Ideal Deferred Tax Calculation Spreadsheet

Having higher qualifications and expertise will earn you more money than the individual who has only basic skills.

Deferred tax calculation spreadsheet. Perform annual income tax monthly salary calculations based on multiple tax brackets and a number of other income tax salary calculation variables. For those who have not emailed me directly I understand it will be available for download in the Excel zone if suitable. Deferred Tax Rate Calculator.

To master the technique of calculating deferred taxes when consolidating organizations To get a working model for calculating deferred taxes in MS Excel easily adaptable. DTD expected to reverse. Applying the IAS 12 amendments January 2016.

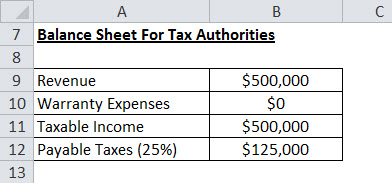

Here an effort is made to comprise all tax computation viz Provision for Tax MAT Deferred Tax and allowance and disallowance of Depreciation under Companies Act and Income tax Act in. Utilizing deferred rent schedule excel template for Excel worksheets can help enhance efficiency in your service. Deferred tax calculation spreadsheet for everyone xls.

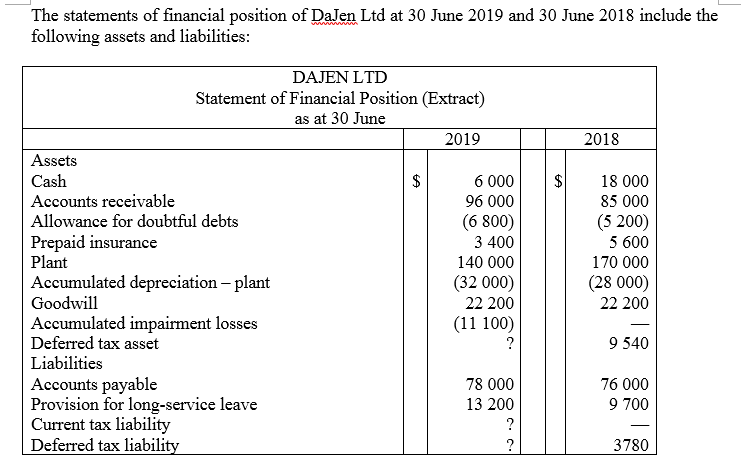

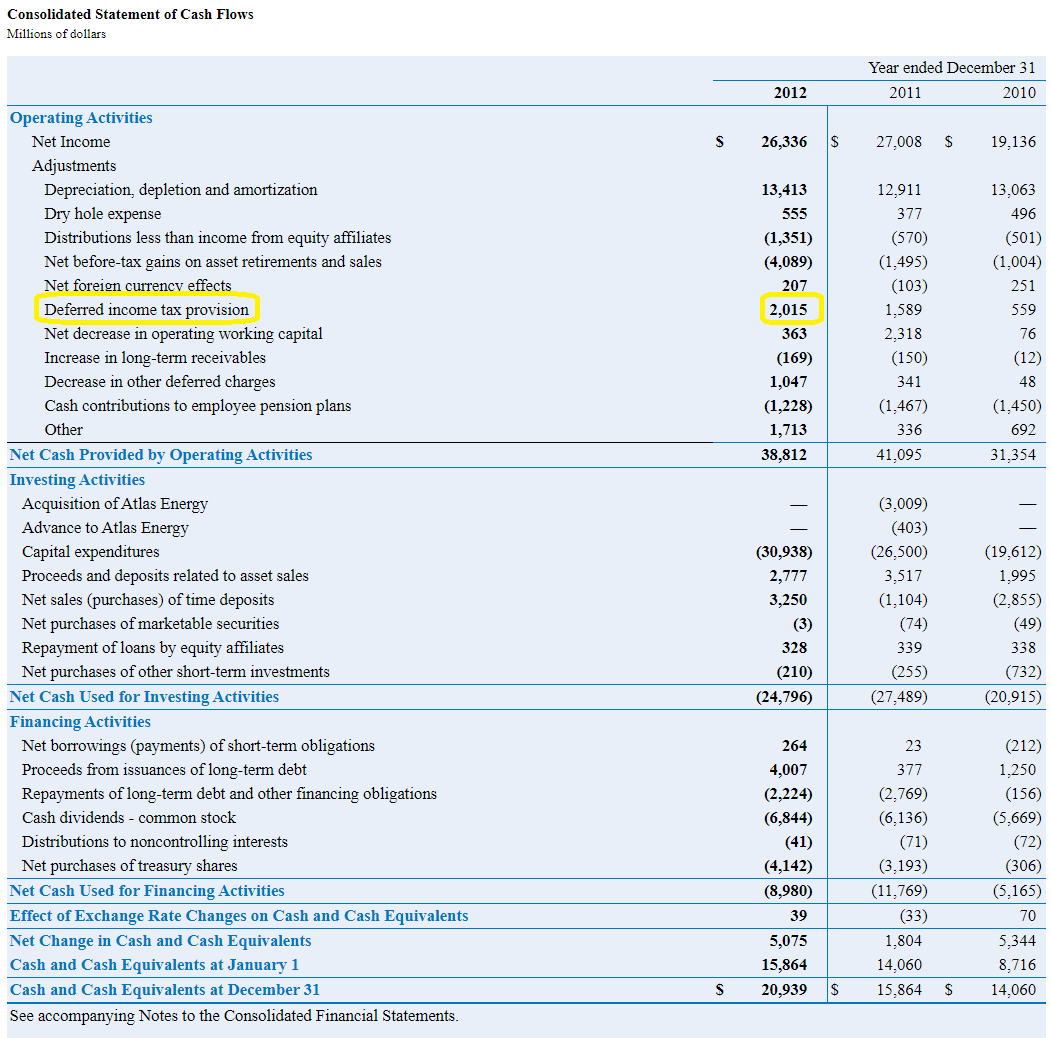

The deferred tax represents the negative or positive amounts of tax owed by the Company. Generally FRS 102 adopts a timing difference approach ie deferred tax is recognised when items of income and expenditure are. What is deferred Tax.

The template design incorporates seven default tax brackets but you can add additional tax brackets if your region requires more tax brackets. Friends most of us face the challenge of calculating tax as per Income tax and AS 22. Tick if total turnover or gross receipts of the company in the previous year 2015-16 does not exeeds 50 crore rupees.

Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts. This article has been a guide to what is Deferred Income Tax. This template was designed to make getting this information as fast and convenient for you as possible All you need to do is follow the directions below to find out how much you could be saving by downloading the free Tax Rate Calculator today.