Spectacular Retained Earnings Calculation Example

A company for example can use retained earnings to run its daily operations when it cant generate earnings.

Retained earnings calculation example. Example of a stock dividend calculation. Beginning of Period Retained Earnings. Retained earnings Beginning retained earnings Net income or loss - Dividends For example a company may begin an accounting period with 7000 of retained earnings.

Retained earnings are all the net income profits you have left after paying out dividends or distributions to ownersshareholders. Retained earnings can be used as a reserve in times of a downturn in the business. Let us now look at some retained earnings examples and their calculation.

This example shows a Retained Earnings Report amounts which helps managers improve decisions related to the streamlining of average exchange rate calculations for roll forward Retained Earnings. These are the retained earnings that have carried over from the previous accounting period. Ending retained earnings For example Smart Home has 600000 of net profits in its current year pays out100000 for dividends and has a beginning retained earnings balance of 1400000Its retained earnings calculation is.

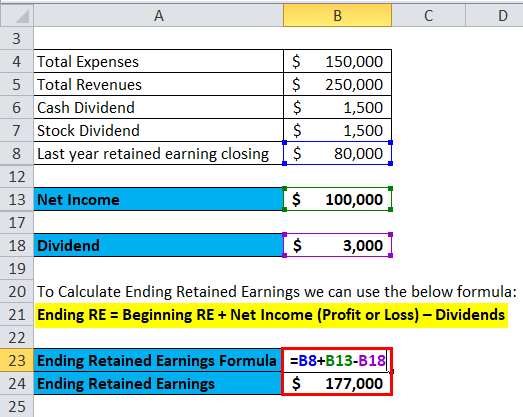

Example Let us assume that in April your business continues progressing along and you make another profit of 20000. If youre the sole owner that means any profits left. To calculate Retained Earnings the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted.

How to calculate retained earnings. The simple calculation for Paid-In capital can be performed by adding the share issued at nominal par value plus the additional reserve as share premium. In order to calculate the retained earnings for each accounting period we add the opening balance of retained earnings to the net income or loss.

The following is a simple example of calculating retained earnings based on the balance sheet and income statement information. Lets say that in March business continues roaring along and you make another 10000 in profit. Retained Earnings Beginning Period Retained Earnings Net IncomeLoss Cash Dividends Stock Dividends.