Great Examples Of Permanent Differences In Deferred Tax

Some examples of permanent differences are.

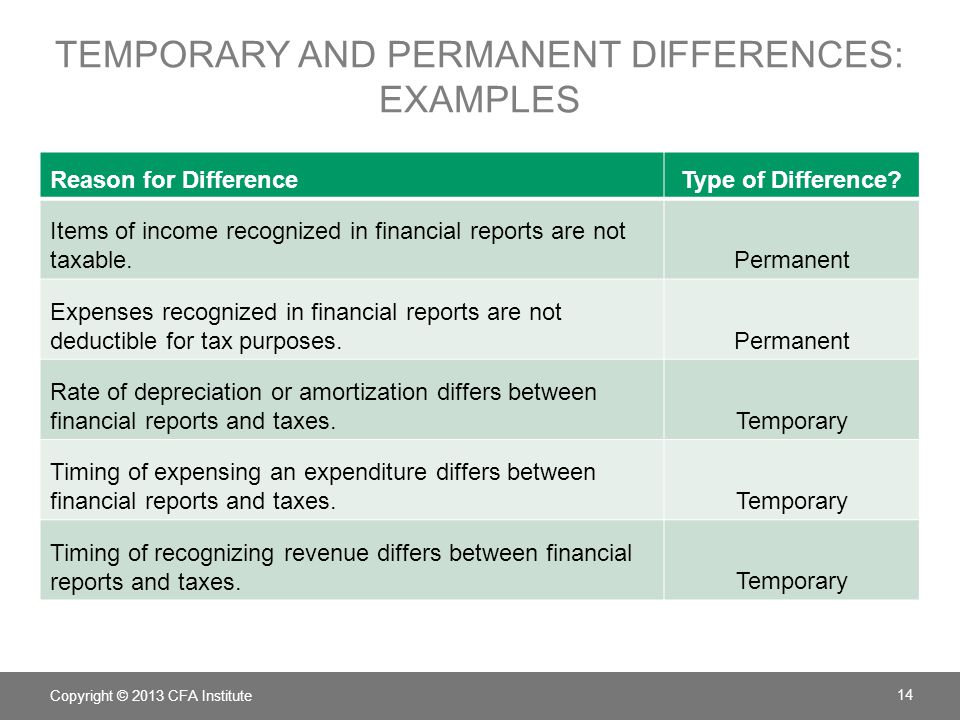

Examples of permanent differences in deferred tax. Permanent differences depend on the tax law and the jurisdiction. The difference of 800 represents a temporary difference which the company expects to eliminate by year 10 and pay higher taxes after that. Payment disallowed us 40A3 ie.

A government grant may be a gift that is not taxed. The carrying value of truck of asset truck in the accounting base is bigger than in the tax base. 2 Section 40 A 30 Of Expense On Which Tds Not Deposited Allowed In Year When Actually Deposited 2.

