Divine Off Balance Sheet Activities Examples

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Contingent liabilities are different from off-balance sheet items as the former is only mentioned when the liability is likely and the obligation can be quantified.

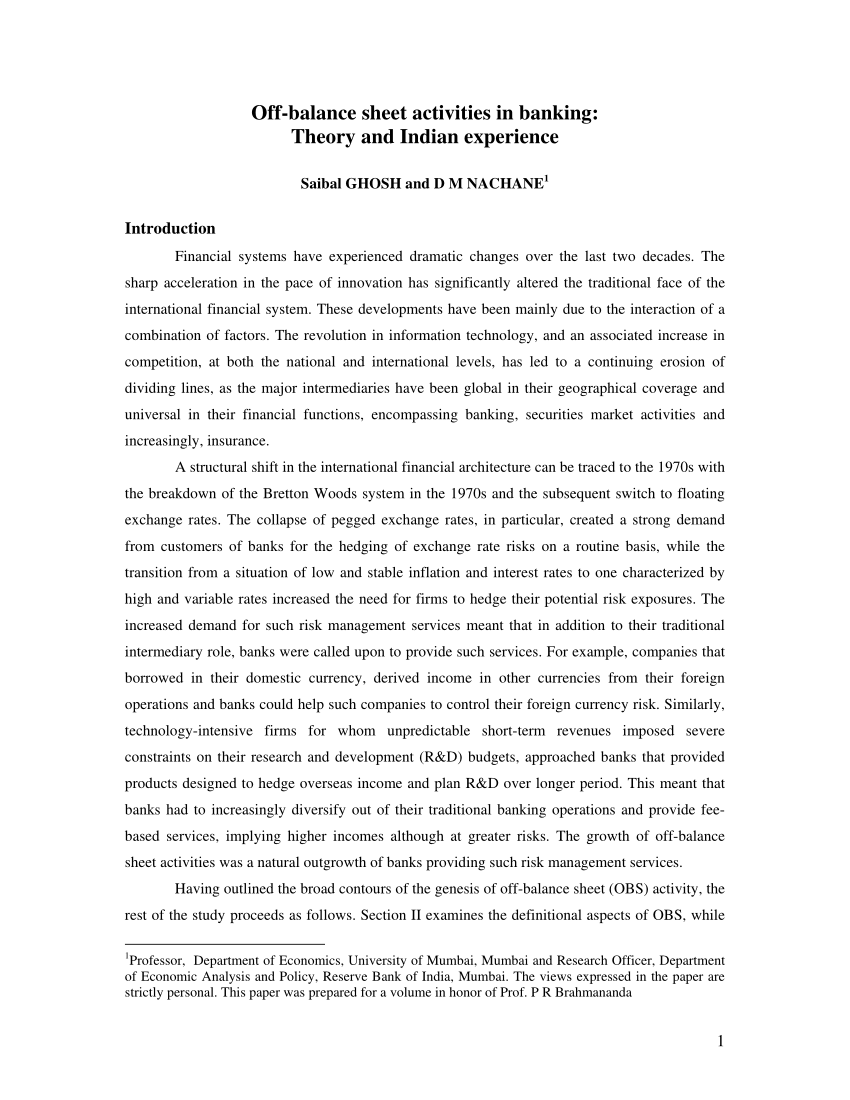

Off balance sheet activities examples. Off Balance Sheet Debt - 6 Sales securitization of Receivables or hiding receivables and payables of f-balance sheet Before we examine receivable securitization. OBS accounting activities targeted by the Accounting Standards Boards The FASB and IASB released their new lease accounting standards in early 2016. Borrowing From Other Banks.

Examples of Off-Balance Sheet Assets OBS assets allow companies to keep assets and liabilities off the balance sheet. Selling Negotiable CDs B. Under some economic conditions the bank could be exposed to too much risk.

In this case the assets being managed by firms do not belong to them but to the clients so they are not recorded on the balance sheet. Off-balance sheet activities include items such as loan commitments letters of credit and revolving underwriting facilities. Banks earn profits from off-balance sheet loan sales A by foreclosing on delinquent accounts.

D selling negotiable CDs. Lets take a look at a situation where a company may decide to opt for off-balance-sheet financing. Trading in financial futures.

Assume a bank has 200 million of assets with a duration of 25 and 190 million of. Examples and Reasons for Off-Balance Sheet Items. The risk is that the bank may overcommit as with Salomon Brothers in market for new 2-year bonds in 1990.

Caused the Treasury to revise the regulations governing the auction of bills and bonds. B guaranteeing debt securities. B by selling the loans at discounted prices.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)