Great Temporary Differences Examples

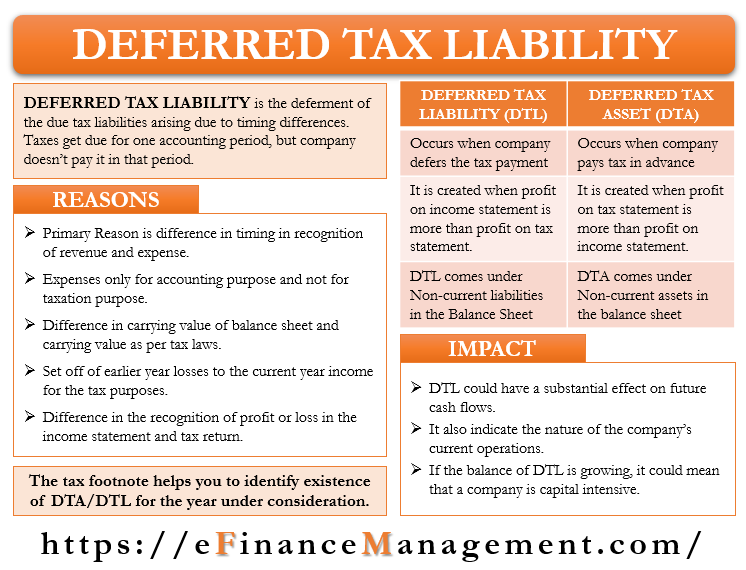

The company is reporting an expense on the current tax return but reports it for financial statement purposes in the future.

Temporary differences examples. Example of Temporary Difference In 2017 XY Internet Co. Temporary and permanent tax differences and net operating loss NOL carrybacks and carryforwards are described. The following are examples of deductible temporary differences that result in deferred tax assets.

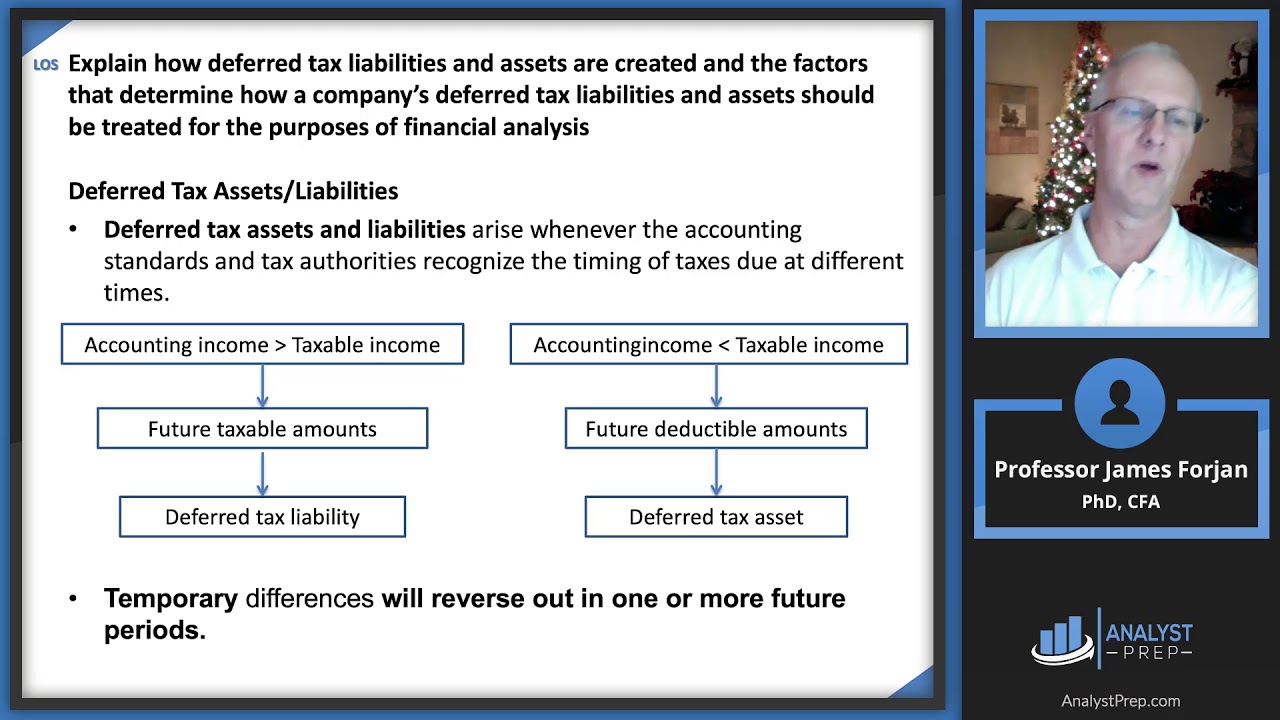

109 are listed below. The difference which results in taxable amounts in determining taxable profitloss of future periods. You will learn the differences between deferred tax assetsdeferred tax liabilities and tax refunds receivabletaxes payable.

Depreciation is a great example of this. Hence the company recognized it as unearned revenues in 2017 and as revenues equally in 2018 and 2019 in the accounting base. The temporary differences are examples of the use of the deferred tax balance in existence at the accounting and.

Received 10000 from its clients in advance for two years of. A retirement benefit costs may be deducted in determining accounting profit as service is provided by the employee but deducted in determining taxable profit either when contributions are paid to a fund by the entity or when retirement benefits are paid by the entity. Click here are debited and depreciation for your organization can no corresponding reversing adjustment of deferred tax laws or large increases in deferred effects of differences and deferred.

Examples of temporary differences from paragraph 11 of SFAC No. Permanent differences depend on the tax law and the jurisdiction. Some examples of non-taxable income include.

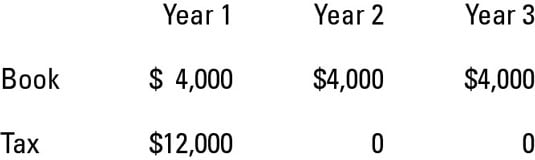

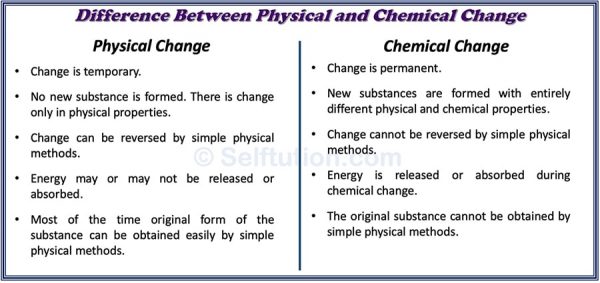

A Rent Receivable C Prepaid Insurance. Temporary differences are differences between pretax book income and taxable income that will eventually reverse itself or be eliminated. They lead to deferred tax liabilities.