Fun Current Years Profit And Loss Calculation Sofp

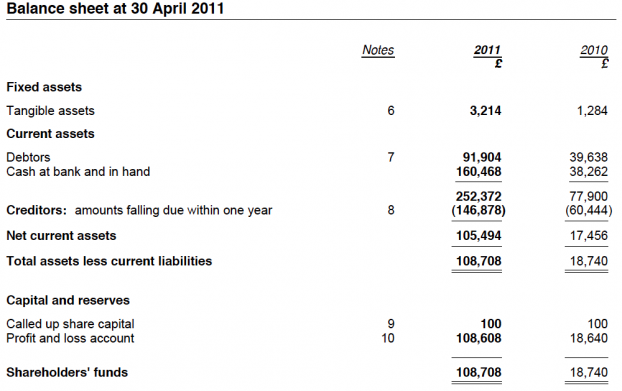

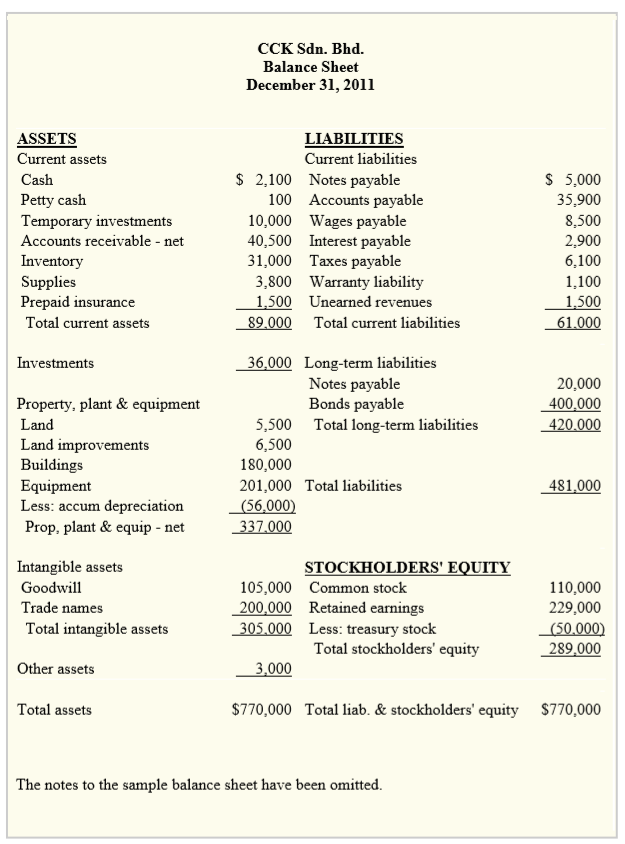

The Current Year Earnings would be displayed on the Balance Sheet and would be the Net Profit or Net Loss value from which is shown on the Profit and Loss.

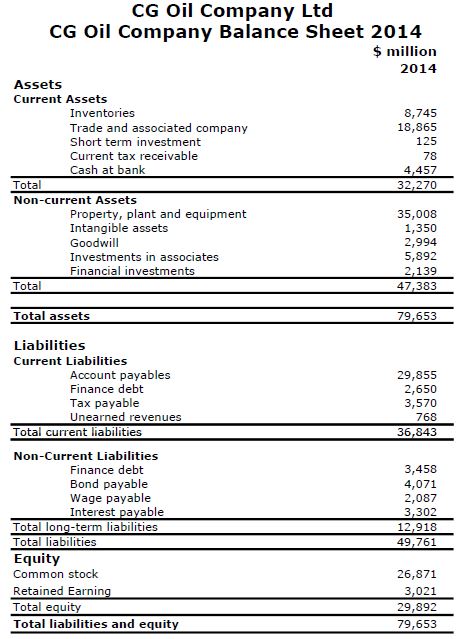

Current years profit and loss calculation sofp. The profit for the year from. PL Format 2 Annual Statement. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

For false weight profit percentage will be P True weight false weight false weight x 100. Statement of financial position extract 31 March 2010. The single step profit and loss statement formula is.

The balance sheet by comparison provides a financial snapshot at a given moment. In addition businesses may elect for the enhanced. Carrying value machine 35000 4375 first 6 months depreciation 8750 current year charge 21875.

It is also useful for analyzing performance YOY. The profit and loss PL account summarises a business trading transactions - income sales and expenditure - and the resulting profit or loss for a given period. A PL statement compares company revenue against expenses to determine the net income of the business.

The current assets include cash accounts. When the profit is m and loss is n then the net profit or loss. They wouldnt be the same if running the Profit and Loss for the full financial year or running the Profit and Loss report as a Cash basis method.

PPE Non-Current Asset SOFP X Up to the maximum of a revaluation surplus and the balance being accounted as follows. It doesnt show day-to-day transactions or the current profitability of the business. Subtract operating expenses from business income to see your net profit or loss.