Supreme Accounts Receivable Are Valued And Reported On The Balance Sheet

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

If a company uses the allowance method to account for uncollectible accounts the entry to write off an uncollectible account only involves balance sheet accounts.

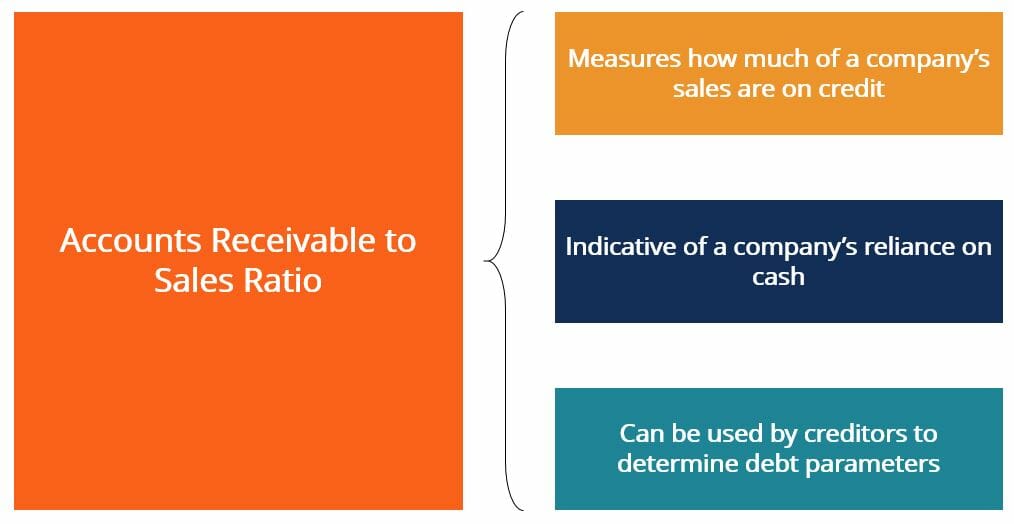

Accounts receivable are valued and reported on the balance sheet. Only if they are not past due. Receivables of all types are normally reported on the balance sheet at their net realizable value which is the amount the company expects to receive in cash. Accounts receivable are valued and reported on the balance sheet a.

With the account reporting a credit balance of 50000 the balance sheet will report a net amount of 9950000 for accounts receivable. At gross amounts less sales returns and allowances. Understand that gains and losses are reported on a companys income statement when certain foreign currency balances are remeasured using new currency exchange rates.

In the investments section. Accounts Receivable is a current asset account remember that current means they are due within 1 year shown on the Statement of Financial Position IFRS Balance Sheet ASPE. Accounts receivable are valued and reported on the balance sheet a.

Accounts receivables are created when. C at net realizable value. On a companys balance sheet receivables can be classified as accounts receivables or trade debtors bills receivable and other receivables loans settlement amounts due for non-current asset sales rent receivables term deposits.

If the receivable amount only converts to cash in more than one year it is instead recorded as a long-term asset on the balance sheet possibly as a note receivable. Receivables are recorded at net realizable value. Walmart agrees to buy 50000 units that people can only buy at Walmart.

Receivables are valued and reported in the balance sheet at their gross amount less any sales returns and allowances and less any cash discounts. Under the allowance method Bad Debt Expense is recorded a. At gross amounts less sales returns and allowances.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)