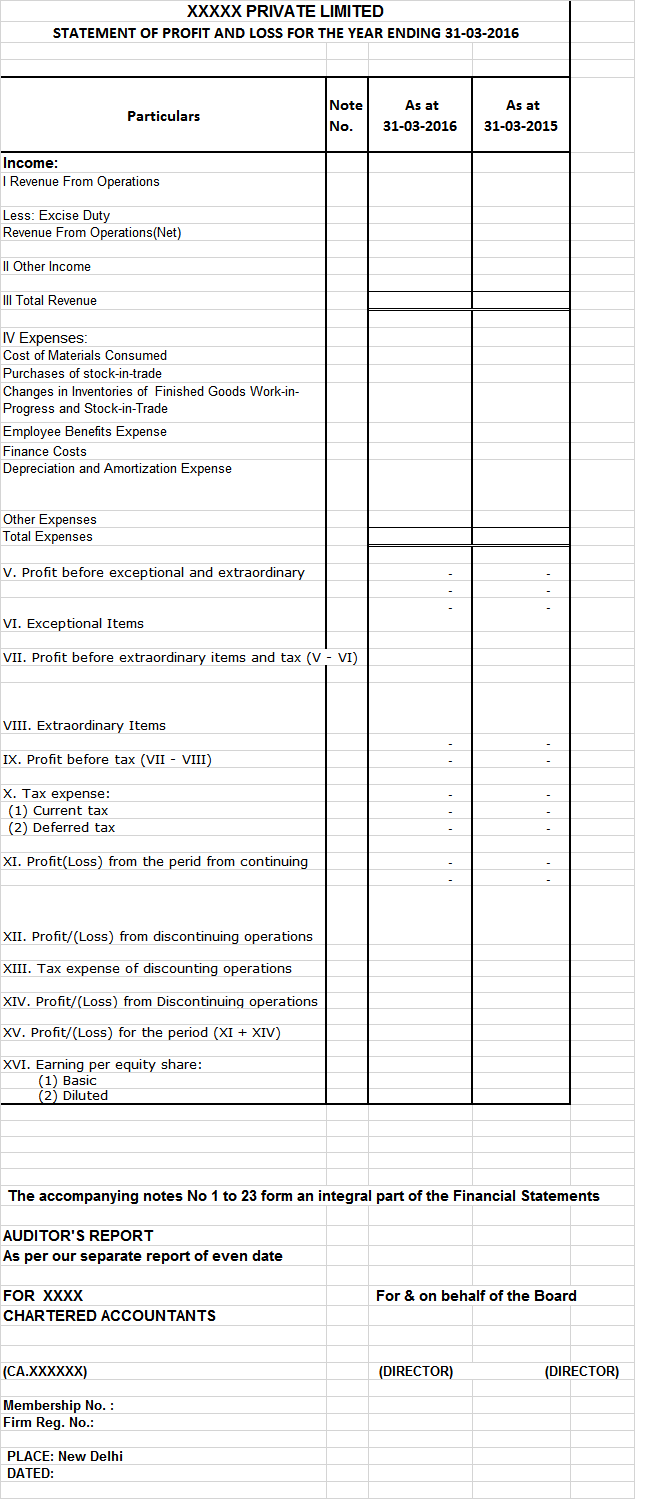

The schedules referred to above accounting policies and explanatory notes that may be attached shall form an integral part of the Balance Sheet. Every Company is required to file its Balance Sheet along with statement of Profit and Loss Account and Director Report in this form within 30 days of holding of Annual General Meeting. 8 Part VI Conversion of Section 8 Company into a Company of any other kind I Procedure Rule 21 22 - Pass a Special Resolution - Explanatory Statement should contain the following details - the date of incorporation of the company - the principal objects of the Company as set out in MOA - the reasons as to why the activities for achieving the.

MGT-7 Filing of Annual Returns with ROC. In the e-form AOC-4. Name of the Company.