Smart Aro Lease Accounting

Balance sheet income statements.

Aro lease accounting. The liability is commonly a legal requirement to return a site to its previous condition. Use our Accounting Research Online website for financial reporting resources. This Roadmap is intended to help entities address the impact of certain environmental and asset retirement laws and regulations on accounting for environmental obligations and AROs.

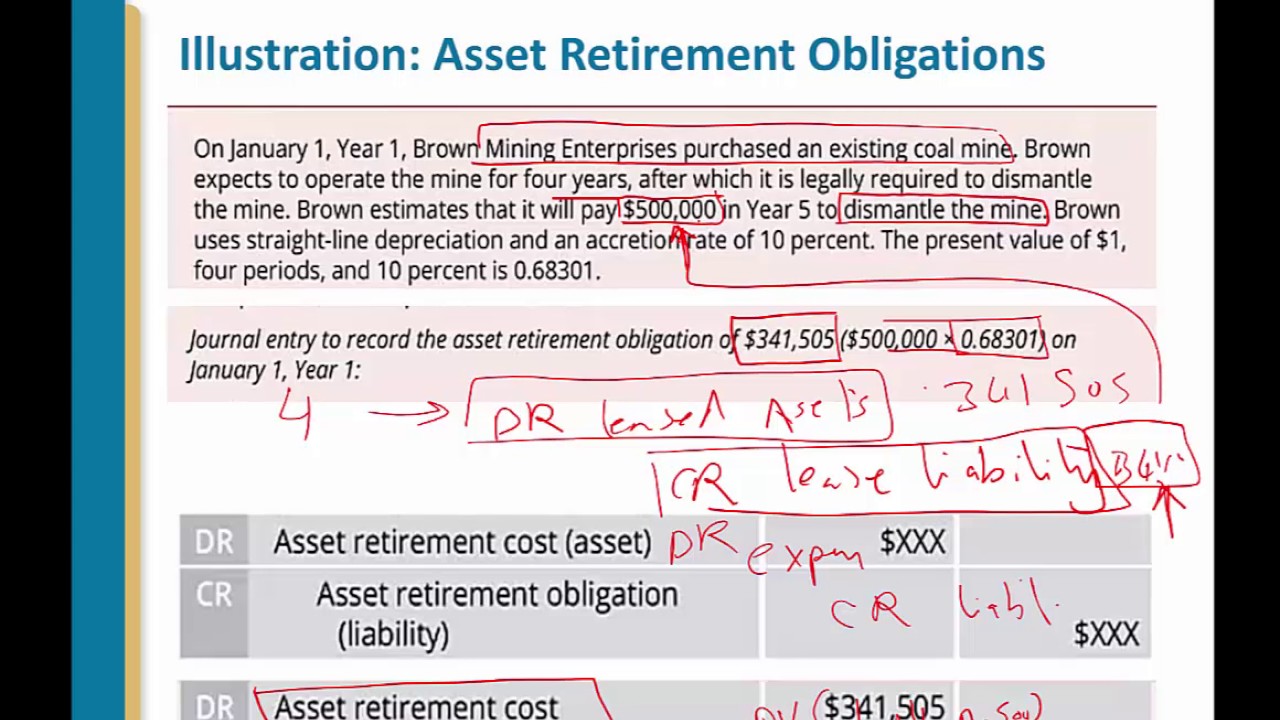

Accounting for AROs Initial recognition of an ARO relates to timing. Asset retirement obligations ARO are legal obligations associated with the retirement of tangible long-lived assets where a company must ultimately remove equipment or clean up hazardous. An asset retirement obligation ARO initially should be measured at fair value and should be r ecognized at the time the obligation is incurred provided that a reasonable estimate of fair value can be made.

This treatment is consistent with the accounting when equipment is purchased for the purpose of performing asset retirement activities. But if the fair value is initially unobtainable then the ARO must be recognized at a later date. Store all of your documents in one repository.

ASC 842-10-55-37 includes guidance on such obligations. Call us on 46 0 8-505 930 00. The new rules regarding the retirement of.

An asset retirement obligation ARO is a liability associated with the eventual retirement of a fixed asset. Use our Accounting Research Online website for. Leasing the equipment that will be used to satisfy the ARO does not reduce the ARO since it is not an asset retirement activity.

For example certain obligations such as nuclear decommissioning costs generally are incurred as the asset is operated. The new lease accounting standards are significantly changing the accounting for operating leases. One of the many nuances of lease accounting an asset retirement obligation ARO is a liability related to the retirement of a tangible long-lived asset when the timing or method of settlement might be dependent upon a future event.