Exemplary Deferred Tax Calculation Example Excel

PRO WARE LLC Release History.

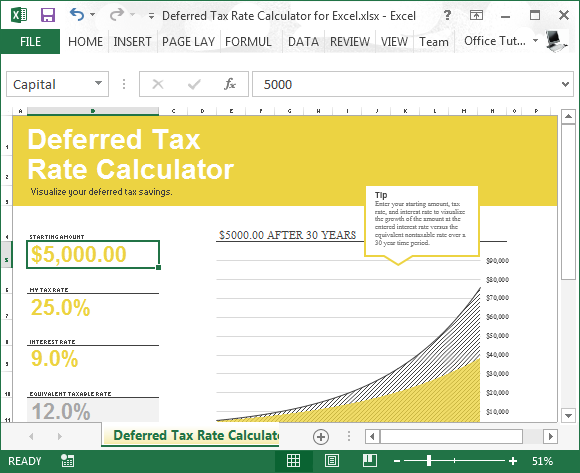

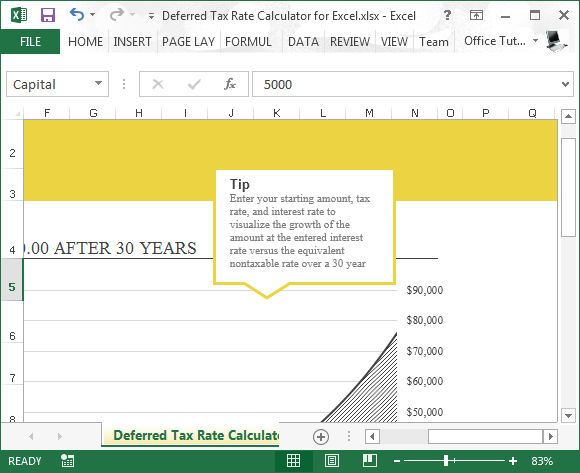

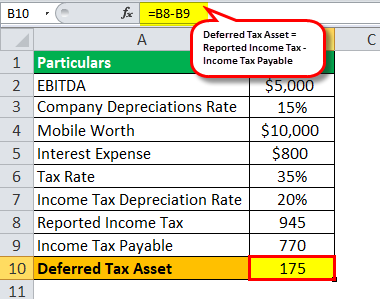

Deferred tax calculation example excel. Since the Deferred Tax Rate template is in fact just a simple calculator all youll need to do is enter a few items to receive the information you need. If needed in credit risk assessment on. Deferred Tax Calculation-an easy way out in Excel.

This calculator calculates everything with complete accuracy and ensures that it does not mislead you with wrong or inaccurate results. Deferred Tax Calculator Template Tutorial. How to Calculate Pre tax Rate for Value in Use IFRSbox.

The deferred tax rate calculator is a great tool to be used for all those people who dont have any clue about how to calculate the deferred tax rate. I am preparing a first years set of accounts. Deferred Tax Calculation-an easy way out in Excel.

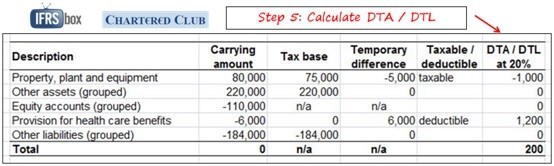

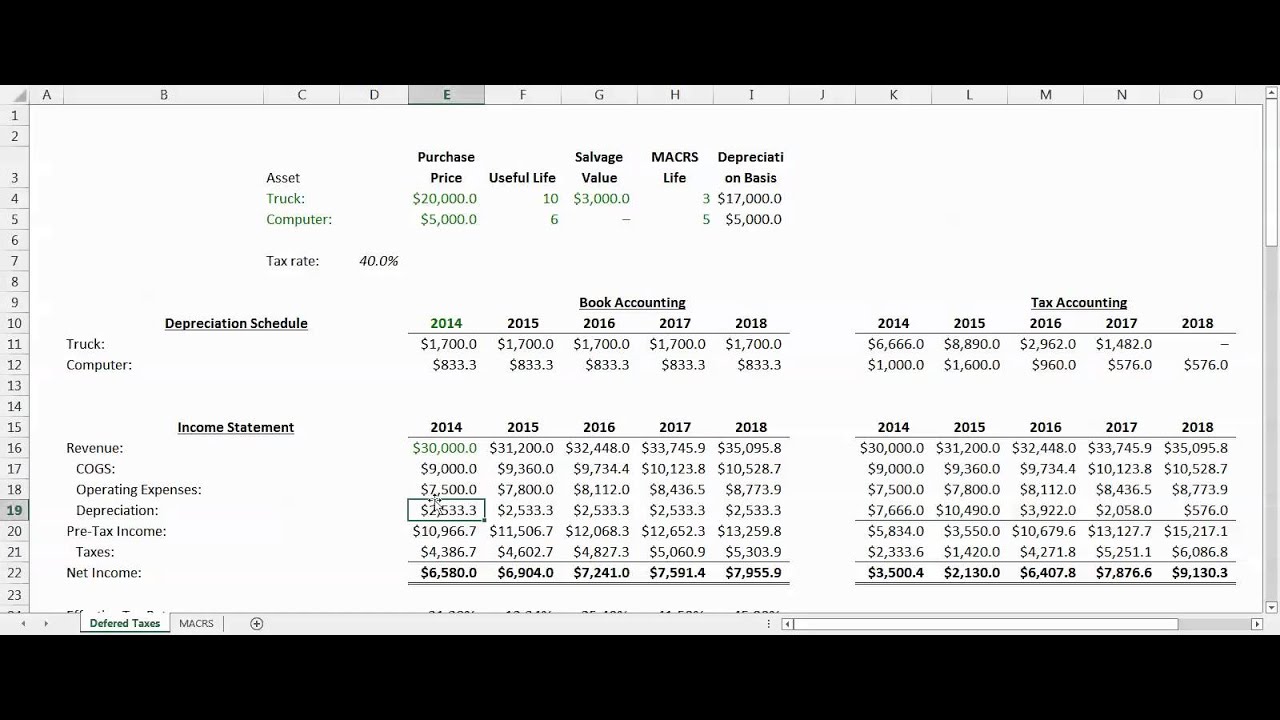

Download Deferred Tax Calculation file in xls format- 13002 downloads. Would my deferred calculation be as follows. A deferred tax liability has arisen in the example above because the company has made.

Fair value due to market rate change. What is future taxable profit for the recognition test. Deferred income taxes impact the future cash flow of the Company ie if its an asset the cash outflow will be less and if its a liability the future cash outflow will be more.

IAS 12 excel examples. An excel sheet to better understand the deferred tax calc. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities.