Casual Off Balance Sheet Exposure Examples

The LEQ factor varies from 0 to 100 whereas CCF is generally closer to 100.

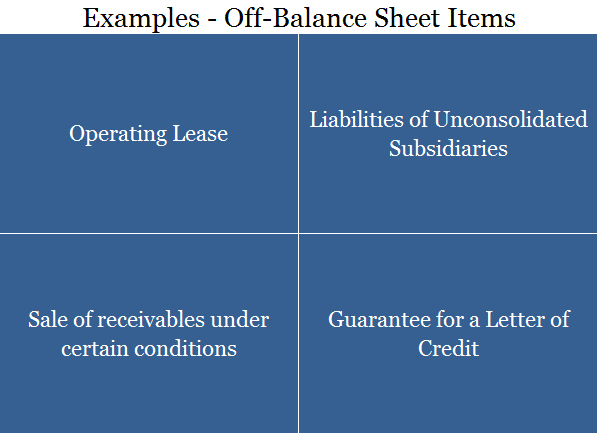

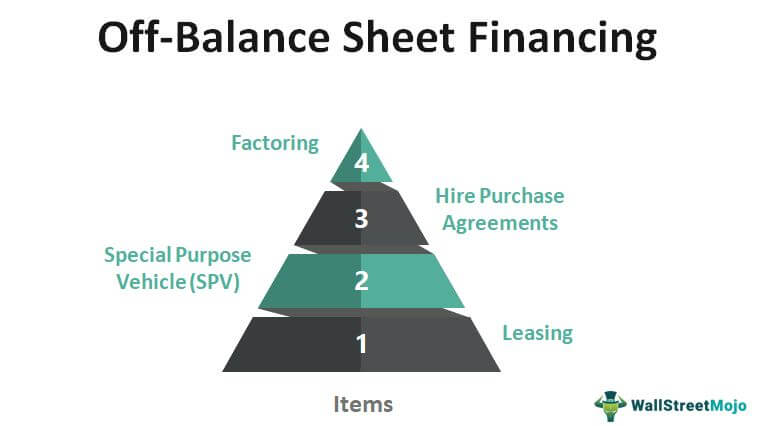

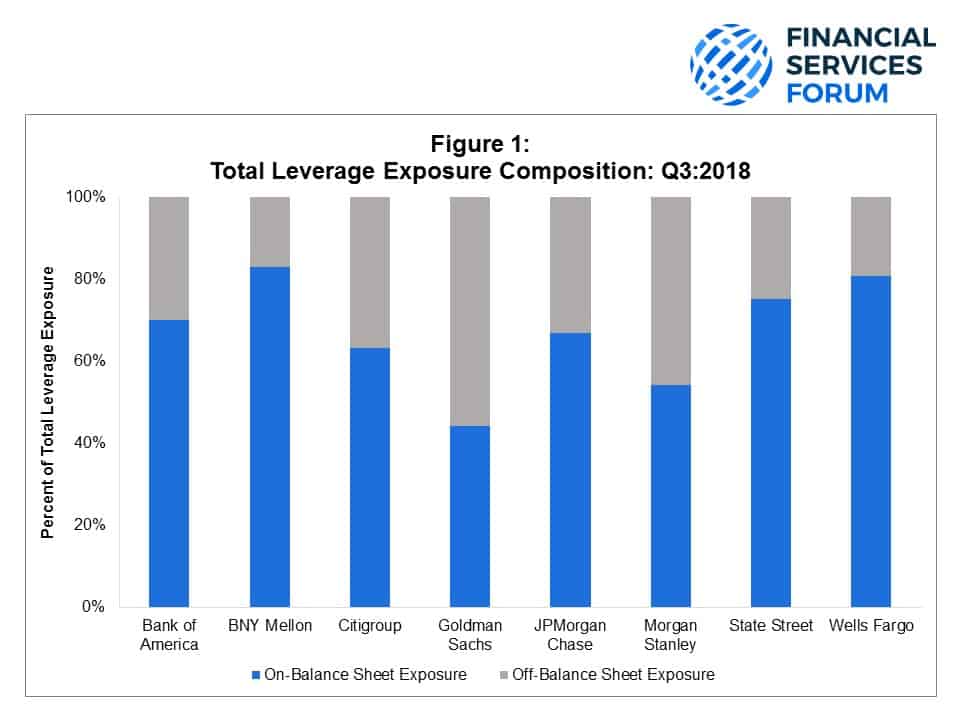

Off balance sheet exposure examples. In the case of operating leases the asset. Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. So any type of lending is a balance-sheet exposure.

The regulatory Basel 1 treatment of off balance sheet exposures is to use a CCF of 50 factor. For committed lines of credit it makes sense to set the exposure at 100 of the commitment since the bank is contractually at risk for this total amount even if. Total return swaps are an example of an off-balance sheet item.

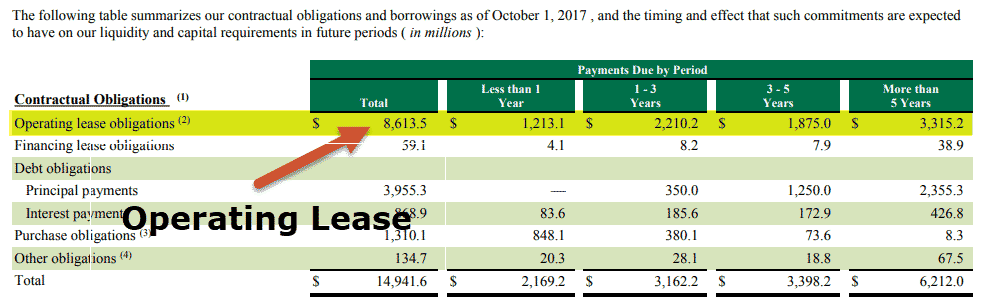

They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. We know from the present value formula that on the day it is made said loan is worth PV FV 1 i 100000108 9259259. Among the above examples operating leases are the most common examples of off-balance-sheet financing.

The asset continues to appear in lessors books of accounts. The risk is that the bank may overcommit as with Salomon Brothers in market for new 2-year bonds in 1990. Most commonly known examples of off-balance-sheet items include research and development partnerships joint ventures and operating leases.

Examples of Off-Balance Sheet Assets OBS assets allow companies to keep assets and liabilities off the balance sheet. One of the most common examples of off balance sheet is operating leases which are not recorded in lessees balance sheet. This helps improve their accounting ratios or.

Thus CCF is a measure applied on on-balance sheet exposure. These are the more traditional off-balance-sheet exposures where a bank hasunderwritten the obligations of a third party and currently stands behind the risk. Thus LEQ is a measure applied on entire off-balance sheet exposure.

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)