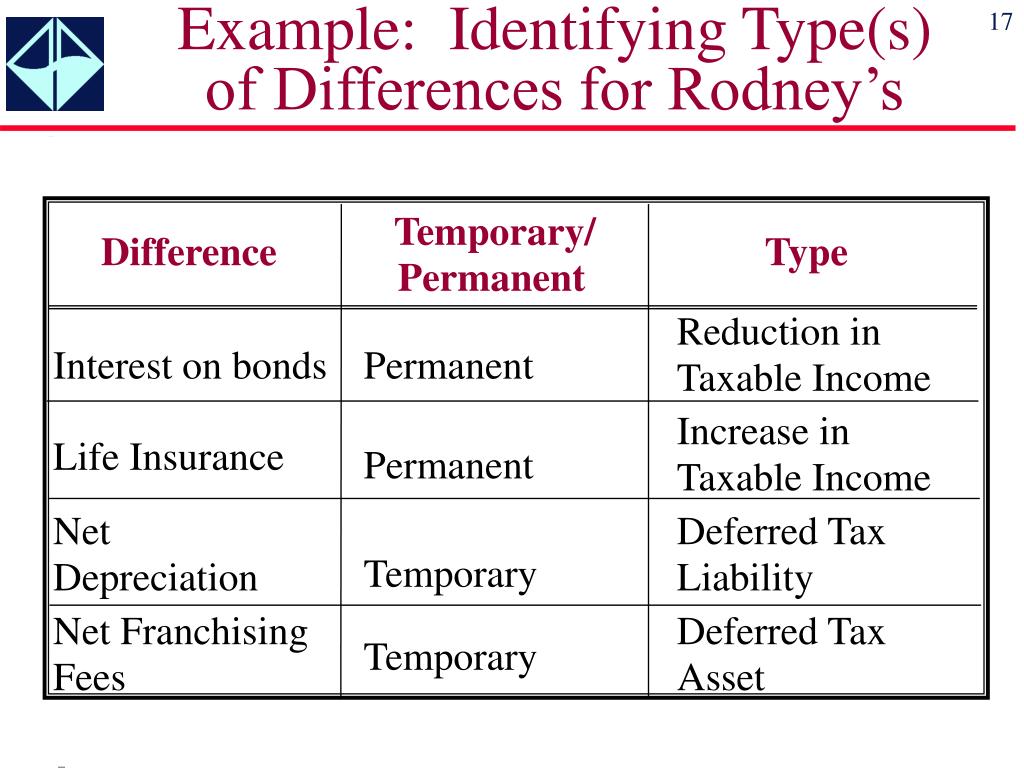

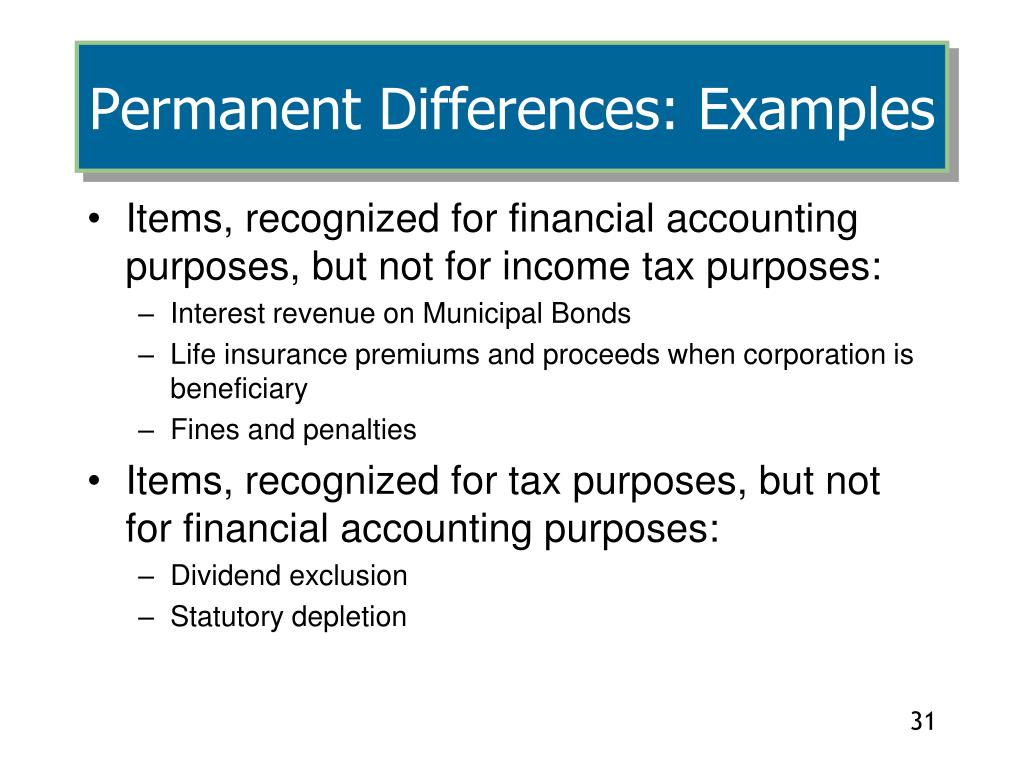

Since they are not reversed permanent differences do not give rise to deferred tax assets or liabilities. Fines and Penalties Meals and Entertainment Political Contributions Officers Life Insurance and Tax-exempt Interest. Personal expenses disallowed by Income Tax.

