Fantastic Deferred Tax Working In Excel

AS 22 Deferred Tax Calculator in EXCEL Download.

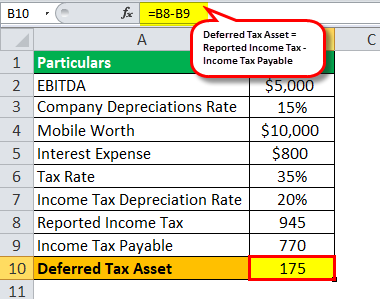

Deferred tax working in excel. Deferred tax timing differences If an income or expense which creates a profit or loss is taxed in the same period that it appears in the income statement or equity such as share issue costs the tax charge for the year will reflect this and no further action is required. Below is a screenshot of a tax loss carryforward schedule built in Excel. As per AS 22.

Deferred Tax Calculation-an easy way out in Excel. If you want a completed example to work with. Expected tax loss on bottom line of tax return.

I am preparing a first years set of accounts. Disallowing Depreciation as per Companies Act Deferred Tax Basics Difference between DTA and DTL Permanent Difference And Timing Differnce Deferred tax computation format You are here Income Tax Computation Format For Companies Amendment. So at the year end the balance is 1700.

Can P recognise a deferred tax asset. Exporting Data in Excel. ITR V Receipt Status.

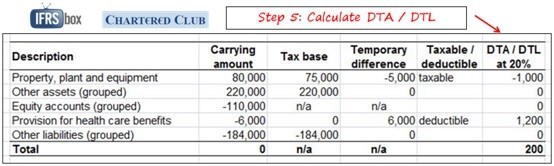

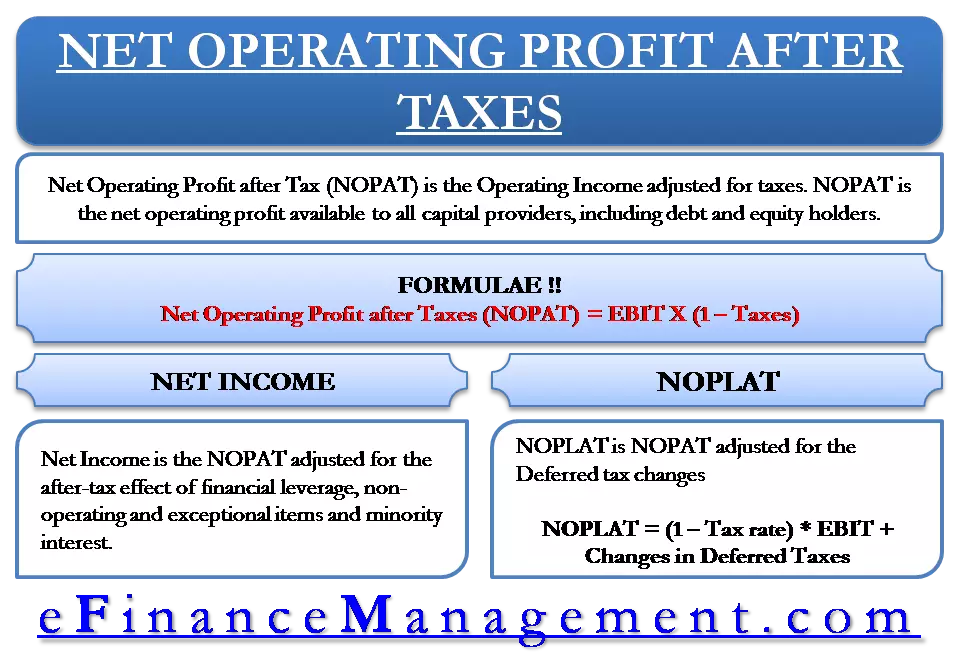

It is crucial to note that deferred tax is only recorded in the books of an organisation if chances of a reduced or increased tax liability in the future are more likely to occur than not. To learn how to calculate deferred taxes in interim periods during the reporting year using an effective tax rate To master the technique of calculating deferred taxes when consolidating organizations To get a working model for calculating deferred taxes in MS Excel easily adaptable to your business. FRS12IAS12 requires several steps in determining deferred tax information first is the construction of a tax balance sheet that involved the determination of tax base for each asset and liability recognised in the accounting balance sheet in order.

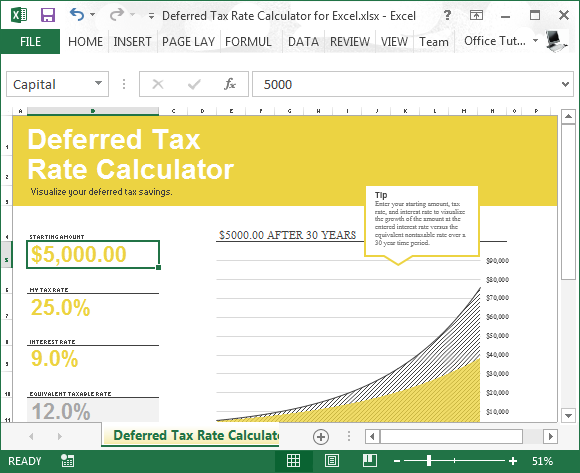

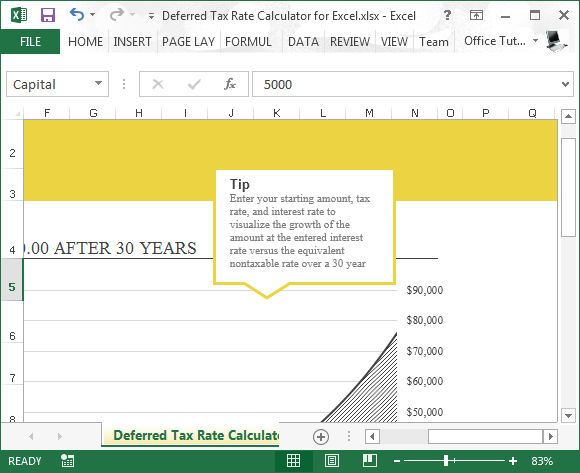

Deferred tax calculation current year The best way is to put all the assets liabilities and any other potential items like tax loss in the table and calculate the temporary differences and deferred tax. P also has a taxable temporary difference TTD. Enter your starting amount tax rate and interest rate and the chart will show you growth over a 30 year period.