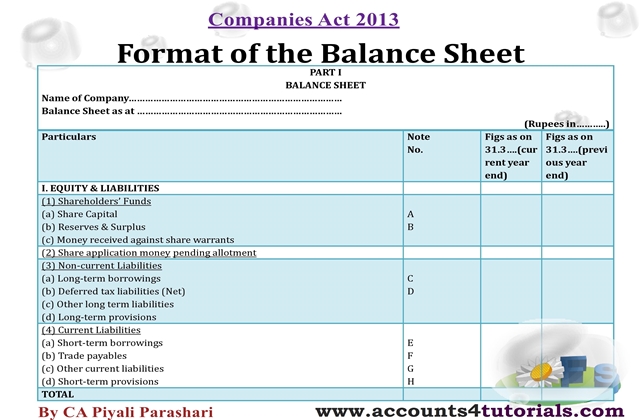

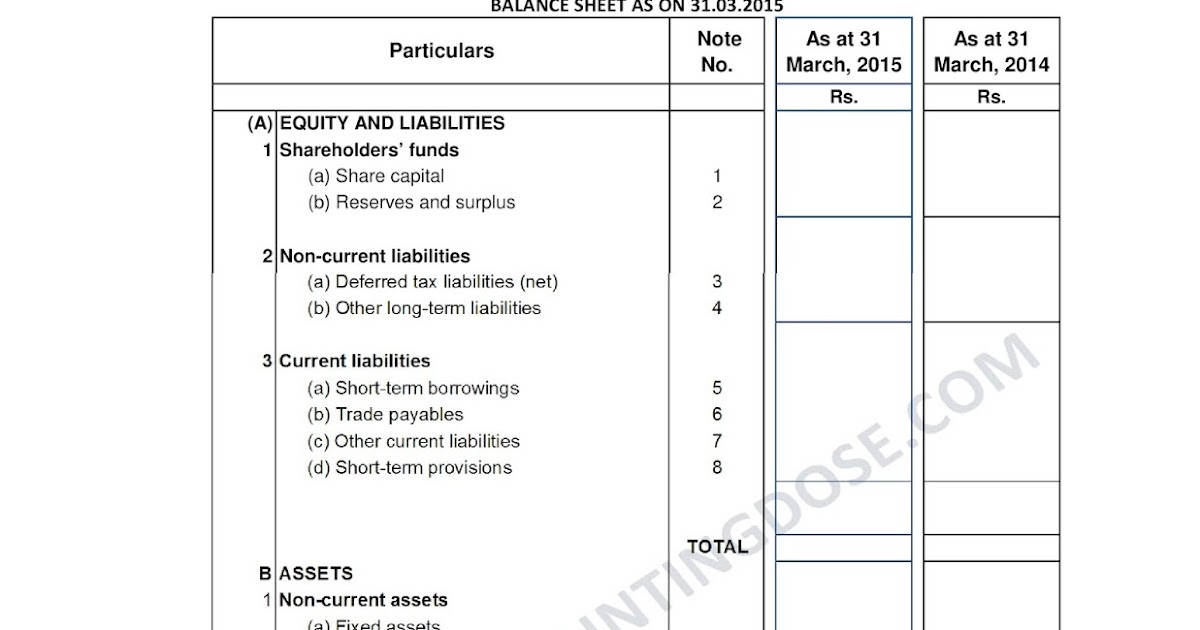

Neat Schedule Iii Of Companies Act 2013 In Excel Format Download

Inserted by Amendment to Schedule III to the Companies Act 2013.

Schedule iii of companies act 2013 in excel format download. Iii Where loans have been guaranteed by directors or others the aggregate amount of such loans under each head shall be disclosed. DIVISION II A7 g Other loans and advances specify nature. Nature of security shall be specified separately in each case.

Excel Format Of Schedule III As Per Companies Act 2013. Section 3 to 22. Ii Borrowings shall further be sub-classified as secured and unsecured.