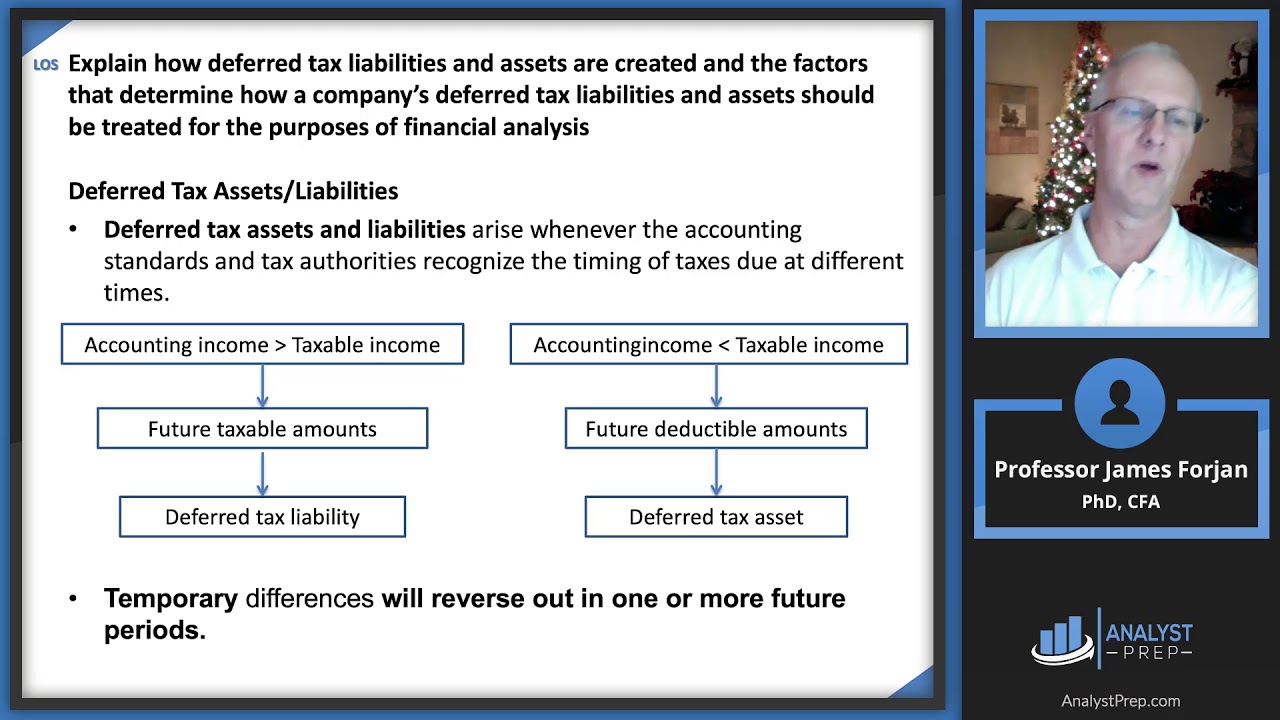

They lead to deferred tax assets. Some examples of temporary differences are. Income or expense items that are not allowed by tax legislation and Tax credits for some expenditures directly reduce taxes.

Example of Permanent differences Amortization of goodwill considered disallowable expenses. Capital gain on disposal of equity stake in other companies exempt in Singapore. As with temporary differences quite a few accounting events lead to a permanent difference.

Example of temporary difference for deferred revenue For example in 2019 ABC Internet Co. Cash payment exceeding Rs20000- Donation to Political Parties. They are caused by a Credit balance in carrying amount of assetliability in financial statement compared to tax base.