Best Deferred Tax Balance Sheet Approach Example

Deferred tax footnote disclosures however are more relevant than the amounts recognised under the balance sheet method.

Deferred tax balance sheet approach example. For example if an acquisition or disposition was not properly recorded in the deferred tax accounts then the ending deferred balance may also be. It is the tax difference which we are paying now based on taxable income whereas our accounting income is less. For example WDV as per BOOKS.

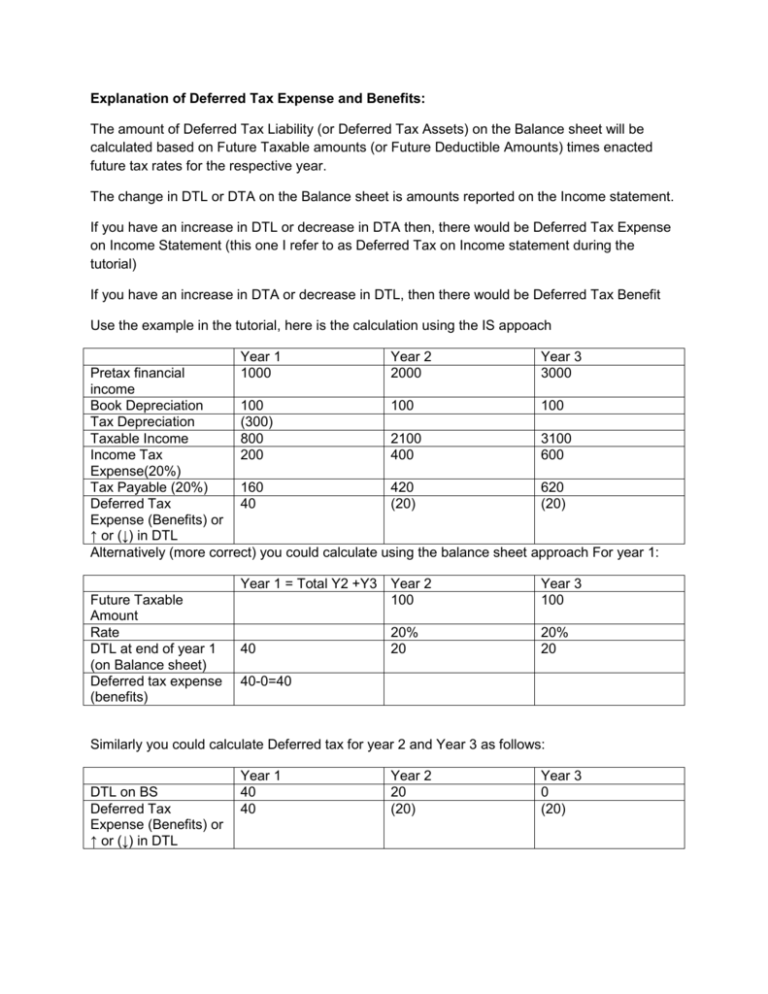

Allocating the deferred tax charge or credit The second section of this guide summarises the approach to allocating the deferred tax. Thus deferred tax liability represents additional income tax payable that will be due in future years. When income tax expense is smaller than income tax payable as a result of deducting any noncash expenses in accounting books some income tax expense is deferred to the future.

The sample includes 440 firm years over the period 2008-2012The results show that deferred tax amounts recognised under the balance sheet method provide no more information to investors than the taxes payable method TPM. Lets assume that a company has a book profit of 10000 for a financial year including a provision of 500 as bad debt. 108529109 WDV as per Income Tax Act.

However for the purpose of taxes this bad debt is not considered. It is worth noting here that revaluation gains which increase the carrying value of the asset and leave the tax base unchanged result in a deferred tax liability. 08 September 2016 Can somebody give an easy example of balance sheet approach of calculating deferred tax asset liability.

Deferred tax and the framework As we have seen IAS 12 considers deferred tax by taking a balance sheet approach to the accounting problem by considering temporary differences in terms of the difference between the carrying amounts and the tax values of assets and liabilities also known as the valuation approach. Tax deferred liability 280015 420. The larger income tax payable on tax returns creates a deferred tax asset which companies can use to pay for deferred income tax expense in the future.

The Balance of Deferred Tax Liability Asset is reflected in Balance sheet. Deferred tax assets may be presented as current assets if a. In the above example assume AZN shares have a cost base of 600 and at the balance sheet date are valued at 1800 since the shares have been revalued up by 1200 suppose the asset is to be sold at this revalued price taking into consideration of 13 CGT discount there will be 120 tax payable.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)