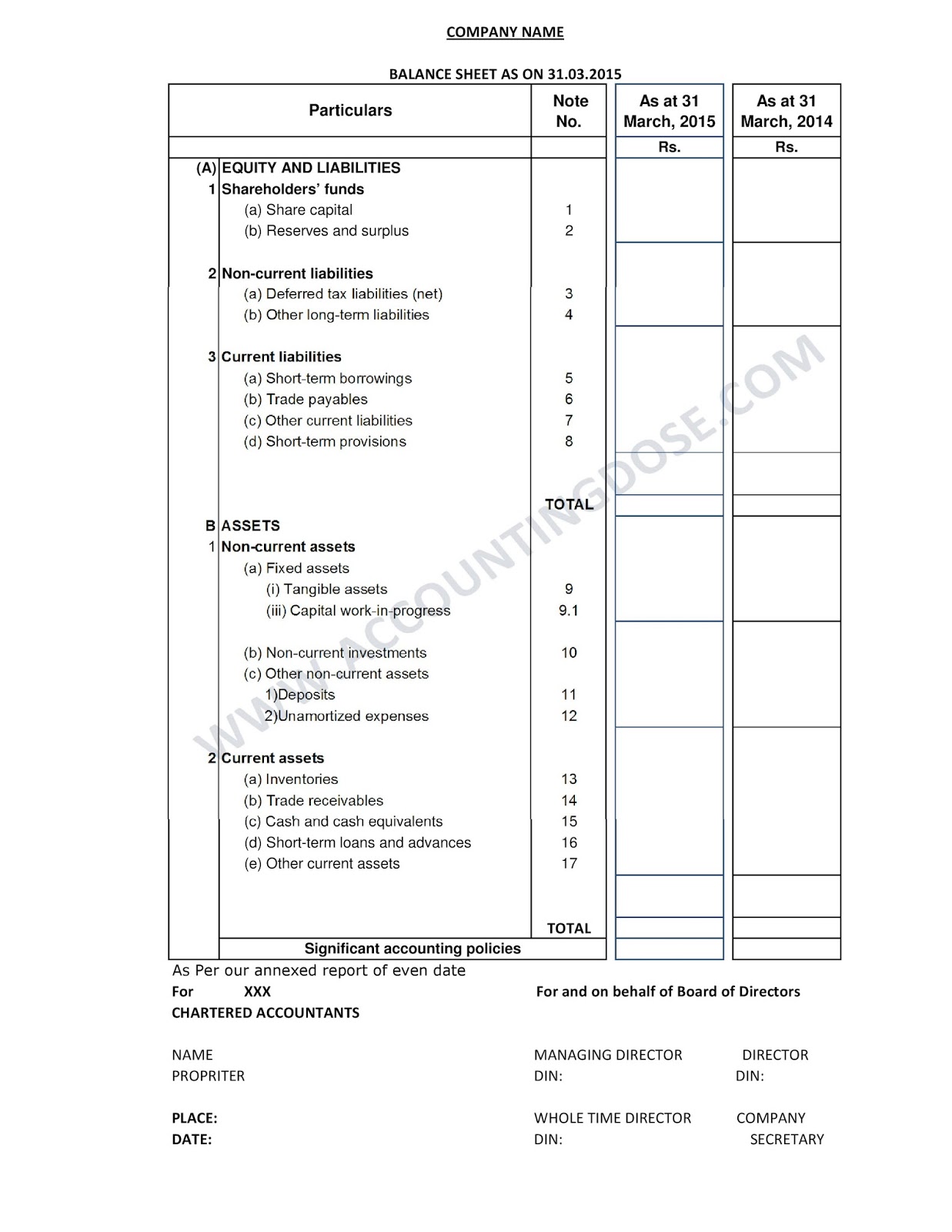

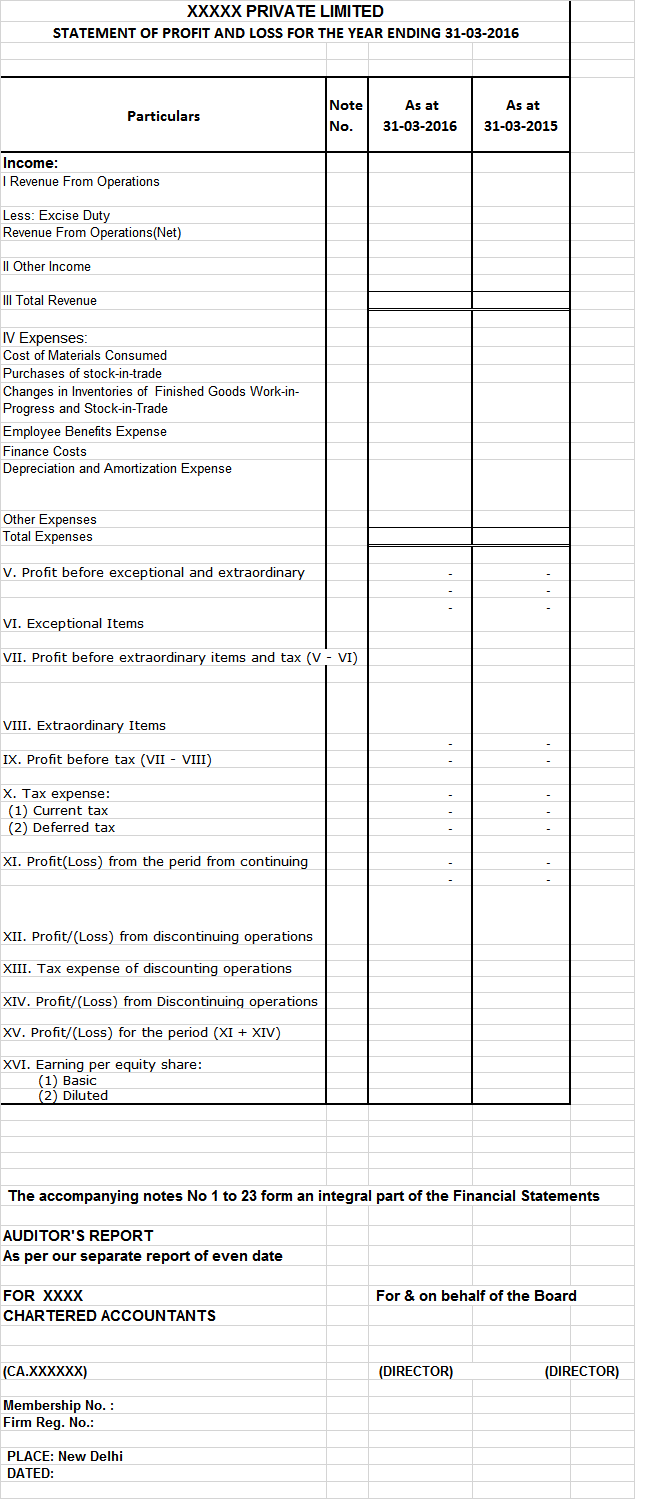

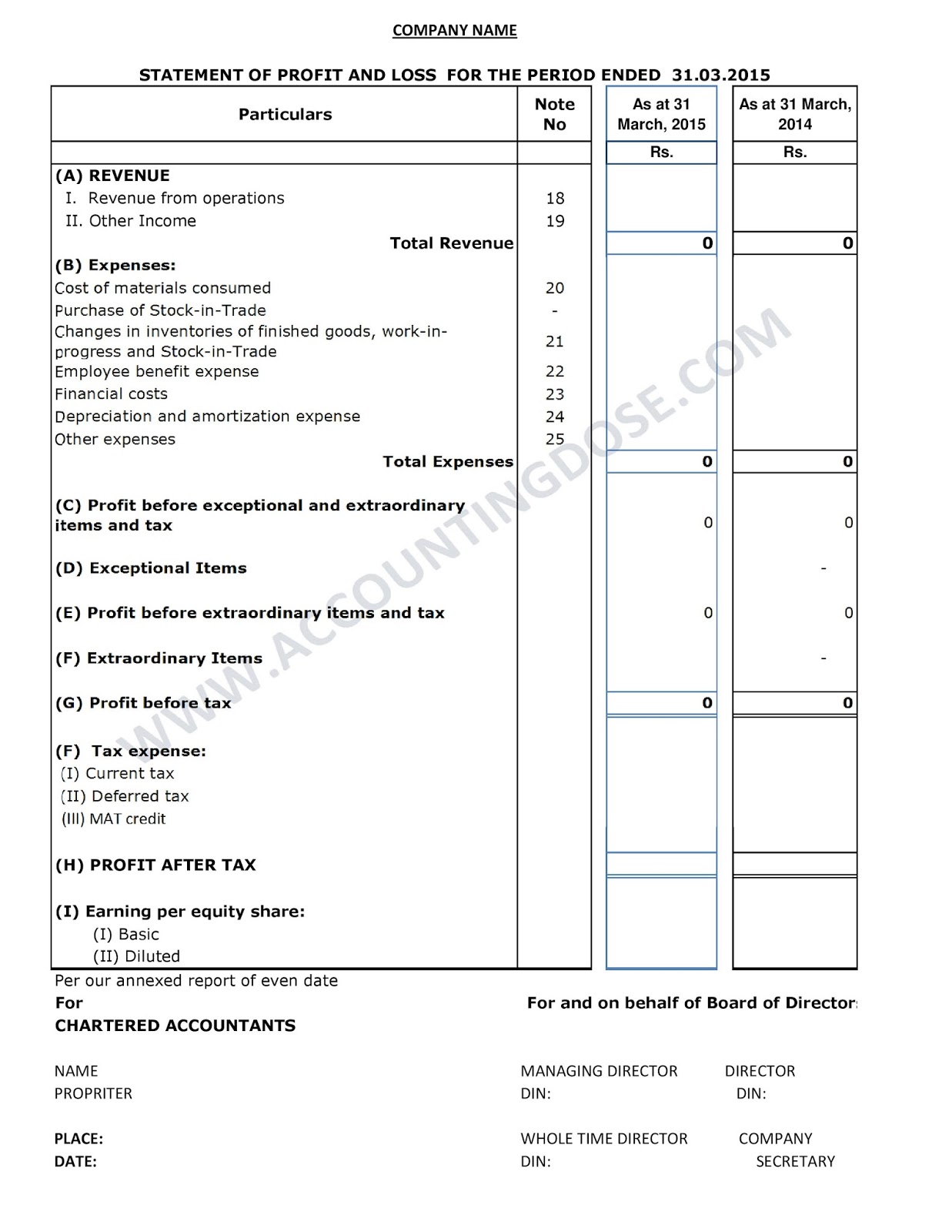

These are made as per current reporting requirements in India. It prepares the Balance Sheet Profit loss as per Revised Schedule III as per Companies Act 2013. Substituted by Amendment to Schedule III to the Companies Act 2013.

Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment. Effective from 01st April 2021. Excel Format of Schedule III as per Companies Act 2013.

Under the heading Assets under sub-heading Non-current assets for the words Tangible assets. Schedule III to the Companies Act 2013 deals with the form of Balance Sheet and Profit and Loss Account and classified disclosure to be made therein and it applies to all the companies registered under the Companies Act 1956. Here we are providing Revised Schedule III in Excel.

ABCAUS Excel Depreciation Calculator FY 2020-21 under Companies Act 2013 as per Schedule-II Version 0504. Tax Audit Report is prepared for Companies Non- Companies and online submission of the same. Download Excel Format of Schedule III as per Companies Act 2013 file in xlsx format- 38520 downloads.