Out Of This World Bank Balance Sheet Explained

And a legitimate question is.

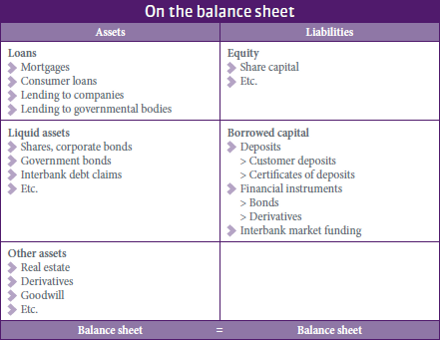

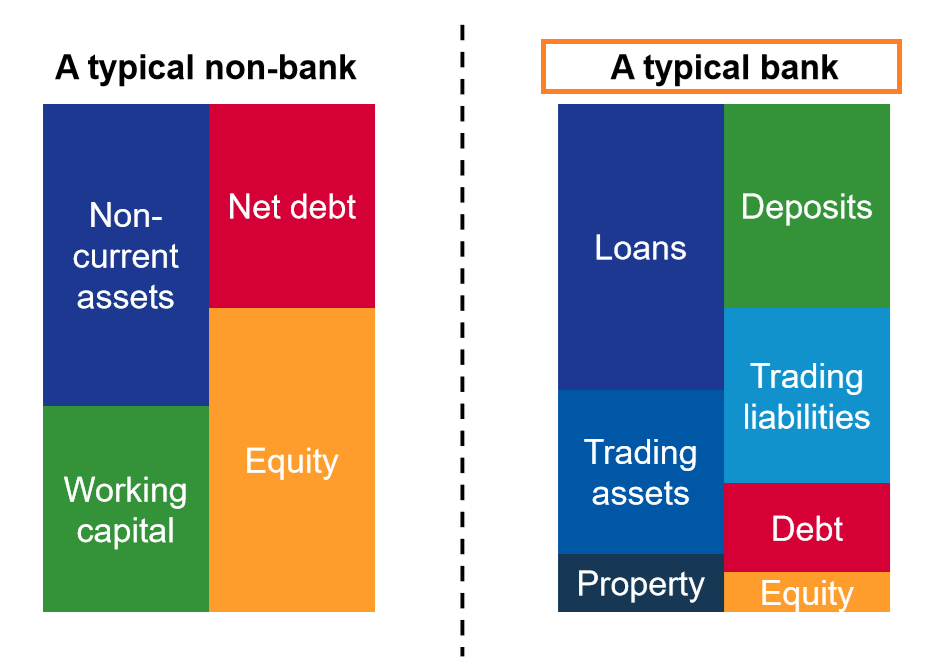

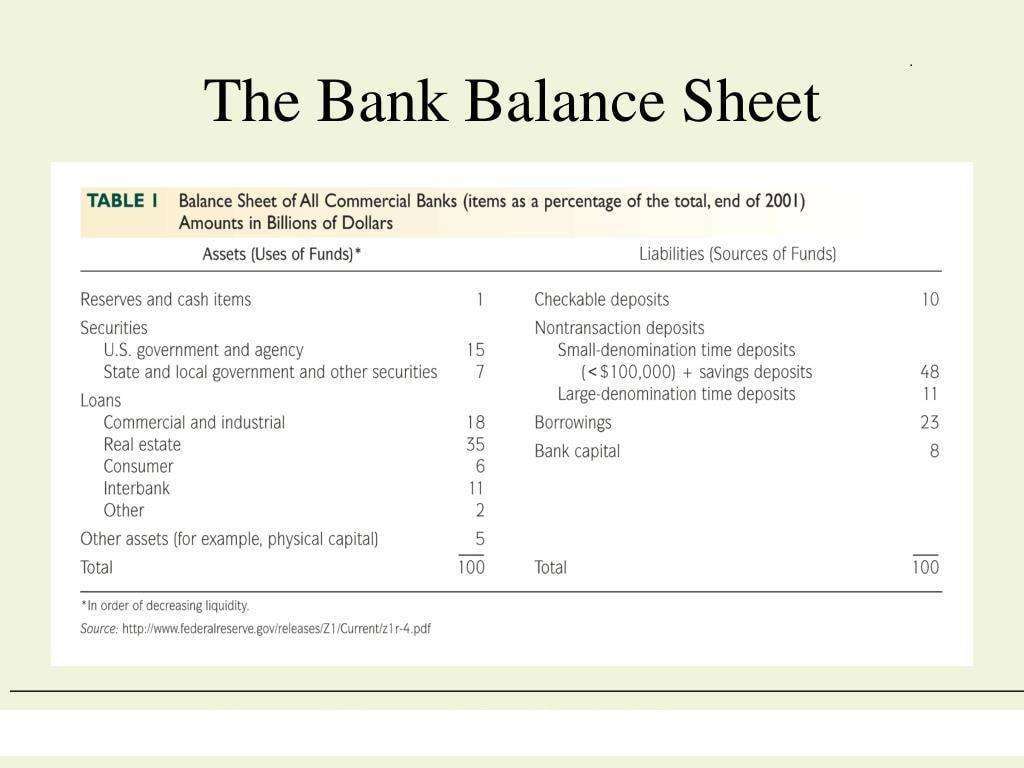

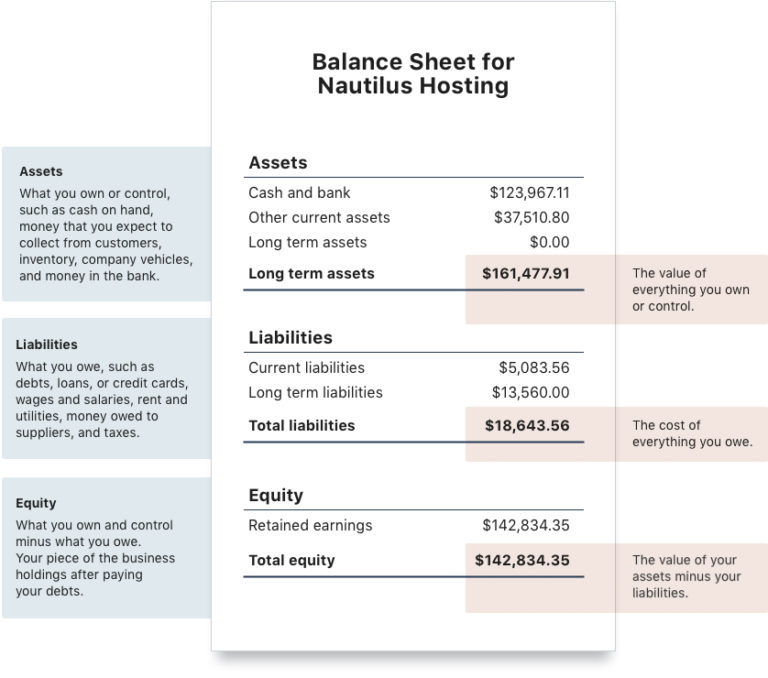

Bank balance sheet explained. Fixed assets broadly covers the money spent to develop the banks branch network and corporate offices. On a bank balance sheet assets always equal liabilities they balance. The volume of business of a bank is included in its balance sheet for both assets lending and liabilities customer deposits or other financial instruments.

The main liabilities of the central bank banknotes and commercial bank reserves form the ultimate means of settlement for all transactions in the economy. Understanding a banks assets The hardest challenge in understanding a banks balance sheet is that from the banks perspective whats an asset and whats a. Liabilities on a banks balance sheet.

Loans are the heartbeat of a traditional bank the more they can loan out the more money they are going to make on the spread between interest rates. A banks balance sheet which sums up the financial balances is prepared and tailored to reflect the mandate put in place by a banks regulatory authority. The Balance Sheet of the Federal Reserve Bank Just like any other balance sheet the Feds balance sheet consists of assets and liabilities.

Instead under assets youll see mostly loans and. What you own and what you owe. I cant write a piece on bank balance sheets without talking about risk.

This handbook provides a useful framework for understanding the necessary details. The balance sheet of the bank is different from the balance sheet of the company and it is prepared only by the banks according to the mandate by the Banks Regulatory Authorities in order to reflect the tradeoff between the profit of the bank and its risk and its financial health. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement.

Each week the Fed issues its H41 report which. They also usually report the sector-wise breakup of their loan book. I once wrote a piece explaining how payment systems work.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)