Wonderful Preparation Of Trial Balance Helps In Locating

It assists in the preparation of financial statements ie.

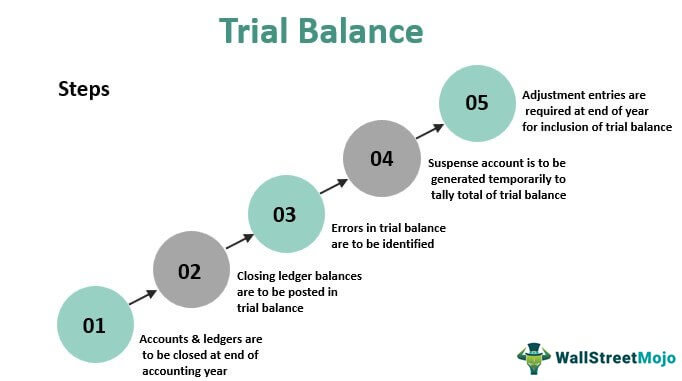

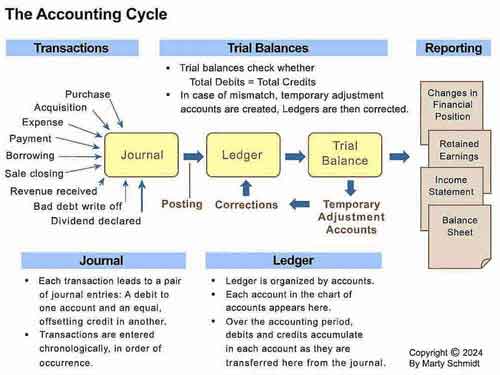

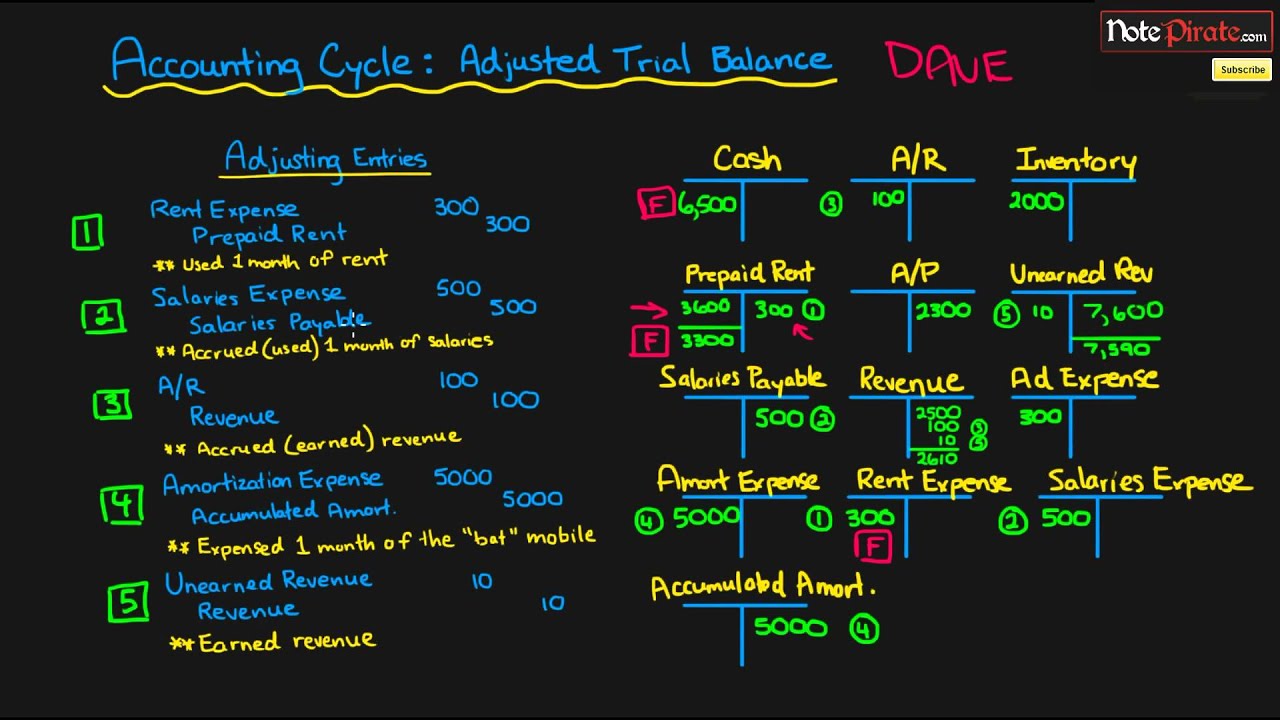

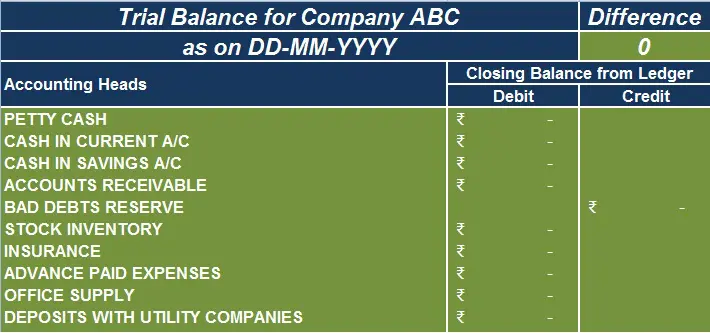

Preparation of trial balance helps in locating. A self-balanced trial balance ensures the arithmetical accuracy of the entries made. Preparing ledger accounts to determine the closing balance of each account. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns.

The balances are usually listed to achieve equal values in the credit and debit account totals. Edit with Office GoogleDocs iWork etc. Preparation Of Trial Balance Helps In Locating Preliminary Expenses Treatment Cash Flow This is oversimplified of course but explains in fundamental terms what a Profit and Loss statement is.

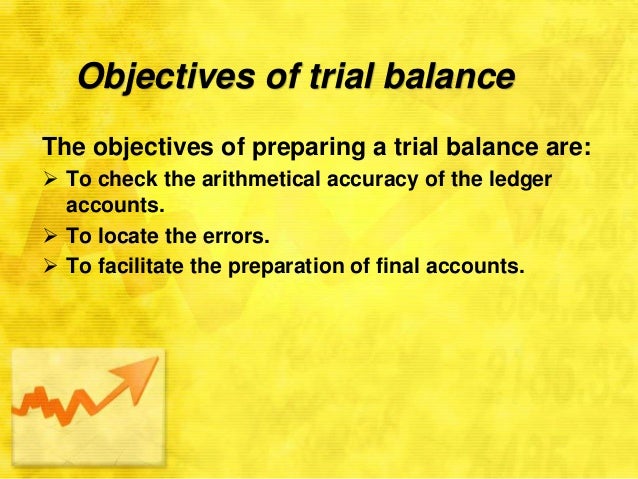

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Therefore at the trial balance stage accountants and bookkeepers are often forced to go back and review vouchers journals and ledgers to locate the errors and bring the accounts back to balance. Trial Balance helps the auditors to locate the entries in the original books of accounts.

Iv Help in Locating Errors When the total of both the sides of a trial balance does not tally we come to know that at least one error has occurred. Preparation of trial balance helps in locating the. Auditors are then able to comment on the preparation of financial statements in their audit report.

Download Template Fill in the Blanks Job Done. Ad Download Our Trial Balance All 2000 Essential Business and Legal Templates. The main objective of the trial balance is to ascertain the accuracy of accounts and locating errors.

Preparing and adjusting trial balances aid in the preparation of accurate financial statements. To prepare a trial balance you need to list the ledger accounts along with their respective debit or credit amounts. And then efforts are made.